原标题:港股被抢疯! 南向资金净流入230亿美元,创历史新高。 哪些部队急于筹集资金?

概要

[HongKongstocksarerobbedcrazy!Thenetinflowofsouthboundcapitalis23billionandhitanewhighWhichforcesarerushingtoraise?】SouthboundfundsareunstoppableAfterhittingarecordhighofHK$19486billiononJanuary11thenetinflowofsouthboundfundsreachedHK$22971billiononthe18tharecordhighWiththeexpectationoftheglobaleconomicrecoveryinstitutionscontinuetoincreasethelowvaluationofHongKongstocks(ChinaBusinessNews)

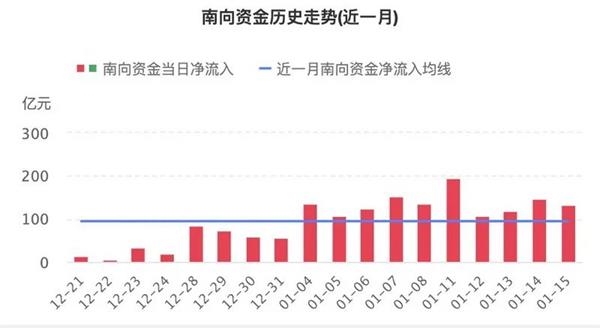

Southbound funding is unstoppable.After hitting a record high of HK$19.486 billion on January 11, on the 18th, southbound fundsNet inflowIt even reached 22.971 billion Hong Kong dollars, a record high. With the expectation of the global economic recovery, institutions continue to increase the low valuation of Hong Kong stocks.

18th, Hong Kong Hang Seng IndexDrive low, Closing up 1.01%, to close at 28862.77 points. The strong trend of technology stocks drove the Hang Seng Technology Index to soar 3.88%, breaking the 9,000-point mark, and closing at 9116.24 points, setting a new record high.

Last week, the Hang Seng Index rose 2.5%, and the Hang Seng Technology Index closed up 1.7%. In terms of individual stocks, the gains were leadingthe companyforChina Telecom(+19.4%)、ASM Pacific(+13.9%)、China Unicom(+13.6%). The leading decliners are Xiaomi Group (-8.3%),AAC Technology(-5.0%)、Kingboard Laminate(-4.8%).In terms of southbound funds, the Shanghai and Shenzhen stock markets last weekSouthbound tradingA net purchase of 70.213 billion Hong Kong dollars was traded.Major increase in capital holdings in the southChina Mobile、Tencent Holdings、SMICAnd other companies, mainly reducing their holdings of Xiaomi Group,BYDShares,Kingdee InternationalWaiting for the company.

Credit Suisse China Securities ResearchSupervisorIn an interview with a reporter from China Business News on the 18th, Edmond Huang said that Nanxiang Capital has suddenly become more active since December last year. There are two potential reasons.First, the valuation of Hong Kong stocks is lower than that of A shares.marketProsperity and development also have some spillover effects, that is, mainland funds hope to find opportunities to allocate assets in other markets, and the more familiar and more liquid Hong Kong stocks are the first choice. It does not mean that the quality of Hong Kong stock companies has suddenly become better.

China Business News previously reported that in 2021, investors will pay as much attention to low-value Hong Kong stocks as A-shares.bankFinancial managementSubsidiary,InsuranceInstitutions and others have allocated Hong Kong stocks in advance, and nearly half of the equity exposures of some wealth management subsidiaries are Hong Kong stocks. In 2020, the total annual net inflow of southbound funds reached 672.1 billion Hong Kong dollars, which is the net inflow of northbound funds (208.9 billion yuan).RMB) Nearly 3 times. Currently,Hang Seng AH Premium IndexNearly 136, still higher than the level of 126 at the beginning of January 2020.ToInsuranceFor example, institutions have always preferred real estate and financial stocks, and the financial sector AH has a high degree of overlap, especiallybankIn the sub-sector, there is a certain premium in valuation of A shares, which also attracts the company and itsExecutivesIncrease holdings in Hong Kong stocks orAdditional issuance.For example, Li Lu’s recent HimalayasfundIs to increase holdings in the Hong Kong marketPostal Savings BankH shares.

Another factor is related to the recent executive order of the Trump administration in the last few months of his term. In view of the fact that some Chinese companies have been affected and eliminated by international indexes, stock prices have seen a sharp correction.Huang Xiang said: “It is not ruled out that some mainland funds enter the market to buy the bottom. At the same time, we have indeed seen some foreign institutions outside the US.clientTo theseenterpriseI am very interested because their valuation has fallen to a low level and has deviated greatly from the past average. At the same time, they are also very attractive in terms of dividend income. “

The outside world expects that, driven by the above two forces, Hong Kong stocks will be promising in 2021. Previously,Bank of Communications InternationalLongteng core growthFund investmentManager Li Junhui said in an interview with China Business News: “Although A-share returns have ranked first in the world in the past two years, the allocation value of Hong Kong stocks cannot be ignored, especially with the return of Chinese concept stocks to Hong KongSecondary listing‘In addition, many outstanding new economic head companies have already or intend to list on Hong Kong stocks, which makes the ecology of Hong Kong stocks richer. Some scarce sub-sectors (property, education, 18A pharmaceutical companies, etc.) that are not available in A-shares, giveActive fundProvides more and better choices. “

In Li Junhui’s view, three main lines should be grasped in the industry rotation: consumption recovery, technological prosperity and predicamentReverse.Under the logic of consumption recovery, we can focus on the fields of medicine, catering, education, etc.; under the logic of science and technology, we are optimistic about the continued opportunities of computer hardware and media.artificial intelligenceRelated thematic opportunities are also worth looking forward to; under the logic of global economic recovery, the midstreammanufacturingDilemma reversal is expected to become the focus of investment in 2021. In the first half of the year, there are opportunities for value revaluation in nonferrous metals and chemical industries. Consumer electronics, automobiles, and new energy sectors are all worthy of attention.In addition, there are many potential high-qualityNew crotchThe target is also worthy of investors’ betting chips.

(Source: China Business News)

(Editor in charge: DF537)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.