原标题:巨额亏损达1亿美元,但连续9天涨停,什么时候“ 2021年第一只恶魔股票”将不再是恶魔?

概要

[Hugelossof100millionbut9consecutiveboarddailylimitwhenwillthe”firstdemonstockin2021″stopbeingdemon?】YibinPaperofJiulianBoardissuedariskwarningannouncementagainOntheeveningofJanuary18YibinPaperannouncedthatthecompany’sstockhasreachedadailylimitfornineconsecutivetradingdaysandthecumulativeincreasehasreached13459%DuringtheperiodthefundamentalsoflistedcompanieshavenotchangedThereisariskofspeculationinthecompany’sstockpriceInvestorsareadvisedtopayattentionLevelmarkettransactionrisk(ChinaSecuritiesJournal)

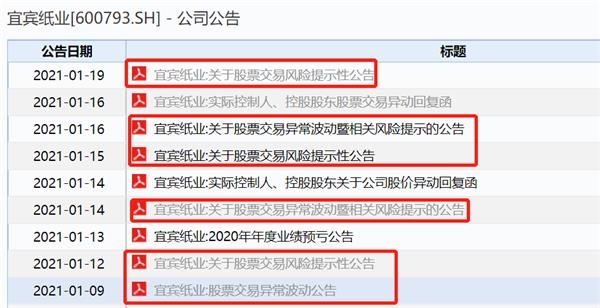

Nine-linkedYibin PaperReissue risk warningannouncement。

On the evening of January 18,Yibin PaperThe announcement stated,the companyThe stock has a daily limit for nine consecutive trading days, and the cumulative increase has reached 134.59%. During the period, the fundamentals of listed companies have not changed, and the company’s stock price is at risk of speculation.investmentPay attention tomarketTransaction risk。

According to statistics from Zhongzheng Jun, this is alreadyYibin PaperThe 6th announcement this month suggests risks.In this announcement, Yibin Paper emphasized that rising paper prices and the ban on plastics have limited impact on the company’s operations.PerformanceThere are major uncertainties for improvement.

Source: ListingCompany Announcement

Zhongzheng Jun noticed that behind the rising stock price of Yibin Paper is the hot money competing for bargaining chips and alternate relays. Judging from historical experience, most of the “demon stocks” after the hot money speculation are in decline. Small and medium investors should pay attention to risks and refrain from taking the last shot of drumming and spreading flowers.

Last year’s performance is expected to lose 100 million yuan

Since January 6th, Yibin Paper has continued its daily limit. As of the close of trading on the 18th, a total of 9 daily limit has been harvested.Market valueSoaring from nearly 1.6 billion to 3.4 billion.

“Demon stock” is called “demon”, there must be “qi”.The “gas” in the stock market includestheme, Market value, etc., for Yibin Paper, it combines the two in one. On the one hand, Yibin Paper’s small market value is low, which is regarded as an “oversold stock”, and capital is likely to form a leverage effect; on the other hand, under the influence of the plastic restriction order recently, paper prices have risen, and Yibin Paper has caught up The outlet of hype.

However, the hype of Yibin Paper can be said to have seriously deviated from the fundamentals.

On the evening of January 12, Yibin Paper issued a 2020 annual performance pre-loss announcement saying that it is expected to return to the mother in 2020Net profitApproximately 98 million yuan, non-deductible in 2020Net profitIt is estimated to be about -169 million yuan.

In fact, this is not the first time Yibin Paper has deducted non-netprofitLossSince 2005, Yibin Paper has had a negative net profit for 15 consecutive years after deductions. The deduction of non-net profits has been negative, indicating that Yibin Paper’s profit in the past 15 years has not depended on its main business.

Source: Listed company announcement

Zhongzheng Jun noticed that in 2011, the company needed to implement the overall relocation due to the Yibin city plan. In recent years, Yibin Paper has “survived” on the A shares by relying on the relocation compensation. From February 2017 to September 2019, Yibin Paper received a total of 1.288 billion yuan in relocation compensation funds.

hot money”Drumming”

Behind Yibin Paper’s becoming a demon is a game of drumming and passing flowers among hot money.

Zhongzheng Jun StatisticsLonghubangAccording to the data, since January 6th, Yibin Paper has been on the top four rankings, and the enthusiasm for hot money participation is high.

January 6-8, Huaxin Securities Co., Ltd. ShanghaiBranch officeThe seats were bought for 8,135,100 yuan and also sold for 7,874,400 yuan. Next are the Hubei Branch of Shenang Securities Co., Ltd., Zhejiang Branch of Dongguan Securities Co., Ltd.,West China SecuritiesYibin Beizheng Street Securities Business Department. From January 11th to 13th, the above three seats were bought with the left hand and sold with the right hand.

From January 13th to 15th, the securities business department of Dongguan Securities Co., Ltd., Shenzhen Houhai Zhongxin Road once again staged such a fast-buying and fast-selling drama. During the period, it bought Yibin Paper for RMB 9,575,200 and sold RMB 9,759,700.

In addition, likeEverbright SecuritiesSecurities Sales Department of Beijing Headquarters Base of Co., Ltd.,Caitong SecuritiesThe Securities Sales Department of Shangtang Road, Hangzhou Co., Ltd. has been on the list many times, with both buying and selling operations.

It is worth noting that on January 11, the special seats of the institution sold 7,744,200 yuan of Yibin Paper.

Some market participants said to Zhongzheng Jun that from the disk situation, Yibin Paper has been accelerating the daily limit continuously in the past two days, and then it needs to continuously shrink the one-word daily limit to lock the bargaining chip. Otherwise, once there is a difference in the volume, the stock is very May receiveBig Yinxian。

The end of the “monster stock” is all chicken feathers

Industry insiders told Zhongzheng Jun that, like Yibin Paper, a continuous rise in hype that seriously deviates from the fundamentals, it is very likely that the regulatory authorities will pay attention to it and further measures will be taken.

Zhongzheng Jun noted that last Friday, January 15, the Shanghai Stock Exchange routinely announced the operation of the Shanghai stock market. The Shanghai Stock Exchange stated that it has included the recent continuous abnormal rise in stocks into key monitoring and timely self-regulatory supervision of abnormal trading behaviors that affect market trading order.

Source: Shanghai Stock Exchange website

According to the Regulations on the Real-time Monitoring of Securities Abnormal Transactions of the Shanghai Stock Exchange, when securities transactions occur, “investors pass false declarations, large-value declarations, intensive declarations, and price limitpriceA large number of declarations,Actual controlTransactions between accounts, intraday or next dayReverse transactionIn the event of abnormal behaviors such as affecting securities trading prices or trading volume, the Shanghai Stock Exchange may issue written warnings to relevant investors, or directly take measures such as suspending investor account transactions on the day and restricting investor account transactions.

“If it continues to rise, likeTianshan BiologyIt is possible to be stopped in that way. “The insider said.Data Display,Tianshan BiologyFrom August 19, 2020 to September 8, 2020, the cumulative increase in the closing price was 494.51%, and the cumulative turnover rate was 283.71%. During this period, abnormal stock trading fluctuations were encountered 5 times, and severe abnormal stock trading fluctuations were encountered once. period,Tianshan BiologyAlso announced twice on abnormal fluctuations in stock tradingSuspensionVerification.

When the profit is withdrawn and the hype enthusiasm fades, what will Yibin Paper do?

Judging from historical experience, the “monster stocks” after the hot money is often all over the place.E.gShengxing shares, Its early listing can be called subNew crotchThe king of the “monster stocks” in China, after the first opening of the market, went out of 14 daily limit, or 317.9%, but then fell and fell, never returning.

Starting in November 2018,DongfangtongWith the aura of “5G leader”, the stock price has risen 10 times in just a few months. However, after the end of the song, it has taken a continuous “yin decline” road.

Countless historical experiences have proved that such a hype that deviates from the fundamentals hides huge risks. After all, the rise in the stock price of listed companies is not due to the appreciation of the company’s own value, but the result of hot money drumming and spreading flowers. There is no “demon stock” that can stand upright. When the profit is settled, the game is destined to end. Small and medium investors should pay attention to risks and refrain from taking the last shot.

(Source: China Securities Journal)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.