原始标题:每天六个限制后突然下限! ST亚星的“杯”精制酒,是否改组了涉嫌内幕交易的标的?

概要

[Sixthelimitsuddenlyfellafterthelimit!STYaxing’s”cup”JingzhiWinereorganizationsubjectsuspectedinsidertrading?】STYaxing’sexplanationalso“failedtohavefun”AfterlearningofthismattertheShanghaiStockExchangeissuedaregulatoryinquirylettertothecompanyagainrequestingthecompanytoverifywhethertherewereanyviolationssuchasinsidertradingHoweverSTYaxinghasnotyetresponded(ShanghaiSecuritiesNews)

ST Asia StarToday’s opening limit is lower, hundreds of thousands of lotsCover sheetLock the drop stop firmly.

Just a week ago, the proposed acquisition of Jingzhi WineryST Asia StarAlso bemarketTouted as “the first stock of Shandong wine”, and today,ST Asia StarIt has become the “catastrophe” of the liquor sector.

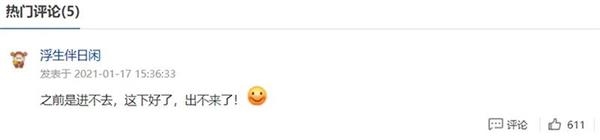

Many small people who managed to grab chips last week couldn’t help but sigh: “I couldn’t buy it last week, I can’t sell it this week!”

Source: stock bar

Jingzhi Winery Co., Ltd

After the market opened today, ST Yaxing sealed the limit without any suspense. The number of single positions sold is up to 420,000 lots. In contrast, at the close of the market last Friday, there were still about 100,000 lots of ST Asia’s daily limit orders.

According to the latest caliber disclosed by ST Yaxing on the 17th, ST Yaxing and Jingzhi Winery continued to discuss the core subject matter involved in the transaction.OperatingThe scope of sexual assets was negotiated again, especially for the derivatives involving liquor businessOperating assets (liqueurcultureWenluindustryThe two parties failed to reach an agreement on whether to include assets, etc.) in the scope of this acquisition.

The reporter noticed that this timeReorganizationThe failure is the second time that Jingzhi Liquor has collapsed the capital market.This worldThe acquisition failed for less than a month.

Since 2018,This worldDirect acquisitionSharesAnd initiateM&AfundThe acquisition of equity in Jingzhi Winery was unsuccessful.

December 24, 2020This worldSaid that due to major changes in the market valuation of the liquor industry, the parties to the cooperation are concerned about future market development trends andenterpriselongstrategyPositioningDifferent opinions arose and decided to terminate the acquisition of Jingzhi Winery.

source:Company Announcement

According to the data disclosed by Jinshiyuan at the end of 2019, Jingzhi WineauditThe total assets of is 3.493 billion yuan, and the revenue is 1.248 billion yuan.Net profitIn the first 11 months of 2019, its total unaudited assets were 3.453 billion yuan and revenue was 1.236 billion yuan.Net profitIt is 37.15 million yuan.

Exchange inquiry letters are issued three times in a row

The reporter noticed that the exchange has issued two enquiry letters to ST Yaxing on the 11th and 14th. In addition to the enquiry letter after the reorganization was terminated on the 17th, ST Yaxing has not responded to three enquiry letters. .

source:the companyannouncement

In the inquiry letter on the 11th, the exchange required ST Yaxing to disclose the detailed financial data and related trading arrangements of Jingzhi Liquor, and required a reply within two trading days.

In the inquiry letter on the 14th, the Shanghai Stock Exchange asked ST Yaxing to explain Jingzhi Winery and itsRelated partyTo verify whether there are violations such as insider trading, a reply is also required within two trading days.

In the latest inquiry letter on the 17th, the regulatory authorities still required a reply within two trading days.

After repeated questions, ST Yaxing was unable to reply, but the transaction was terminated first. What is the real meaning?

“The meaning of drunken man” in Jingzhi wine industry?

It is worth mentioning that just before ST Yaxing disclosed its cooperation agreement with Jingzhi Winery on January 9th, Jingzhi Winery had bought 209,400 shares of ST Yaxing at an average transaction price of 5.02 yuan in advance. Entrusted Beijing Yufengtang to buy 1.5544 million shares.

Source: Company announcement

Excluding the current limit, Jingzhi Liquor’s previous floating profit has exceeded 4 million yuan.

Regarding this operation of Jingzhi Liquor Industry, ST Yaxing explained in an announcement on the trading of company shares on the 14th that Jingzhi Liquor Industry hopes to try to increase its holdings of listed company shares and recommend director candidates to enter the board of directors. The company cooperates. Since then, Jingzhi Liquor Industry has chosen the “diversified ownership structure,Market valueST Yaxing, which is “lower”, is the target of holdings.

Source: Company announcement

ST Yaxing stated in the above announcement: “If this asset restructuring is successfully completed, Jingzhi Wines promises to increase its shareholding within 24 months from the disclosure date of this announcement.”

But now that the reorganization failed, I wonder if the promise of Jingzhi Liquor Industry can still be fulfilled?

In addition, ST Yaxing’s explanation also “failed to enjoy it.” After learning of this matter, the Shanghai Stock Exchange again issued a regulatory inquiry letter to the company, requesting the company to verify whether there are violations such as insider trading. However, ST Yaxing has not yet responded.

(Source: Shanghai Securities News)

(Editor in charge: DF064)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.