原标题:什么信号? 拥有1,545万会员的平台突然宣布将于1月底关闭! 网络互助如何进行? 监督呢?

概要

[Whatsignal?The1545millionmemberplatformsuddenlyannounceditsclosureattheendofJanuary!Howdoesnetworkmutualassistancego?】RecentlyMeituanMutualAidasubsidiaryofMeituanissuedaclosingannouncementstatingthatduetobusinessadjustmentsMeituanMutualAidwillbeofficiallyclosedat24:00onJanuary31Thisismycountry’sfirstlarge-scalenetworkcriticalmutualaidplantoshutdownanditisalsothesecondmutualaidplanofanInternetgianttoshutdownafterBaiduLanhuoMutualHelp(BrokerChina)

Recently, Meituan Mutual Aid, a subsidiary of Meituan, announced the shutdownannouncement, Said that due to business adjustments, Meituan Mutual Aid will be officially closed at 24:00 on January 31.This is my country’s first large-scale network critical mutual assistance program that has been shut down.BaiduAfter the lights were turned on, the second one closedthe InternetA mutual aid program under the giant’s.

Since the second half of 2020, network mutual assistance has encountered growth troubles. Since December last year, Ant Financial’s Huhebao’s three consecutive phases of apportionment numbers have dropped by more than one million month-on-month; last September,BaiduIts subsidiary Lanhuo Mutual Assistance announced its termination because the number of participating members was less than 500,000.

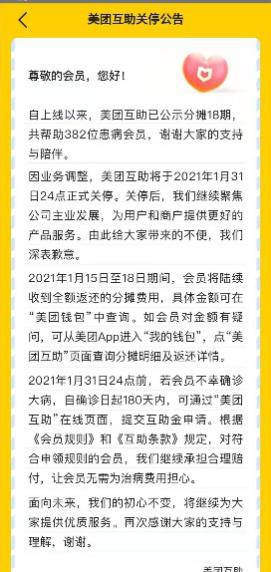

Meituan Mutual Aid will be closed for one and a half years

Meituan Mutual Aid was launched in June 2019, and the first recipient case was announced in April 2020. In June 2020, it was upgraded to the first “unlimited disease” mutual aid plan for major illnesses.Since the establishment of Meituan Mutual Assistance, the highest number of participants has reached 34 million, with a total of 382 sickmemberCarried out mutual aid apportionment.

Different from the previously closed small mutual aid plan and the Mutual Aid of Lights, although Meituan Mutual Aid has fallen in the number of shares recently, the current number of members is still close to 15.45 million.

Meituan explained that the shutdown was due to business adjustments and focusthe companyMain business development. However, at a time when network mutual assistance is experiencing growth troubles, this move does not rule out that it is related to the uncertain development of network mutual assistance. After several years of rapid development, disputes and controversies over network mutual assistance have increased significantly, and the problem of lack of supervision has become increasingly prominent. Meituan Mutual Aid’s move has also aroused the attention of network mutual aid peers.

Meituan Mutual Aid said that from January 15 to 18, Meituan Mutual Aid members will successively receive full refunds of their shared expenses. Before 24:00 on January 31, 2021, if a member is unfortunately diagnosed with a serious illness, within 180 days from the date of diagnosis, he can submit a mutual aid application through the “Meituan Mutual Aid” online page. For members who meet the application rules, Meituan Mutual Assistance will continue to bear reasonable compensation.

Mutual aid program shuts down, members are injured

Although Meituan Mutual Aid promised to continue its critical illness relief until 24 o’clock on January 31, and return all the shared expenses of members. But this does not eliminate the impact of the planned shutdown on ordinary users. A new member who joined Meituan Mutual Aid said that it was shut down shortly after joining Meituan Mutual Aid, which made him doubt about the continuity of the network mutual aid plan.

The shutdown of Meituan Mutual Aid is also a reminder for the majority of mutual aid users.Mutual assistance is not realInsuranceproduct, It’s not mutual in the traditional senseInsurance. Relying on the Internet traffic platform, network critical illness mutual assistance can quickly become a traffic portal, attracting a group of people with guaranteed needs but limited purchasing power, and to a certain extent can popularize protection awareness and provide a part of basic protection for the public. However, the “malfunctions” of the Mutual Assistance Program for Network Critical Diseases are also very obvious.

First, there are disputes over compliance. The network mutual assistance platform currently has no clear regulatory body and regulatory standards, and is in an embarrassing situation of unsupervised. From May 2020, there has been constant discussion on whether and how to include network mutual assistance in supervision.

Second, there are risks in stability and continuity. From the perspective of the bottoming mechanism,InsuranceThe company has a bankruptcy protection mechanism for policyholders.InsuranceThe law stipulates: business haslife insuranceBusinessInsurance company, Except for division, merger or cancellation according to law, it shall not be dissolved.Operating lifeInsuranceIf the insurance company that is responsible for the business is cancelled or declared bankrupt in accordance with the law, the life insurancecontractAnd responsibilityReserve, Must be transferred to other insurance companies operating life insurance business. This is not the case for the Critical Illness Mutual Assistance Program. Once there is a business adjustment, or an imbalance between the remaining members and the people who need to receive mutual aid, the mutual aid plan will face the risk of adjustment and termination.

The next step of network mutual assistance: licensed operation is the direction

The shutdown of Meituan Mutual Aid is a microcosm of the consolidation of the network as a whole.

As the benchmark of the domestic network mutual assistance program, the mutual treasure of Ant Financial, which was launched in October 2018, created the miracle of joining hundreds of millions of members in one year. However, after reaching the highest peak of 106 million people in November 2020, the number of people participating in Xiang Hubao’s apportionment declined rapidly, and the number of participants has been negative growth for four consecutive periods. In the first phase of January 2021, the number of people participating in Xiang Hubao’s apportionment was 101 million, a decrease of 1,188,900 from the previous phase.

Water Drop Mutual Aid has gradually declined since 2019. The current number of shared members is 12.9 million, which is less than one-third of the highest point of 43.52 million in 2019.

Complaints, disputes and compliance issues are more troublesome to the person in charge of network mutual assistance than the decline in the number of apportionments.According to the person in charge of a network mutual assistance program, although the number of users of the network mutual assistance platform has increased rapidly, the awareness of user protection has not increased with it. Some rejected users do not understand the rules. The investigation of the platformcostAnd communication costs are relatively high. And more urgent than this is the issue of operational compliance.

In September 2020, the Anti-illegal Affairs Bureau of the China Banking Regulatory Commission published a theoretical research article “IllegalbusinessAnalysis of Insurance Activities and Research on Countermeasures.It points out that the network mutual assistance platform that has grown savagely in the recent period has essentiallybusiness insuranceHowever, there is currently no clear regulatory body and regulatory standards, and it is in an embarrassing situation of unsupervised.

The article emphasizes the risks and problems associated with online mutual assistance platforms. It points out that the network mutual assistance platform has a large number of members and is a non-licensed operation. Stakeholder risks cannot be ignored. Some pre-charging model platforms form precipitation funds, and there is a risk of running away. If improperly handled and poorly managed, it may also cause social risks.

The aforementioned article suggested that all insurance activities should be strictly admitted and licensed, driving without a license should be strictly prohibited, and various illegal commercial insurance activities should be severely cracked down.One of the important measures is to increaseborrowTo help combat new types of illegal commercial insurance activities carried out by Internet means, it is necessary to include network mutual assistance platforms into supervision, study access standards as soon as possible, and realize licensed and legal operations.

In this regard,BrokerageThe three network mutual aid leaders interviewed by Chinese reporters all welcomed the license to operate and be included in supervisionattitude. A person in charge of the Network Mutual Aid Program said that he believes this will be another important milestone in the healthy development of the industry.

However, network mutual assistance is an emerging thing. Although network mutual assistance platforms (also known as P2P insurance platforms) exist in the world, they are generally dominated by small-scale acquaintances.Subject of InsuranceMost of them are small-value products, with a wide range of distribution, and the risk of business stakeholders and the risk of fund escape are relatively small. China is currently the country with the largest number of participants in critical illness mutual assistance. It is estimated that approximately 120 million people have joined various mutual assistance programs.

Zhong Cheng, the former co-CEO of Easy Group, previously said in an interview with a brokerage China reporter that network mutual assistance has developed very fast in recent years. Although it is not true insurance, the core is still managing risk. In order to promote the sustained and steady development of the Critical Illness Mutual Assistance Program, it is necessary to regulate management.

He called on the regulatory authorities to include the critical illness mutual assistance plan into the scope of supervision as soon as possible, and suggested that it should be regulated in three aspects:

One is that supervision should clarify the thresholds and requirements for entering the mutual assistance industry, and implement licensed operations. E.g,Insurance ProductsRequires insurance company, professional insurance intermediary and part-time jobproxyFor licensed sales, the main institution that sets up a mutual aid plan should also have the corresponding license qualifications.

The second is to standardize the management and information disclosure requirements of the critical illness mutual aid plan.For example, the risk management of the mutual assistance industry can be strengthened by introducing third-party institutions.auditThe organization conducts actuarial analysis of the population characteristics, fund allocation and compensation status of the mutual aid plan and forms a report. The report is made public to all members for members to understand and evaluate the operation of the mutual aid plan.

The third is that the mutual assistance plan cannot help each other in everything, it must have boundaries. The core of mutual assistance is a risk sharing mechanism composed of individuals with the same type of risk protection needs. It is recommended that mutual assistance plans should be concentrated in the field of critical illness and medical mutual assistance. As for whether other risks can also help each other, it should be regulated.

(Source: Brokerage China)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.