原标题:惊险! 159亿固定增加的“突然死亡”,900亿锂电池的领导者经历了什么?

概要

[Thrilling!159billionfixedincrease”suddendeath”Whathappenedtothe90billionlithiumbatteryleader?】OntheeveningofJanuary17the90billionlithiumbatteryleaderTianqiLithium(002466)suddenlyissuedanannouncementsayingthatinviewofthecontrollingshareholder’searlierimplementationofthereductionplaninordertoavoidanycontinuingadvancementofthisnon-publicissuanceofstocksthatmayresultinsubstantialTheriskofshort-termtradingisdecidedtoterminatethisnon-publicissuanceofAshares(BrokerChina)

This may be the most “short-lived” fixed increase plan for A shares in 2021.

On the evening of January 17, 90 billion lithium battery leadersTianqi Lithium(002466) Sudden releaseannouncementSaid that in view of the holdingshareholderA share reduction plan was implemented in the early stage. In order to avoid any risks that may constitute a substantial short-term transaction due to the continued advancement of this non-public issuance of shares, it was decided to terminate this non-public issuance of A shares.

Simultaneously,Tianqi LithiumIn the announcement, it said that in the future, it will actively evaluate and continue to carry out refinancing matters in accordance with relevant refinancing policies. The termination of the non-public issuance of shares has not harmedthe companyAnd the interests of all shareholders, especially small and medium shareholders.

Tianqi LithiumThis fixed increase plan can be described as a twists and turns, sweeping the capital circle.Just 2 days ago (January 15), Tianqi Lithium disclosed its fixed increase plan. Its original plan was to raise funds not exceeding 15.926 billion yuan.priceIt is proposed to be 35.94 yuan/share, the controlling shareholder Tianqi Group orWholly-owned subsidiaryIt is planned to subscribe in full.

After the disclosure of the fixed increase plan, it immediately triggered intense market discussions.On the evening of January 16, the Shenzhen Stock Exchange issued a letter of concern to Tianqi Lithium, requesting it to explain the holdingShareholder reductionLater participation in the behavior of fixed increase, whether it actually constitutes a short-term transaction, whether it will harm the interests of small and medium shareholders.

To terminate the fixed increase plan,BrokerageThe Chinese reporter contacted Tianqi Lithium’s secretary of the board, and as of press time, no response has been received.

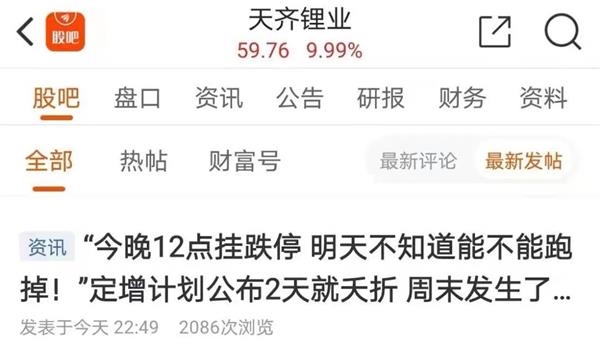

What’s interesting is that Tianqi Lithium’s shareholders have experienced great ups and downs this weekend. After the announcement of the fixed increase announcement, Tianqi Lithium Stocks were cheered. Some investors said bluntly: “At least 5 daily limit.” After the announcement of the termination of fixed increase, some investors said, “The daily limit is gone. Ended a few lower limits!” More netizens said that the lower limit will be suspended overnight.

New energy giants suddenly terminated the 15.9 billion fixed increase project

On the evening of January 17, Tianqi Lithium, standing in the spotlight center of public opinion, suddenly issued an announcement stating that the company will hold the fourteenth meeting of the fifth board of directors on January 17, 2021.meeting, Deliberated and passed the “Proposal on Termination of the Company’s Non-public Issuance of Stocks.”

It stated in the announcement that in view of the controlling shareholder’s early implementation of the share reduction plan to support the company’s development, in order to avoid any risks that may constitute a substantial short-term transaction due to the continued advancement of this fixed increase, it will comprehensively and effectively protect small and medium-sized investments. From the perspective of the interests of investors, the company decided to terminate this non-public issuance of A shares after careful analysis and repeated communication with intermediaries.

At the same time, Tianqi Lithium emphasized that the company’s various businesses are currently operating normally, and the termination of the fixed increase will not affect the company’s operating conditions and sustainable and stable development, nor will it affect the company’s established strategy and the company’s wholly-owned subsidiaries. Tianqi Lithium Energy Australia Pty Ltd introduced strategic investor issues.

In response to the high debt-to-asset ratio, Tianqi Lithium said that it will actively evaluate and continue refinancing matters in a timely manner in accordance with relevant refinancing policies.

Finally, Tianqi Lithium stressed in the announcement that the termination of the non-public offering of shares did not harm the interests of the company and all shareholders, especially small and medium shareholders.

15.9 billion fixed increase plan for A shares

Let’s review Tianqi Lithium’s 15.9 billion fixed increase plan.

On the evening of January 15, Tianqi Lithium released a fixed increase plan, which planned to raise funds not to exceed 15.926 billion yuan, which will all be used for repayment by the companybankLoans and supplementary working capital to optimize the company’s asset-liability structure, improve asset quality, reduce financial risks, and improve financial conditions.

According to the announcement of the fixed increase, the subscription target of this fixed increase is Tianqi Group, the controlling shareholder of Tianqi Lithium Industry, or its wholly-owned subsidiary. It will subscribe for the shares of this fixed increase in cash through its own funds and self-raised funds. .

The fixed increase price is 35.94 yuan/share, and the announcement stated that it shall not be lower than 80% (ie 35.94 yuan/share) of the company’s stock trading average price (ie 44.92 yuan/share) on the 20 trading days before the pricing base date. It is worth mentioning that as of the close of trading on January 15, Tianqi Lithium’s share price was 59.76 yuan per share, which means that the discount rate for the fixed increase price is close to 40%.

On the eve of the release of the fixed increase plan, Tianqi Group disclosed a shareholding reduction plan. In the six months from January 29, 2021, Tianqi Group plans to reduce its holdings by 51.08 million shares. The reason why Tianqi Group reduced its holdings was to provide Tianqi Lithium with financial assistance and other funding needs.

In addition, from July 3 to December 28, 2020, Tianqi Group has reduced its holdings of 88.61 million shares of Tianqi Lithium, accounting for 5.9989% of the company’s total share capital.

Therefore, a very critical problem has arisen. The reduction of holdings is to sell stocks, and Tianqi Group intends to become the target of fixed increase subscription, which is equivalent to buying stocks. It is suspected of short-term trading of buying low and selling high.

After the announcement of this fixed increase plan, it became the focus of market discussion.

According to the announcement, as of January 15th, Tianqi Group holds 444 million shares of Tianqi Lithium Industry, accounting for 30.05% of the shares; if the fixed increase is completed, Tianqi Group will hold 8.87 Tianqi Lithium Industry shares. 100 million shares, the shareholding ratio will rise to 46.19%.

The Shenzhen Stock Exchange’s fast attention letter: Does it constitute a short-term transaction?

This fixed increase plan of Tianqi Lithium has attracted the attention of the Shenzhen Stock Exchange.

On the evening of January 16, the Shenzhen Stock Exchange hurriedly issued a letter of concern to Tianqi Lithium, requesting Tianqi Lithium to combine with Tianqi Group’s shareholding reduction (including but not limited to the previous reductions in price, quantity, amount, and share ratio). And compared with the fixed price increase, it is specified whether the controlling shareholder’s behavior of subscribing to the company’s non-public offering of shares after reducing its holdings actually constitutes a short-term transaction and whether it will harm the interests of small and medium shareholders of the listed company.

In addition, another suspicious point of the fixed increase plan is that on the day when the fixed increase plan was disclosed, Tianqi Lithium’s stock price was exceptionally strong, and the board was closed strongly near the end of the day, with a trading volume of 8.558 billion yuan throughout the day.

And in the first 60 trading days of Tianqi Lithium’s disclosure of the fixed increase plan, its stock price rose by as much as 201.82%, which can be called a super bull stock.

In this regard, the Shenzhen Stock Exchange clearly requested Tianqi Lithium in the letter of concern to explain the specific planning process of the fixed increase plan, the personnel involved, the company’s measures to keep inside information confidential, and whether there is a situation where inside information is known in advance; whether the controlling shareholder There is a violation of Article 53 of the Securities Law.

Another doubtful point of this 15.9 billion fixed increase plan is, can Tianqi Group spend so much money to participate in the subscription?

According to reports, since 2020, Tianqi LithiumM&ASQM fell into a debt crisis, and the funding chain was tight. In this regard, the Shenzhen Stock Exchange requires Tianqi Lithium to explain in detail:

1. The source of the target’s own funds and self-raised funds, and the specific ways to raise funds;

2. Whether to make a minimum subscription commitment toGuaranteeIn the implementation of this non-public offering, if there are no relevant commitments and Tianqi Group and its wholly-owned subsidiaries breach the contract due to the inability to raise sufficient funds, what measures will be taken to protect the interests of the listed company from harm;

3. Whether the total amount of funds raised from the non-public issuance is reasonable and feasible, and whether there is a flickering fixed increase.

As of press time, Tianqi Lithium has not yet responded to the letter of concern from the Shenzhen Stock Exchange.

After the termination of fixed increase, how will Tianqi Lithium repay 12.2 billion debts?

According to the official website of Tianqi Lithium, Tianqi Lithium is a leading new energy material in China and the world with lithium as its core.enterprise, The business covers lithiumindustryThe key stage of the chain will help the electric vehicle and energy storage industries to achieve long-term sustainable development of lithium-ion battery technology.

However, since 2020, Tianqi Lithium has once been trapped due to the acquisition of SQM.Invest inGolden chain crisis.

This landmine of the debt crisis was buried in 2018. That year, Tianqi Lithium acquired SQM for US$4.066 billion (Chile Mining and Chemical IndustryThe company)’s 23.77% shares became its second largest shareholder. Calculated at the exchange rate at the time, the amount of the merger was as high as 25.9 billion yuan.RMB。

According to data, SQM is engaged in the resource development and utilization of Chilean Atacama Salt Lake.Atacama Salt Lake has high lithium concentration, large reserves, mature mining conditions and low operating costs. It is a global salt lake resource with superior endowment and global lithiumproductAn important producing area.

At that time, Tianqi Lithium’s net assets were only in the tens of billions.currencyThe capital is less than 4 billion yuan, and the acquisition of SQM can be regarded as a snake-like adventure.

Among the sources of funds for Tianqi Lithium’s acquisition, US$3.5 billion is a cross-border merger of domestic and overseas syndicated loans, and the financial leverage is very large.

Unexpectedly, after the acquisition, the global lithium price suddenly continued to fall. The SQM company acquired by Tianqi LithiumNet profitIs 1.56 billion yuan, a sharp drop of 46.5% compared to 2018, which is much lower than thePerformancePromises that Tianqi Lithium’s provision for impairment of SQM is as high as 5.3 billion yuan. Affected by this, Tianqi Lithium will return to its mother in 2019Net profitLoss5.98 billion yuan.

At the end of November 2020, when the loan of US$1.884 billion (approximately RMB 12.2 billion) was due at that time, Tianqi Lithium’s monetary funds on the books were less than 1.3 billion yuan (at the end of the third quarter of 2020).

atcrucial moment, Tianqi Lithium waited for the white knight.

At the beginning of December 2020, Tianqi Lithium announced that its wholly-owned subsidiary TLEA intends to increase its capital and shares to introduce strategic investor IGO, an Australian listed company. The latter subsidiary will invest US$1.4 billion to subscribe to TLEA’s new registered capital of US$304 million.

Thanks to the capital increase of strategic investors, Tianqi Lithium and the syndicate signed a “modified and restated loan agreement” to extend the repayment period of US$1.884 billion in debt to November 26, 2021, suspending the urgent need.

Tianqi Lithium originally planned to raise 15.9 billion yuan through this fixed increase in funds to completely alleviate the capital chain crisis, but suddenly announced its termination, which may bring uncertainty to Tianqi Lithium’s debt repayment plan.

(Source: Brokerage China)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.