原标题:冷吗? 7亿美元的回购不能阻止财务欺诈的问题,股价回落到2年前! 监管部门采取了果断行动,社会保障基金已经提前启动!

概要

[700millionbuybackscan’tstopfinancialfraudquestioningthestockpricefellbackto2yearsago!Thesupervisoryauthoritieshavedecisivelylaunchedthesocialsecurityfundaheadofschedule!】AtthepressconferenceoftheChinaSecuritiesRegulatoryCommissionheldyesterdaythespokespersonoftheChinaSecuritiesRegulatoryCommissionGaoLiinresponsetoareporter’squestionaboutpossiblefinancialfraudinAntarctice-commercesaidthattheChinaSecuritiesRegulatoryCommissionhasbeenconcernedaboutthecompany’sstockpricefluctuationsandmediareportsAndinaccordancewithrelevantregulationsthecompany’sstocktradinghasbeenincludedinthekeymonitoringscopeforthefirsttime(DailyEconomicNews)

At the press conference of the China Securities Regulatory Commission held yesterday, Gao Li, the spokesperson of the China Securities Regulatory Commission, was answering reporters’ questions aboutAntarctic e-commerceWhen questioning questions about possible financial fraud, it was stated that the China Securities Regulatory Commission had been concerned about the company’s stock price fluctuations and media reports, and in accordance with relevant regulations, immediately included the company’s stock trading into the key monitoring scope.

whyAntarctic e-commerceHas it aroused the attention of the SFC? Bulleye noticed,Antarctic e-commerceSince mid-October last year, it has started a long-term negative decline. This year, it has accelerated its downward trend, and hit a new low in nearly two years in the intraday trading this Thursday, holding 35,000 people.shareholderI’m afraid I yelled “cool” in my heart.

On the surface, the decline in Antarctic e-commerce’s stock price feels unreasonable. The company just announced on January 5 that the amount is not less than 500 million yuan and not more than 700 million yuan.RepurchaseIt was planned and implemented for the first time on January 12, but the market just didn’t buy it. What happened?

The “King of Tag” is under the key monitoring of the China Securities Regulatory Commission

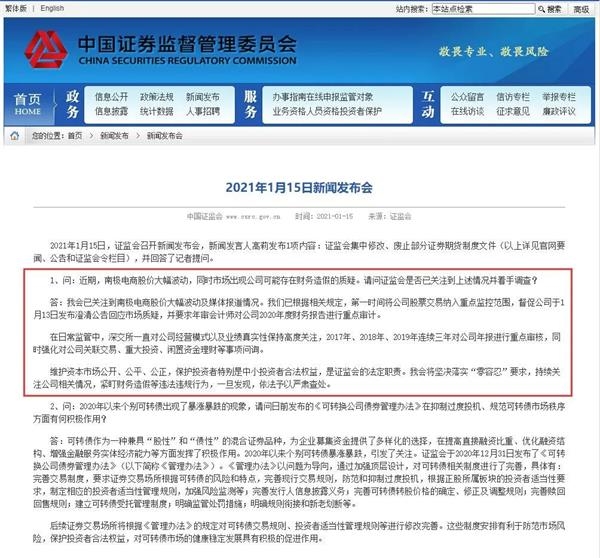

Image source: China Securities Regulatory Commission official website

At the press conference of the China Securities Regulatory Commission yesterday, a reporter asked: Recently, the stock price of Antarctic e-commerce has fluctuated sharply, and there are doubts about the company’s financial fraud. Has the China Securities Regulatory Commission paid attention to the above situation and initiated investigations?

Gao Li, a spokesperson for the China Securities Regulatory Commission, replied: I have been concerned about the sharp fluctuations in the stock prices of Antarctic e-commerce and media reports.In accordance with relevant regulations, we have included the company’s stock trading in the key monitoring scope as soon as possible, and urged the company to issue a clarification on January 13announcementResponding to market queries, and requiring annual audit accountants to conduct key audits of the company’s 2020 financial report.

In daily supervision, the Shenzhen Stock Exchange has been monitoring the company’s business model andPerformanceMaintain high attention to authenticity. In 2017, 2018, and 2019, the company’s annual report was reviewed for three consecutive years, and the company’s related transactions, major investments, and idle funds were strengthened.Financial managementAnd other matters.

It is the statutory duty of the China Securities Regulatory Commission to maintain the openness, fairness and justice of the capital market and protect the legitimate rights and interests of investors, especially small and medium investors. We will resolutely implement the “zero tolerance” requirement, continue to pay attention to the company’s relevant situation, and keep a close eye on financial fraud and other violations of laws and regulations. Once discovered, it will be severely investigated in accordance with the law.

So, what kind of company is Antarctic e-commerce?The official website shows that the company’s main business is brand integrated services, dealer brand authorization services, mobilethe InternetMarketing business and other business.The company focuses on e-commerce channels, using brand authorization andindustryChain Services strives to build a world-class consumer goods giant.

Image source: Antarctic e-commerce official website

Public information shows that the Antarctic e-commerce predecessor was an Antarctic, founded in 1997, is one of the earliest established underwear companies in my country. However, as early as 2012, Antarctic people had cancelled the self-operated links of production and sales, and switched to a brand licensing business, and changed their name to Antarctic e-commerce, which was once known as the “king of tag”.

Suspected of financial fraud, stock price fell back to 2 years ago

Looking at the daily K-line chart of Antarctic e-commerce stock prices, Niuyan Jun couldn’t help feeling shocked: I don’t know how much money is buried under this high “mountain”.

Antarctic e-commerce year-to-date K-line chart last year

The stock price of Antarctic e-commerce began a strong rise in mid-March last year. In just 4 months, the increase was more than 140%, setting a new high in 13 years. However, since then, the stock price began to fall gradually, and the downward acceleration accelerated in late October last year. After the beginning of this year, it fell sharply and rebounded on January 14.

but,Antarctic e-commerce also hit a new low of 8.91 yuan per share on the day of January 14, which was a decline of more than 180% from the historical high in 6 months. It not only returned to the position of rising since March last year, but also It set a new low of nearly two years since February 19, 2019. During this period, shareholders who hold Antarctic e-commerce are equivalent to two years of playing for nothing.

Niuyanjun inquired about public reports from the media and found that the decline of Antarctic e-commerce and the question of possible financial fraud that caused the CSRC’s attention may be related toIndustrial SecuritiesAnalystAs early as 2019, a paper entitled “The Definition and Identification of Earnings Management and Earnings Manipulation”Research reportRegarding, the example cited in the chapter “Identification of Cardiopulmonary Bypass Fraud” in the research report uses “XX e-commerce”.

The report mentions the six major suspects of fraud in XX e-commerce, namely: netinterest rateVery high without obvious barriers, no obvious competitors, very light asset operating model, poor financial data quality, accounts receivable and business scale doubled, the number of employees has declined, and suppliers and customers overlap.Mentioned from this reportEquity pledgeIn terms of details and time, the market believes that the case of financial fraud points to Antarctic e-commerce.

On the evening of January 12, Antarctic e-commerce issued a “Clarification Announcement on Media Reports”, saying: “I paid attention to the recent online PPT questioning the company’s cardiopulmonary bypass fraud, which was later reprinted by many third-party self-media. In order to avoid investors It constitutes misleading, and it is now clarified.”The announcement on the “netinterest rateVery high without obvious barriers; no obvious competitors; very light asset operating model; poor quality of financial data and a relatively high proportion of accounts receivable; business scale doubled, but the number of employees decreased; suppliers and customers are highly overlapping.Calculated from a tax perspective, the company’s value-added tax payable is much lower than the quarterly value-added tax through a financial perspective;PledgeEight major doubts including the main purpose of funds have all responded.

Urgently throw 700 million repurchase planSocial securityfundFlee early

In addition to the announcement and clarification, Antarctic e-commerce also took out real money in an attempt to restore the market’s confidence in the company by repurchasing huge shares.

After the stock price fell its limit on January 4 and the stock price almost fell on January 5, the company issued a “plan for repurchasing company shares”, stating that it intends to use its own funds to repurchase some of the company’s shares through centralized bidding for follow-up Implement equity incentives or employee stock ownership plans.The total repurchase amount is not less than 500 million yuan, not more than 700 million yuan, and the repurchase price does not exceed 15 yuan per share, which is called “the largest repurchase in the history of the company.”However, this plan did not prevent the stock price from falling, and the stock price continued to plummet by 6.49% on January 6.

After the stock price fell again on January 12 and hit a new low for nearly a year, the company urgently issued an announcement on the progress of the share repurchase on the evening of the same day, stating that it has repurchased 35,601,144 shares of the company through centralized bidding, accounting for 1.45 of the company’s current total share capital. %, the highest transaction price was 10.62 yuan/share, the lowest transaction price was 9.23 yuan/share, and the transaction amount was 347,685,577.54 yuan. The timely repurchase seems to have stopped the stock price from continuing to fall, and after hitting a new low in nearly two years on January 14, the stock price rebounded upward by more than 8%.LonghubangData DisplayShenzhen Stock ConnectThe special account and two institutional special accounts were net sold, and the three institutional special accounts were net buying. On January 15, the stock price continued to rebound by 2.64%.

Niuyanjun noticed that in the company’s announcement on the shareholding of the top ten shareholders and the top ten shareholders with restrictions on sales on January 7, combined with the statistics, it can be found that:Both the National Social Security Fund 416 Portfolio and China Universal Social Security Fund 432 Portfolio carried out lightening operations in the fourth quarter of last year, reducing their positions by 3.84 million shares and 3.5 million shares respectively, ranking the 7th and 9th largest shareholders of tradable shares. Another National Social Security Fund 418 portfolio that still held 36 million shares at the end of the third quarter of last year dropped out of the top ten shareholders of tradable shares. That is to say, it reduced its position at least 7 million shares in the fourth quarter of last year.In addition, another China Universal Fund also lightened its position by 3.04 million shares, ranking it the tenth largest shareholder.

Faced with the recent rapid decline in the share price of Antarctic e-commerce, the more depressed may be the growth value of RuiyuanHybridStock investmentFund, the fund has just entered Antarctic e-commerce with 34.26 million shares in the fourth quarter of last year, ranking the 8th largest shareholder. Faced with the continued decline in stock prices, the foundation will not feel like stepping on the “thunder” of Zhongda?

In addition, the decline in the share price of Antarctic e-commerce may be related to the apparent decline in performance growth.The data shows that the company deducts non-return to parentNet profitThe growth rate has been declining year by year since 2017: The growth rate of net profit at the time of the 2017 annual report fell by about 3% compared with the same period in 2016, and the growth rate in 2018 fell by about 5% compared with the same period in 2017. By 2019, The growth rate of net profit deducted from the parent company fell by approximately 31 percentage points compared with the same period in 2018.

Image Source:Soochow SecuritiesResearch report

However, there are stillBrokerageFull of confidence in Antarctic e-commerce.Soochow SecuritiesAnalysts Wu Jincao and Zhang Jiaxuan said when commenting on the company’s share repurchase plan that the company’s net profit from the parent company is expected to be 15.44/1.907/2.377 billion yuan from 2020 to 2022, a year-on-year increase of 28.1%/23.5%/24.6%, corresponding to the current market value. The PE is 18x/ 14x/ 11x, and the rating of “Buy” is maintained.

(Source: Daily Economic News)

(Editor in charge: DF506)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.