原标题:制药公司是否仍可以在年底前“评分”退出市场的新规则?

概要

[Canpharmaceuticalcompaniesstill“score”thenewrulesfordelistingfromthemarketattheendoftheyear?】Accordingtothestatisticsof”InternationalFinanceNews”reportersatotalof11listedpharmaceuticalcompanieshaveannouncedthattheycanturnlossesin2020AmongthemYuhengPharmaceuticalandAsiaPacificPharmaceuticalshadhugelossesofmorethan2billionyuanin2019(InternationalFinanceNews)

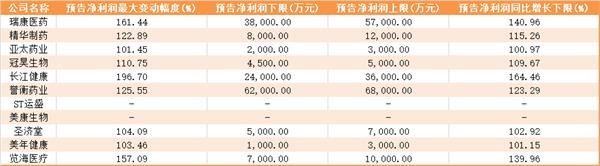

As of the close of January 15, more than 100 listed pharmaceutical companies have released 2020PerformancePreview, inmarketIt caused a series of responses.

For example, on January 14,Asia Pacific PharmaceuticalThe announcement of the performance forecast said that in 2020the companyIt can turn losses into profits and is expected to return to the motherNet profitReached 20 million to 30 million yuan, and then the stock received 2 consecutive daily limit; on the same day, another listed pharmaceutical companySt. Francis ChurchAlso released a performance turnaroundannouncement, In the past two trading days, the stock has gained 10.93% cumulatively…

The reporter noticed that including the aforementioned twoenterpriseIn addition, dozens of pharmaceutical companies made a “struggling” move at the end of the year in order to protect their shells.In order to beautify their performance, some companies choose to transfer the equity of their subsidiaries, some companies resell their patents, and some companies even bet on house demolition compensation.LossVulnerabilities.

Do everything for self-help

according to”International financeAccording to statistics from reporters of the newspaper, a total of 11 listed pharmaceutical companies have announced that they can turn losses in 2020. among them,Yuheng Pharmaceutical、Asia Pacific PharmaceuticalIn 2019, he had a huge loss of over 2 billion yuan.

For “turning against the wind”,Asia Pacific PharmaceuticalIt was explained in the announcement that it was caused by receiving 178 million yuan in compensation for house demolition;Yuheng PharmaceuticalIt is through the sale of subsidiary equity to obtain more than 600 million yuan in income. In addition, among the aforementioned 11 companies that have turned losses,Lanhai Medical、St. Francis Church、Guanhao BioAlso sold part of their assets in 2020, onlyMeikang BioA company’s turnaround was due to a significant improvement in its operating conditions compared to 2019.

The reporter noticed that in 2020, many pharmaceutical companies have resold their assets, such asXinhua MedicalIt plans to publicly transfer 70% of the equity of the subsidiary,Harbin PharmaceuticalValue 13.1 million yuan to transfer its real estate,XinlitaiTransfer multipleproductThe related rights and interests of… and the reasons for reselling assets are mostly to activate assets and focus on the main business.

Insiders pointed out that in recent years, affected by industry policies, some companies do need to adjust their business structure by selling assets. However, there are also some companies that need to rely on reselling assets or even government subsidies to achieve so-called performance growth or profitability due to poor main business.

In response, Shenzhen Guogen Financial Consulting Co., Ltd.partnershipWang YaowuacceptIn an interview with the “International Finance News” reporter, “As long as the company’s main business has not undergone major changes, the company often sells assets to whitewash its performance, such as the disposal of subsidiary equity, housing,landWait. This type of income belongs to non-recurring gains and losses, which are not sustainable and can only solve the company’s urgent needs.If the listed company has been relying on non-recurring gains and losses to “struggle”, especially non-stopSell offWhen it comes to assets, it means that the company is probably already going downhill.investmentPeople need to be especially careful. “

Wang Yaowu further pointed out, “The above-mentioned assets that are resold are often non-current assets.Related partyCome pick it up.andRelated transactionMostly notMarket behavior, There may be obvious benefit transfer. “

It’s hard to hit the side ball anymore

Financial commentator Zhao Huan added to the “International Finance News” reporter, “In order to turn losses, not to be hated or delisted, listed companies have resorted to selling assets and assets.ReorganizationSuch behaviors can achieve large profits in a short time. However, treating the symptoms rather than the root cause has failed to optimize and improve the long-term profitability of the company. On the contrary, it undermines the fairness of the market. It makes it difficult for immature investors in the market to judge the quality of listed companies and damages the interests of investors. Regarding this type of behavior, the supervisory authorities need to issue policies to strictly manage them to encourage enterprises to do a good job in operation and develop in a healthy manner. “

On December 31 last year, the Shanghai and Shenzhen Stock Exchanges formally issued new delisting regulations.Among them, the newNet profit+Operating income“Combined financial delisting indicators. According to the new regulations, theprofitListed companies with negative value and revenue of less than 100 million yuan will face the risk of delisting.

According to a reporter from International Finance News, under the new delisting regulations, onlyLanhai MedicalOr will be implemented a delisting risk warning. In 2019, the company achieved a net profit of -175 million yuan attributable to the parent, and a net profit of -191 million yuan attributable to the parent after deduction. As of the first three quarters of 2020, it has only achieved a revenue of 38.005 million yuan, and the net profit attributable to the parent and the net profit after deduction are still negative.

Although the company issued an earnings pre-profit announcement on January 13, stating that it will realize a net profit of 70 million to 100 million yuan attributable to the parent in 2020, the turnaround was due to the sale of 51% of its subsidiary Shanghai Hefeng Hospital. After deducting the non-recurring gains and losses,Lanhai MedicalThe net profit after non-deduction is expected to be 127 million yuan to 157 million yuan.

A private equity individual in Shanghai pointed out to a reporter from the International Finance News that “under the new delisting regulations, listed companies that have long-term unsatisfactory main businesses and continue to rely on government subsidies or sell assets to protect their shells will no longer be able to “flip the ball.” Technology-based companies whose main business is normal but have not yet begun to make profits, or companies that have temporarily lost money due to industry cycles will no longer face the risk of stock delisting.”

(Source: International Finance News)

(Editor in charge: DF380)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.