概要

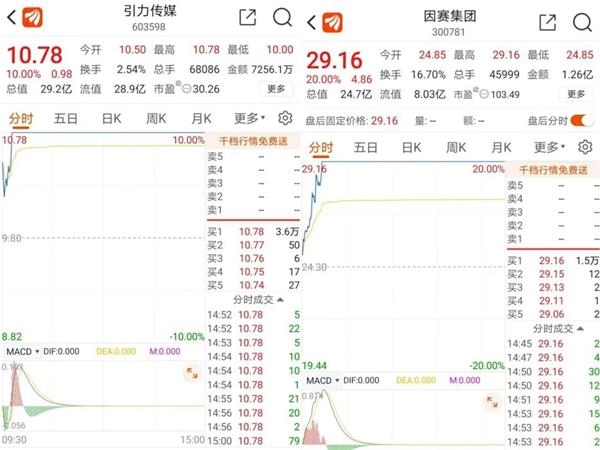

[The”oldirons”whohavemadenewprogressintheA-sharelistinginKuaishoufirsthaveawave!】Althoughasof15:00thatdaytheHongKongStockExchangehasnotupdatedtheKuaishoupost-hearingdatasetbutthe”Kaishouconceptstocks”ofA-shareshavebeenmovedbythewindAtthecloseofthedaythedailylimitofYinsaiGroupandGravitationMediamanystockssuchasCapitalOnlineandChineseOnlinerosemorethan7%(ShanghaiSecuritiesNews)

submitHong Kong stocksTwo months after the listing application, new developments in the Kuaishou IPO journey were announced.

On January 15, it was reported that Kuaishou had passed the Hong Kong Stock Exchange listing hearing.Kuaishou listingSponsorteamWill start on January 18AnalystThe roadshow then officially entered the IPO stage with a fundraising amount of approximately US$5 billion.the companyThe IPO may be launched as soon as possible before the Lunar New Year and will be listed on February 5.

Although as of 15:00 on the same day, HKEx Disclosures has not updated the post-hearing data set of Kuaishou, theConcept stock“Already moved by the wind. It closed that day,Insai Group、Gravity MediaDaily limit,Capital Online、Chinese onlineMany stocks rose more than 7%.

Passed a target valuation of 50 billion US dollars

In addition to the listing timetable, the valuation of Kuaishou’s IPO is alsomarkethot spot.

It is reported that the market’s target valuation of Kuaishou may reach US$50 billion. This valuation is nearly double the valuation of Kuaishou’s latest financing-when the F round of financing is completed in early 2020, Kuaishou’s post-investment valuation exceeds 28 billion US dollars.

In recent years, short videos have served asthe InternetThe popular track attracts capital to succeed.Since its establishment, Kuaishou has conducted multiple rounds of financing, and there are many well-knowninvestmentmechanism.

The prospectus shows that at present, Kuaishou’sshareholderIncluding Tencent, Sequoia Capital,Baidu, Temasek, Boyu Capital, Morningside Capital, etc. Among them, Tencent is the single largest shareholder of Kuaishou with a shareholding ratio of 21%; Morningside Capital is the first venture capital institution to invest in Kuaishou with a shareholding ratio of 14%.

User growth is concerned

The current Kuaishou business mainly includes live broadcast and online marketingservice, E-commerce and other businesses.According to iResearch, in the first half of 2020, in the first half of 2020, Kuaishou will be the largest live streaming platform in terms of the average monthly paying users of virtual gift rewards and live streaming;active userThe second largest short video platform in countless numbers; withProductThe second largest live e-commerce platform in terms of transaction volume.

According to public reports from the media, in the recent roadshow before Kuaishou’s official IPO, the slowdown in user data growth has become a concern for investors.

The prospectus shows that from 2017 to 2019, the average daily active users of Kuaishou apps were 66.7 million, 117 million and 176 million, respectively. Compared with 2018, the growth rate of active users of Kuaishou in 2019 has slowed down.

Kuaishou active user data, picture source: prospectus

In response, the management of Kuaishou replied that this is because the user base itself is relatively large and the company is alsoadvertisingAnd marketing, etc., to increase daily active usersGrowth. According to the prospectus, as of June 30, 2020, the average daily active users of Kuaishou are approximately 258 million, and the average daily usage time of daily active users on the Kuaishou application exceeds 85 minutes.

Although the user growth rate has slowed down compared with the previous period, the fast handbusinessThe growth of GMV (total e-commerce transactions) of services is particularly noticeable. It is reported that Kuaishou launched its e-commerce business in August 2018 and achieved a total of 96.6 million yuan in e-commerce transactions that year. By 2019, this scale has grown to 59.6 billion yuan. In the first half of 2020, Kuaishou achieved a total e-commerce transaction volume of 109.6 billion yuan.

Kuaishou did not separately disclose the income of e-commerce business in the prospectus, but its other business segments, including e-commerce business and online game revenue, achieved revenue of approximately 810 million yuan in the first half of 2020, an increase of more than 30 times over the same period in 2019.

The revenue of Kuaishou’s various businesses, picture source: prospectus

Overall, in the first half of 2020, Kuaishou achieved revenue of 25.3 billion yuan. Among them, live broadcast is the main source of income for Kuaishou. From 2017 to 2019 and the first half of 2020, the revenue of Kuaishou’s live broadcast business accounted for 95.3%, 91.7%, 80.4%, and 68.5% of its total revenue in the same period, respectively.

What are your A-share partners?

The advancement of Kuaishou’s Hong Kong stock listing journey has brought a lot of enthusiasm to its A-share partners. From January 14 to January 15 alone, more than 5 A-share listed companies were asked by investors about their business dealings with Kuaishou.

It is reported that the daily limit on January 15Insai GroupAs an integrated marketing communication service provider. For cooperation with Kuaishou,Insai GroupSaid that since 2019, the company has been involved in online celebrity live marketing. In 2020, the company and Kuaishou signed an annual framework agreement to promote the integrated development of the company’s core business and online celebrity live broadcast marketing.

Gravity MediaSigned with Kuaishou Short Video at the end of 2019strategyCooperation agreement, the two parties will carry out comprehensive research and development, production and operation of short video contentStrategic cooperation, Especially the in-depth cooperation on the short video of broadcasting and TV media platforms and resources.

Internet Data Centerservice providerCapital Onlineused to beinteractiveAccording to the platform, the company mainly provides IDC data center services for Kuaishou.Big Dataservice providerShuzhi TechnologyIt also stated that the company has cooperated with Kuaishou in the field of smart marketing.

In addition,Haofeng TechnologyThe interactive platform also stated that the company provides IT system solutions based on storage and video training for ByteDance and Kuaishou platforms, but the overall amount accounts for a small amount of company revenue.

(Source: Shanghai Securities News)

(Editor in charge: DF537)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.