概要

[The“beareststocks”havebeencutinjust9tradingdays!What’sthematter?】ThecharacteristicsofA-share”February-to-eightdifferentiation”werefullydemonstratedinthemarketatthebeginningoftheyear!Injust9transactionssincethebeginningoftheyearthesharepricesof2stockshavebeencutinhalfandthenumberofstocksthathavefallenbymorethan25%hasreached44

The “February-to-eight differentiation” characteristics of A-shares were fully demonstrated in the market at the beginning of the year!

In just 9 transactions since the beginning of the year, the share prices of 2 stocks have been cut in half, and the number of stocks that have fallen by more than 25% has reached 44.

Choice dataIt shows that since the beginning of the year, in the context of the rise of the three major indexes, A sharesMedianThe stock price fell 6.07%,Share3,049 stocks fell and 1,101 stocks rose.

The “bearest stock” of the New Year has been cut in half!

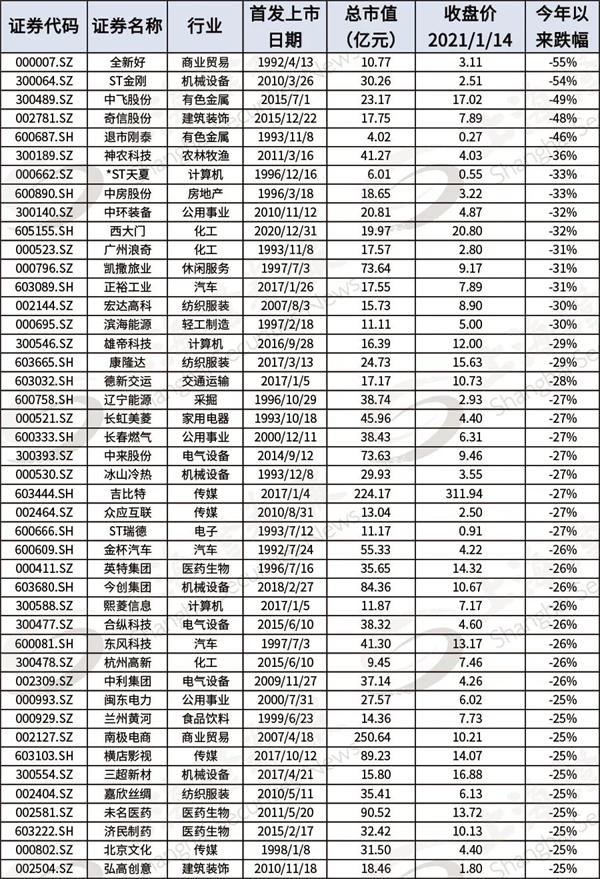

ChoiceThe data shows that as of the close of January 14, the closing prices of 2 stocks have been cut in half compared to the end of 2020, and there are 12 stocks that have fallen between 30% and 50%.

source:Choice Financial Terminal(Data as of the close of January 14)

The rise and fall of individual stocks are random, but inMarket indexIn the context of rising, the rapid and extreme decline of individual stocks is still worthy of investors’ vigilance.

Golden Eagle FundoffundManager Yang Xiaobin believes that these “bear stocks” industries are very different, and there is not much in common between them. There are only two common features:

First, they are all low attention,Market valueLess than 10 billion small-cap stocks;

Two, mostlyPerformanceContinued to be lower than expected.

Specifically, among the stocks that have fallen sharply in the New Year, there are many ST stocks or delisted stocks, such asST King Kong、*ST Tianxia、Delisting GangtaiWait, all three have fallen by more than 30% this year.

And it has fallen by 55% since this yearBrand new and good, Is the well-deserved “bearest stock” at the beginning of this year.

Brand new and goodIt is the first batch of listings in Shanghai and Shenzhenthe company, The name and main business of the securities have been changed many times since the listing. Since December 30, 2020,Brand new and goodAte 9 limit drops.Some investors in the stock bar posted a sigh of “hereshareholderIt’s too miserable, the New Year’s Eve bull market, but here is a continuous lower limit, small losses suffered heavy losses.” According to its latest financial report, as of the end of the third quarter of 2020, there are 12,700 new shareholders.

In addition, the newly listed timesNew crotchAlso appeared in the list of “bear stocks” at the beginning of the year. The new shares of the chemical sector that were just listed on December 31, 2020,West GateIt has fallen for days after being listed, and has now fallen below the issue price of 21.17 yuan.

The median of A shares fell by 6%!

marketWhy deduce the ultimate market?

Behind the tragic decline of “bear stocks” is the ultimate market of A-shares “2-8 differentiation”. Choice data shows that since the beginning of the year, A shares have shown the ultimate market. As of the close of January 14th, the median A-shares fell 6.07%, a total of 3,049 stocks fell and 1,101 stocks rose.

From the index point of view,The Shanghai Composite IndexRose 2.67%,Shenzhen Component IndexUp 4.14%,Growth Enterprise Market IndexThe number also rose by 4.14%.

Yang Xiaobin, the fund manager of Golden Eagle Fund, said: “The market divergence is because the market started to react ahead of schedule. In December, the social financing was lower than expected. Last year, the market rose relatively large and the social financing was not good. At the beginning of the year, liquidity was relatively abundant. As a result, market risk appetite declined, and funds were concentrated in leading stocks with relatively good performance. These stocks have good liquidity and good performance.Guarantee, To be able to cash in gains faster when the market changes. “

Is there no chance for small-cap stocks?

Kang Chongli, head of the Yuekai Securities Research Institute, said: “Small-cap stocks are not yet popular, unless the big market is gone, and the market begins to enter a sideways or correction phase. Especially when the market pulls back, these new stocks and small caps It is possible for stocks to usher in the market, especially the high-quality varieties. The market is still dominated by the pursuit of high-performing weighted blue chips, but it is only from the much-increased ones in the previous period to the less-increased varieties.”

Be wary of loose funds and move positions or have begun

Recently, institutional “grouping” has become the focus of heated discussions in the market. Will the risk of grouping increase?

Kang Chongli, head of the Yuekai Securities Research Institute, said that this round of group market has lasted for a relatively long time. The market has been showing a trend of “28-eight differentiation” recently, and the market trend is very consistent, mainly concentrated in the leading consumerBrokerage, Military, pro-cyclical varieties, and leading varieties are gradually setting new highs in share prices.Plus variousNew fundIt is also chasing these hot spots and carrying out conventional bottom position allocation, which has also led to this convergence in the market.

“This situation will certainly not last forever. When everyone in the market knows that only this type of variety is rising, risks may relatively emerge.” Kang Chongli said.

From the perspective of recent sector differentiation, some high-end varieties have recently seen loosening of funds, and profitable funds will choose sectors with better annual report performance and quality after withdrawal. For example, Chinese stocks have resource advantages, industry leading advantages, ample cash flow and little previous growth. Their orders can also be expected in the spring market and become the target of the recent influx of funds. Another example is the technology stocks, which have performed generally as a growth sector in recent months, but the current varieties with the attributes of leading white horses have gradually become another major attracting sector.

Looking ahead, Kang Chongli believes that the loosening of funds will not be completed in one day, and there will be repetitions in the middle, but the gradual shift of funds is the general trend. At the same time, in the annual report stage, investors should also focus on preventing and controlling the risk of performance that is not as good as expected or stepping on thunder.

Yang Xiaobin of Golden Eagle Fund believes: “One of the possibilities for subsequent market interpretation is that the improvement of overseas epidemics will bring aboutenterpriseThe expectation of profit improvement has been fulfilled and spread to more varieties. If social finance does not continue to fall below expectations in the short term, the stock market will continue to rise. If this expectation fails and the social finance continues to decline, the stock market will adjust further. Personally, I still tend to think that the former has a higher probability. “

(Source: Shanghai Securities News)

(Editor in charge: DF537)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.