原标题:历史上最糟糕的“银行家”! 196个账户操纵了1只股票,损失了3.2亿元!网民暴露了四种主要的操作技巧:很痛

概要

[Theworst”banker”inhistory!196accountsmanipulated1stockandlost320millionyuan!】TheadministrativepenaltyissuedbytheChinaSecuritiesRegulatoryCommissionrecentlyshowedthatXiongMochangandWuGuorongused196accountstomanipulatestockpricesusedtheircapitaladvantagesandshareholdingadvantagesandadoptedcontinuousintradaytradingAfterasingleoperationtheydidnotmakeaprofitandlostandthelossreached324millionyuanTheChinaSecuritiesRegulatoryCommissiondecidedtogiveawarningtoXiongMochangandimposeatotalfineof205millionyuanandawarningtoWuGuorongandatotalfineof185millionyuanAtthesametimethelatterwillbebannedfromthesecuritiesmarketforthreeyears(BrokerChina)

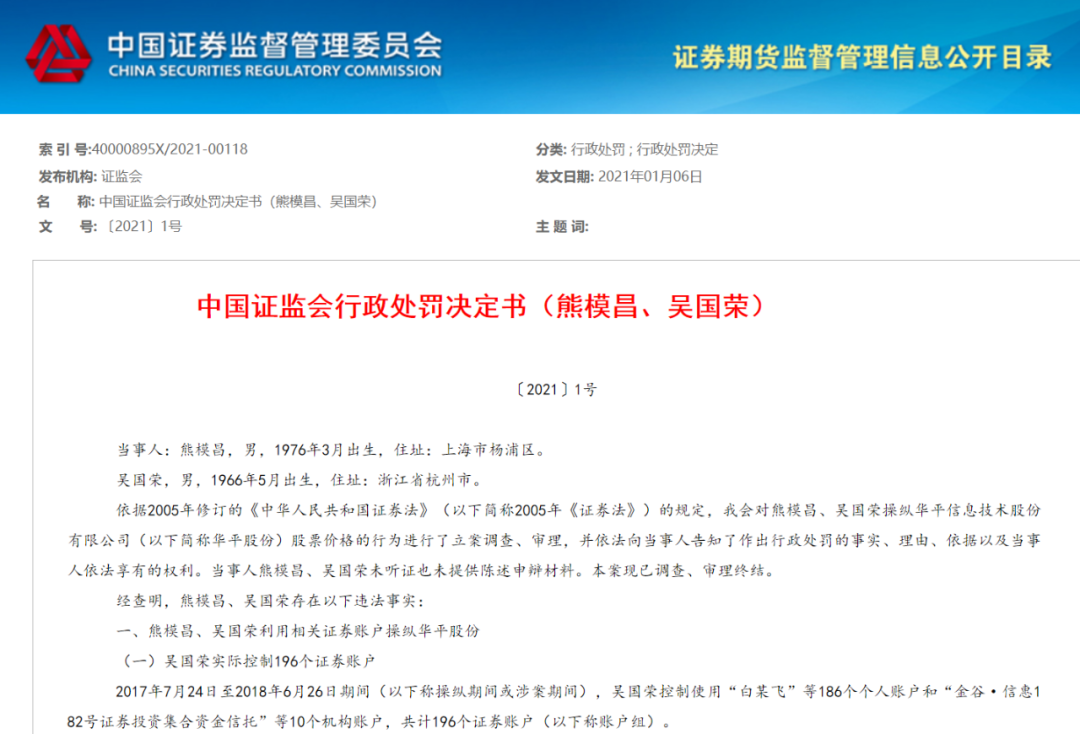

The SFC’s first ticket in 2021 was riggedmarket, Two retail investors who did not make a profit, they were called the “worst dealers.”

The administrative penalty issued by the China Securities Regulatory Commission recently showed that Xiong Mochang and Wu Guorong used 196 accounts to manipulate stock prices, used their capital advantages and shareholding advantages, and adopted continuous intraday trading.LossThe amount reached 324 million yuan. The China Securities Regulatory Commission decided to give a warning to Xiong Mochang and impose a total fine of 2.05 million yuan and a warning to Wu Guorong and a total fine of 1.85 million yuan. At the same time, the latter will be banned from the securities market for three years.

Some netizens ridiculed that they should have hated the market manipulation behavior, but now they have a little bit of pain.

Market manipulation is one of the key violations of the law and regulations in recent years. The China Securities Regulatory Commission stated that market manipulation cases use improper means to create abnormal demand relationships and mislead investors’ decision-making, thus distorting the market.PricingThe mechanism has damaged the interests of investors, and such behaviors will be resolutely cracked down.

196 accounts manipulated a stock and lost 324 million yuan

Time went back to three years ago.

The investigation by the China Securities Regulatory Commission showed that between July 24, 2017 and June 26, 2018 (hereinafter referred to as the period of manipulation or the period involved), Wu Guorong controlled the use of 186 personal accounts such as “Bai Moufei” and “Jingu·Xinhui No.182”Stock investmentCollectionjoint venturegoldTrust“A total of 196 securities accounts, including 10 institutional accounts, found Xiong Mochang, and provided funds according to a ratio of 1:4. Xiong Mochang used Xiong Mousong, Xiong Chu, and Xiong MoubankAccount, accumulatively designated to Wu Guorong in three stagesbankThe account transferred funds of 172 million yuan, Wu Guorong transferred to the allocation account under his control according to the allocation ratio.

After getting the account and funds, Wu Guorong used the advantages of capital and shareholding to use intraday continuous trading,Actual controlSecurities transactions between the accounts ofWarburg Pincus“, affecting stock tradingpriceandDealIn terms of volume, Wu Guorong’s intention to manipulate the market subjectively is obvious. No profit during the manipulation period.

Specifically, Wu Guorong manipulated “Warburg Pincus“Price has four main characteristics:

One is continuous trading: July 24, 2017 to June 26, 2018Share217 trading days, the account group traded in 213 trading days”Warburg Pincus“, accounting for 98.16% of the total number of trading days. The number of purchases ranked first has 153 trading days, and the number of purchases ranked first has 99 trading days. The number of “Warburg Pincus shares” purchased by the account group accounted for market purchasesVolumeMore than 10% have 148 trading days, more than 20% have 99 trading days, more than 30% have 62 trading days, more than 40% have 39 trading days, and more than 50% have 17 trading days. More than 60% have 6 trading days. On February 9, 2018, the buying volume accounted for 66.91% of the market volume on that day. The number of “Warburg Pincus shares” sold accounted for more than 10% of the market volume on 93 trading days, more than 20% had 53 trading days, more than 30% had 32 trading days, and more than 40% had 21 trading days. There are 16 trading days for more than 50% of trading days.

During the manipulation period, Xiong Mochang himself held the original shares of Warburg PincusTotal equityThe ratio is 9.78%. The account group held 20.04% of the tradable shares on February 2, 2018. The total shareholding of Xiong Mochang and Xiong Mochang accounted for about 30% of the tradable shares. After February 2, 2018, there were multiple 20 consecutive transactions in the account group. The number of daily trading shares reached 30% of the total trading volume of the securities during the same period, with a maximum of 45.88%.

two isOppositeTransaction: During the trading period from July 24, 2017 to June 26, 2018, the reverse transaction continued throughout the entire process. In 114 of the 213 trading days, there were reversal behaviors, and the reversal was in the actual control of the account. The inverse volume accounted for more than 10% of the market volume in 33 trading days, more than 20% had 10 trading days, more than 30% had 3 trading days, and more than 40% had 1 trading day. 2018 On May 18, the reverse volume accounted for the highest market volume of 51.90%.

The third is the shareholding advantage: from July 24, 2017 to June 26, 2018, the account group held more than 10% of its A-share outstanding shares in 181 trading days, and more than 20% There are 54 trading days, of which the highest shareholding ratio of tradable shares on February 26, 2018 was 22.30%.

The fourth is the capital advantage: the account group has obvious capital advantages in the transaction of this stock. During the manipulation period, the account group had 193 trading days with buying transactions, with an average daily buying and trading shares of 1,304,300 shares, and an average daily trading amount. 10,020,400 yuan, accounting for 21.50% of the average daily market turnover during this period (average daily average market turnover was 46,116,500 yuan), of which 151 trading days ranked first in the market. The account group had selling transactions on 173 trading days, with an average daily selling transaction number of 1.3167 million shares and an average daily selling transaction value of 8.794 million yuan, accounting for 18.87% of the average daily market turnover during this period (the average daily market turnover The average value is 46,616,500 yuan), and ranks first in the 94 trading day selling volume market.

In the manipulation phase, from July 24, 2017 to June 15, 2018 (the trading day before the multi-day limit), the stock price of Warburg Pincus rose from 6.35 yuan per share to 7.1 yuan per share, an increase of 11.8%. The highest price during the period was 8.86 yuan/share, and the stock had a multi-day limit from June 19 to June 26. As of June 26, the closing price was 3.81 yuan/share. The account group lost 323,723,300 yuan during the manipulation period.

The two conspired to manipulate the stock price and falsely reduce their holdings of “Warburg Pincus”

An investigation by the China Securities Regulatory Commission showed that Xiong Mochang and Wu Guorong’s cooperation model provided Xiong Mochang with fundingGuaranteeJin, asked Wu Guorong to buy “Warburg Pincus shares” accounted for 15% of the number of outstanding shares and maintain the stock price. Wu Guorong was responsible for allocating capital and operating accounts to implement transactions. Xiong Mochang can log in to the account to view, but he has no right to operate. After the increase in holdings of the special account and the sale of all the holdings, the remaining profits will be distributed by Wu Guorong and Xiong Mochang in a 6:4 ratio. The two have agreed to implement the division of responsibilities and income distribution. Facts, to complete manipulation together.

During the period involved, Xiong Mochang held 9.78% of the “Warburg Pincus”, and he and Wu Guorong, the person acting in concert, bought a large number of “Warburg Pincus” through the account group controlled by Wu Guorong. On February 6, 2018, the account group held 20.39% of the shares. , The shares held jointly with Xiong Mochang reached 30%, failed to fulfill the obligation to issue a tender offer as required, and continued to trade “Warburg Pincus” after February 6, 2018.The composition of Xiong Mochang and Wu Guorong, who acted in concert, did not go public as requiredthe companyallshareholderAn illegal act of issuing an offer to acquire all or part of the shares of a listed company.

At the same time, Xiong Mochang also used private equity under his controlproductget onLarge transactionsThe false reduction in holdings of “Warburg Pincus” resulted in false records in relevant information subsequently disclosed by Warburg Pincus. The Securities Regulatory Commission determined that Xiong Mochang’s false reduction of “Warburg Pincus” constituted an illegal act as described in Article 61 of the “Administrative Measures on Information Disclosure of Listed Companies” and Article 193 of the 2005 “Securities Law”.

The China Securities Regulatory Commission decided to impose a fine of 3 million yuan on Xiong Mochang and Wu Guorong’s manipulation of Huaping shares, of which Xiong Mochang was fined 1.2 million yuan and Wu Guorong was fined 1.8 million yuan;

In addition, when Xiong Mochang and his concerted person, Wu Guorong, failed to fulfill the obligation to issue a takeover offer when their increased holdings reached 30% of the issued shares of the listed company, a warning was given and a fine of 300,000 yuan was imposed, of which Xiong Mochang was fined 250,000 yuan. Wu Guorong was fined 50,000 yuan, and Xiong Mochang was given a warning for falsely reducing his holdings of “Huaping Shares” and a fine of 600,000 yuan was also imposed.

In summary, the China Securities Regulatory Commission issued a warning to Xiong Mochang, imposing a total fine of 2.05 million yuan, warning Wu Guorong, a total fine of 1.85 million yuan, and imposing a three-year ban on entering the securities market.

The China Securities Regulatory Commission has repeatedly emphasized the need to “zero tolerance” for illegal activities in the capital market, and severely crack down on listings in the futureCorporate FinanceMajor violations of laws and regulations, such as fraud, malicious market manipulation, and insider trading, will become the norm.The Securities Regulatory Commission stated that it will comprehensively use a comprehensive three-dimensional accountability mechanism such as multiple investigations, administrative penalties, market bans, compulsory delisting of major violations, criminal accountability, and civil compensation to effectively improve violations.cost, Purify the market ecology and protect the legitimate rights and interests of investors.

(Article Source:BrokerageChina)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.