概要

[Antarctice-commerceissuspectedoffraudZhangYuxiang:IamalawstudentwillIcommitfraud?】Antarctice-commercecompany(002127SZ)respondedtothepreviousInternetrumorsaboutthecompany’scardiopulmonarybypassfraud”PPT”incidentontheeveningofJanuary12Antarctice-commercesaidthatalldataisinterceptedfromofficialdataofthee-commerceplatformwhichistruereliableandtraceable(ChinaBusinessNews)

Antarctic e-commerce(002127.SZ) on the evening of January 12th responded to the company’s false “PPT” incident involving extracorporeal circulation that was rumored on the Internet.Antarctic e-commerceSaid that all data are intercepted from official data on e-commerce platforms, which are true, reliable and traceable.

Simultaneously,Antarctic e-commerceIt was also revealed that total GMV sales in 2020 have exceeded 40 billion yuan. GMV, that is, the guide pole e-commerce distributor (Antarctic Community) sells the company’s brand on the e-commerce platformproductThe total turnover.

On January 12, A-shares rose sharply across the board, but the stock price of Antarctic e-commerce reached its limit in early trading, and the limit was not lifted at the close. The stock price closed at 9.23 yuan, the lowest price in eight months. In the 7 trading days since the beginning of 2021, the stock price of Antarctic e-commerce has fallen by 32.5%.

When the CBN reporter communicated with Zhang Yuxiang, chairman of Antarctic e-commerce, he said that Antarctic e-commerce is impossible to fake.

However, contacting Antarctic e-commerce’s response this time and historical information, the reporter found that Antarctic e-commerce is still clarifying the rumors of fraud.

In addition, since January, institutions have continued to sell Antarctic e-commerce, and the Northbound funds have successively received goods.According to three times since JanuaryLonghubangAccording to data, the cumulative amount of sales of seats in Antarctic e-commerce institutions exceeded 600 million yuan, and the amount of purchases was 0. The total amount of Northbound funds bought is about 400 million yuan.

“I am studying law, will I go fraudulently?”

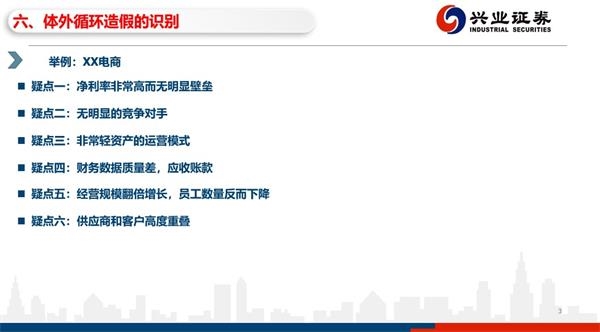

According to the information obtained by a reporter from China Business News, the “PPT” referred to by Antarctic e-commerce may originate fromIndustrial SecuritiesA previous copy of the researcherResearch report。

There is a paragraph in the research report about “Identification of Cardiopulmonary Bypass Falsification”. The PPT uses a certain e-commerce company as an example to explain how to identify funded cardiopulmonary bypass.supplierThe name display is the financial report data of Antarctic e-commerce.

A reporter from China Business News tried to contact the author of the research report, but no response was received as of press time.

However, since the above-mentioned “PPT” was circulated on the Internet in 2018, there have been many questioning articles about Antarctic e-commerce funds cardiopulmonary bypass and business models. When the stock price crashed in the first two trading days of 2021, the doubt reached its peak.

“I started doing business in the 90s,” Zhang Yuxiang said in a telephone conversation with a reporter from China Business News on the evening of January 8, “I am studying law, will I go fraud?”

Zhang Yuxiang created the “Antarctic” brand in 1998 and established Antarctic (Shanghai) Textile Technology Co., Ltd. in December 2010. Many media have reported that Zhang Yuxiang graduated from East China University of Political Science and Law in 1997.

In 2015, Antarctic (Shanghai) Textile Technology Co., Ltd. changed its name to “Antarctic E-commerce”, and backdoor Xinmin Technology went public in 2016.

Before listing, Antarctic e-commerce changed from a self-produced and self-sold model to a brand-authorized business model.

In 2020, total GMV sales have exceeded 40 billion yuan. In 2019, the company’s GMV was 30.559 billion yuan. Based on this calculation, the growth rate of Antarctic e-commerce GMV in fiscal year 2020 will be 31%. Antarctic e-commerce GMV has grown rapidly in recent years, while the company’s GMV in 2016 was only 7.206 billion.

On June 28, 2020, China Business News published “Decrypting Antarctic E-commerce GMV Surging Phenomenon: Dealers frequently change their faces, and subsidiaries play hidden secrets.”

A reporter from China Business News found through investigations that Antarctic e-commerce distributors’ sales data and GMVPerformanceData fighting; many Antarctic heavyweight stores constantly change operators, the registered addresses and names of store operators frequently change, there are unexplainable capital exchanges between upstream and downstream suppliers and distributors, as well as obvious personnel connections. There are signs of funds passing through personal accounts.

Clarification and contradiction

In response to the aforementioned “PPT” question, Antarctic e-commerce responded at 8 points on the evening of the 12th. However, the reporter found that in several important responses, Antarctic e-commerce had contradictions and ambiguities.

Among them, for the companyNet profitThere are very high doubts. Antarctic e-commerce said that the company’s profit mainly comes from the brand integrated service business. The business model is to charge brand integrated service fees. The main cost is the cost of purchased accessories andLabor costsWait, so Maointerest rateHigh, in 2019 Antarctic e-commerce headquarters business (brand integrated service business accounted for more than 85%) grossinterest rateUp to 92.70%.

Therefore, “PPT” questioned the super high net profit, while Antarctic e-commerce responded with “gross margin data.”

Previously, the “PPT” questioned that the company’s accounts receivable as a percentage of revenue increased and fluctuated greatly. “**E-commerce attaches great importance to the secondary market’s attention to the amount of its accounts receivable, and often moves the accounts receivable to other current assets or the balance of current assets to make the accounts receivable data conform to the secondary market. Expectations.” The aforementioned research report once questioned.

Antarctic e-commerce also responded to doubts about the poor quality of the company’s financial data and a high proportion of accounts receivable, stating that in 2018 and 2019, Antarctic e-commerce accounts forOperating incomeThe proportions are respectively 21.61% and 20.21%. The overall proportion is controllable and decreases year by year.

However, it can be seen that Antarctic e-commerce responded to the accounts receivable data after the acquisition of the company “Time Interconnect”. The accounts receivable data before and during the acquisition of “Time Interconnect” fluctuated. Antarctic e-commerce did not respond. .

In addition, the aforementioned “PPT” also questioned that the company’s revenue and GMV in 2017 increased significantly compared with 2016, and the number of company employees did not increase but declined; in 2017, the number of sales employees at the front desk was halved compared with 2016, and the technical staff and financial The number of personnel and administrative staff has increased.

However, Antarctic e-commerce did not respond to the questioned time interval, but responded with employee data from 2018 to the end of 2020. Antarctic e-commerce said that the number of employees in the company’s headquarters decreased by 8 people in 2019 compared with 2018, and in 2020 it increased by 175 people compared with 2019. Antarctic e-commerce also did not respond to the above-mentioned PPT about the halving of sales staff and the increase in the number of middle and back office employees.

Antarctic e-commerce also responded to questions about the previous value-added tax. “PPT” questioned that the amount of value-added tax that the company should pay for the year calculated from the perspective of taxation is far lower than the amount of value-added tax calculated from the perspective of financial reporting.

Antarctic e-commerce responded that the output tax rate of most of the company’s operating income is 6% (attributable to the service industry), which is not the 17% output tax rate calculated from the tax perspective in the previous third-party discussion. The calculation logic (PPT) is error.

Doubt 6: Suppliers and customers overlap

Regarding the question of the high overlap between suppliers and customers, Antarctic e-commerce responded that the company’s front-shop rear-factory model has caused the company to overlap between manufacturers and distributors.

Antarctic e-commerce said that inindustryIn the chain cooperation model, there is overlap between manufacturers and distributors, most of which are in front of the shop and back to the factory, and both manufacturers and distributors are customers of the company.This mode is conducive tosupply chainThe terminal shop directly feeds back consumer demand to the upstream factory, realizing the shortest path of direct user-to-manufacturing (C2M).

Antarctic e-commerce said that manufacturers, distributors and companies together form the Antarctic Community Company.30%~50% of the company’s Alibaba channel is the front-shop and back-factory model.Pinduoduo50%~70% of the channel is the model of front shop and back factory.

However, some professionals believe that the explanation of Antarctic e-commerce is confusing-“How can the VAT be paid at 6% if it is the “front store and rear factory” model? If it is the traditional “front store and rear factory” model, How can there be a 92% gross profit margin?”

According to Antarctic e-commerceannouncement, The company’s main business includes brand integrated service business, dealer brand authorization business, self-media traffic monetization business, factoring business, etc. In other words, the business of the company’s headquarters does not include the business of “front store and back factory”.

“The main business of the company described by Antarctic e-commerce is mainly to provide customers with’tags’, but not to provide goods, so there is no need for the “factory” or “foundry” behind. This’selling tags’ and’front store and back Factory’ is completely two industries.” The above-mentioned professionals think.

Taking into account the clarification announcement, Antarctic e-commerce stated that its gross profit margin is as high as 92%, and the output tax rate of most of its operating income is 6% (attributable to the service industry), which also indicates that the main business of Antarctic e-commerce is to collect brand authorization service fees , Instead of the “front shop and back factory” charged at the 17% value-added tax rate, that is, production and processing (or entrusted production and processing) and sales mode.

In addition, the clarification announcement also revealed that as of January 11, 2021, Mr. Zhang Yuxiang had accumulatedPledge529.935 million shares, with a cumulative net financing of 1.4 billion yuan.

Among them, 530 million yuan of borrowings for return and replacement subscriptions (including subscription subscriptions); 320 million yuan for 2017M&ATime Interconnection 100% equity); 244 million yuan for backdoor listing and Xinmin Technology to sell related assets; 162 million yuan for Mr. Zhang Yuxiang’s personal daily expenses, of which about 150 million yuan is used to pay personal income tax.

Institutions continue to send out, and northbound funds continue to receive

On January 8, Antarctic e-commerce releasedStock repurchasePlan to exceedRMB15 yuan/share (including 15 yuan/share) stock priceRepurchaseStocks with a total value of not less than 500 million yuan and not more than 700 million yuan.

Obviously, the repurchase program failed to stop the decline in Antarctic e-commerce stock prices. Previously, when a reporter from China Business News interviewed Zhang Yuxiang about the company’s stock decline, Zhang Yuxiang once said, “I am in business and don’t care about stocks. We have to always care about stocks. This company is not doing well.”

According to the data from the Shenzhen Stock Exchange’s Dragon and Tiger List on January 12, the two institutions sold 300 million yuan on the trading day. Adding the data on the Dragon and Tiger List on January 4 and 5, the total of the three institutions’ seats on the Dragon and Tiger List The selling amount is 622 million yuan, and the buying amount is 0.

Institutions are selling,Shenzhen Stock ConnectBuying. On January 12, Shenzhen Stock Connect bought 239 million yuan and sold 63.8 million yuan. Previously, according to the statistics of China Business News, from January 4 to 6, Shenzhen Stock Connect net increased holdings of Antarctic e-commerce totaling more than 250 million yuan.

Roughly estimated, in the first 7 trading days of January, Shenzhen Stock Connect increased its holdings of Antarctic e-commerce and spent more than 400 million yuan in total.

It is worth mentioning that Antarctic e-commerce announced the latest top ten on January 4shareholderShareholding data show that the starfundThe growth value of Ruiyuan managed by manager Fu Pengbo has become the eighth largest shareholder of tradable shares of Antarctic e-commerce.

(Source: China Business News)

(Editor in charge: DF353)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.