原标题:疯狂的反击! A股飙升1.6万亿元,大水从何而来? 外资机构信息披露沉重,7月份再度出现热点场面?三大信号引起关注

概要

[Crazycounterattack!A-sharessoared16trillionyuanforeigninstitutionsrevealedblockbusterinformationthehotscenereappearedinJuly?】ThisMondayAsharesfellacrosstheboardandthelimit-downstocksexceededthelimit-upstocksandthemarket’sprofitabilityeffectwasextremelypoorAfteranightofglobaladjustmentstheA-sharemarketsuddenlybecamepopulartodayThestockindexesofthetwocitiesreboundedmildlyintheearlytradingandthesecuritiesfirmsroseintheafternoonCITICSecuritiesoncerosebythelimitTheShanghaiCompositeIndexroseto3600pointsforthefirsttimesinceDecember2015(BrokerChina)

I was still in the ICU yesterday, and it seems that I am going to go to the show again today!

On Monday, A shares fell across the board, and the limit-down stocks exceeded the limit-up stocks. The market’s profitability effect was extremely poor. After a night of global adjustments, the A-share market suddenly became popular today.The stock indexes of the two cities rebounded mildly in the morning and afternoonBrokerageThe rise of the plate,CITIC SecuritiesOnce the daily limit,The Shanghai Composite IndexIt stood at 3,600 points for the first time since December 2015.

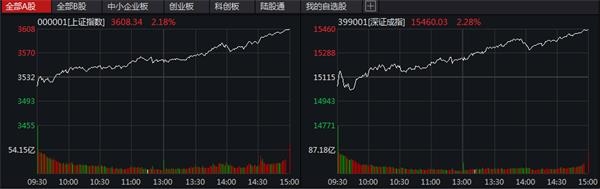

The Shanghai Composite Index closed at 3608.34 points, up 2.18%;Shenzhen Component IndexReported 15460.03 points, up 2.28%;Growth Enterprise Market IndexIt reported 3180.35 points, up 2.83%.As of the close, a total of 53 shares hit a record high (excludingNew crotch), the bull market flagman brokerage stocks rose nearly 7%.

However, from the disk perspective, there are three major signals worthy of attention.One is fundinginterest rate, RecentbankInterval nightInterest rateIn terms of continuity, there seems to be a big change from the previous loose state; second, the turnover of the market today is nearly 110 billion yuan less than yesterday, which is logically a shrinking rebound; third, the high-level meeting held yesterdaymeetingOn the previous page, once again referred to the “three to one down and one supplement”, that is, to reduce capacity, reduce inventory, deleverage, reduce costs, and make up for shortcomings. This one may be ignored by the market.

From the perspective of the stock market, institutions now have a lot of money. Both foreign-funded institutions and domestic-funded institutions are in the peak period of issuance and building positions. In the first week of 2021, a new partial stock class will be establishedPublic offeringFund issuanceThe scale has reached 78 billion copies, which is the second highest level in a single week since 2020. There were five popular models yesterday.fundThe cumulative sales on that day exceeded 110 billion yuan. According to foreign-invested institutions to the brokerage China reporter, the current foreign investment subscriptions are also relatively active, and the allocation demand is even stronger.

One day soaring 1.6 trillion

Today, the Shanghai Stock Exchange Index broke through 3,600 points, setting a new high since December 2015. The total market value has soared by 1.6 trillion yuan, and the disk is very hot.

Kweichow Moutai、China Free、Hikvision、Sany Heavy Industry、Great Wall Motor、Wanhua ChemicalHaier,TCL Technology、Alcoholic liquorWaiting for 53 stocks (excluding new stocks) to set a record high in intraday trading. The bull market flag bearer once again became the vanguard, and the brokerage index rose nearly 7%.China Merchants SecuritiesDaily limit,CITIC SecuritiesOnce the daily limit, it closed up 9.39%,CICCIncreased 8.23%.China Life InsuranceRose more than 8%.

In terms of contribution to the index, the rise of a large number of large-cap stocks has supported the long-term atmosphere throughout the day.In the early trading, Maotai took the lead to pull the index red; in the afternoon, the brokerage took the lead to pull up the index.InsuranceMake efforts to close the index almost at the highest level. During this process, the stock software index also soared by 9.45%.Oriental wealthRose more than 15%,Straight flushUp 9%,Wealth trendSoaring over 7%.

From the perspective of today’s market structure, it is beyond the concept of holding a group to keep warm at the beginning of the year, only increasing the index and not making money.The performance of photovoltaics, new energy vehicles and consumption throughout the day is basically submerged in the limelight of large-cap financial stocks. These three sectorsETFThe gains are all within 3%. Obviously, low-value blue chip stocks have attracted the attention of funds. So, is this the beginning of the handover? In fact, there was a similar structure in the second quarter of 2020. Technology and medicine have skyrocketed, followed by another wave of finance, and finally ended.

Why is it soaring?

In fact, judging from the financial situation, it is not in the trend of releasing water.Recently overnightbankInter-bankBorrowinterest rateThere has been a continuous rise, and the central bank has also continued to operate a net withdrawal of funds. Today it was 5 billion and yesterday it was 15 billion. This action is the norm after New Year’s Day. So why is the market still soaring? Where does the water come from?

Founder SecuritiesChief of Strategy GroupAnalystHu Guopeng said that in the first week of 2021, a new partial stock class will be establishedRaised fundsThe issuance scale reached 78 billion copies, which was the second highest level in a single week since 2020. The cumulative sales of five hot funds yesterday exceeded 110 billion yuan on that day, continuing the hot market in the first week, and residents’ enthusiasm for fund purchases was high. In addition, foreign capital has also maintained a certain degree of inflow. Since January, the inflow has exceeded 20 billion, and today it has exceeded 8.4 billion. On the whole, macro liquidity and market liquidity jointly promote market conditions and accelerate their interpretation.

Another brokerage agency’s investment manager told the brokerage China reporter that after the holiday, they issued funding targets, and at this time it is a question of what to allocate. “Big blue chips must be matched, such as Moutai,WuliangyeWait for the stock, even if you buyLossNor will they be approved, because these are all proven by the marketthe company, Good stocks. In addition, the valuations of popular stocks such as photovoltaics and new energy vehicles are indeed very high. “He said.

Surprisingly, an investment manager of a foreign institution said that now foreign investment funds are also very active. “In fact, the allocation of foreign capital is more vigorous, because many fund contracts do not allow short positions. When money comes, you have to fill it up. This may be an important reason why foreign investors have been buying A shares recently.” He said. In the past 4 trading days,Northward capitalThe net purchase amount of A shares is as high as 33 billion yuan.

In fact, although hot money is not easy to make money recently, it is also very lively. The financing balance has increased by 40 billion yuan this year.

Three major signals attract attention

In fact, to be fair, the macro environment facing the A-share market this year may not be as good as 2020, and the market structure facing it is also inferior to 2020. Therefore, it is not wrong to be cautious when trying to go long. Judging from the current situation, there are three major signals that need attention.

First, the high-level meeting held yesterday pointed out that we must persist in deepeningsupplyOn the main line of structural reform, continue to complete the important task of “three removals, one reduction and one supplement”, and comprehensive optimization and upgradingindustryStructure, improve innovation ability, competitiveness and comprehensive strength, enhance the resilience of the supply system, form a more efficient and higher quality input-output relationship, and achieve a high-level dynamic balance of the economy. What is meant by “three steps, one reduction and one compensation”, that is, decapacity, destocking, deleveraging, cost reduction, and shortcomings. Among them, deleveraging is related to the financial market.

The second is the funding rate. First, from the domestic situation, the short-term capital interest rate has recently been on the rise. SHIBOR and DR001 are in this trend overnight, and as mentioned above, the central bank’s net withdrawal is still continuing; the second is from the international perspective. , U.S. 10-year Treasury bond yields have continued to rise recently, which, for U.S. stocks, will reduce valuations; for China and the United States, it will reduce interest rates. When valuations and spreads fall to a certain level, the market will eventually react.

The third is that the market has risen so much today, but the trading volume has not been enlarged. Instead, it means that the volume has shrunk and rebounded. Instead, it has shrunk by about 110 billion yuan throughout the day, which may mean that the incremental funds are at the current level. Of course, today’s market hotspots have diverged rather than concentrated on a few sectors. This is conducive to the healthy interpretation of the market, and is also conducive to the previous decompression of the group.

(Source: Brokerage China)

(Editor in charge: DF318)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.