原标题:蔚来新车屏风! 李斌:S型不能做ET7,长期的竞争对手是苹果! 边缘大事件频繁发生…

概要

[NIO’snewcarrefreshes!LiBin:ModelScan’tdoET7’slong-termcompetitorisApple!】Inthebeginningof2021afiercebattlearoundnewenergyvehicleskickedoffTesla’sY-seriespricecutsby6digitsandWeilaiAutomobilereleasedanewcarwithabatterylifeofmorethan1000KMLiBinthefounderofWeilaiAutomobilesaidthatWeilai’sShort-termcompetitorsareMercedes-BenzBMWandAudiandlong-termcompetitorsmaybeApple(Ecompanyofficialmicro)

In the beginning of 2021, a fierce battle around new energy vehicles kicked off.TeslaY series price is reduced by 6 digits,Wei LaiThe car released a new car with a battery life of over 1000KM,Wei LaiLi Bin, the founder of the car, said,Wei LaiThe short-term competitors are Mercedes-Benz, BMW and Audi, and the long-term competitors may beapple。

2021 New sourceAutomobile industryBig things happen frequently

Looking back at the new energy vehicle market in 2021, on January 1,TeslaModel Y is officially on sale, with a maximum price cut of 165,100 yuan.TeslaPrice cuts instantly “detonated” new energymarket, Leading to the collapse of Tesla’s official website, the explosion of stores, the explosion of ordering calls, and the skyrocketing stock price of new energy concept stocks…

Recently, on the NIO Day of NIO, NIO ET7 was officially unveiled. The new car is NIO’s first mass-produced sedan, and its price starts at 448,000 yuan.Weilai ET7 is the first of Weilai’s new NT2.0 platformproduct, It is based on autonomous driving technology, and the top models are equipped with lidar. Weilai also launched a battery pack with a 150kWh content and a second-generation power exchange station, which can increase the power exchange efficiency by four times.

Li Bin, the founder, chairman and CEO of Weilai, said that Weilai’s short-term competitors are Mercedes-Benz, BMW and Audi, while long-term competitors may beappleIf it really competes with Tesla, it also competes with Model S. Li Bin believes that the sales of Model S must not be enough for Weilai ET7. If compared with BMW 5 series, ET7 is better than it in almost every aspect. Nothing is worse than them. It does not contain batteries (using the BaaS electricity rental scheme) and is cheaper than them. Too much, and you also need gas to drive a BMW 5 Series, which is more expensive than renting a battery.

Tesla cuts prices, Weilai releases new cars to drive the entire new energyAutomobile industryBig things happen frequently.

On January 4th, by Fordy Industrial Co., Ltd.the companyThe wholly-owned Chongqing Fudi Battery Research Institute Co., Ltd.Founded, The registered capital is 100 million yuan, and the legal representative is Helong.Verdi Industrial forBYDCo., Ltd. holds 100% shares, and the newly established Battery Research Institute isBYD100% indirect holding,BYDThe power battery territory of China has expanded again. Related information shows that the company’s business scope includes battery manufacturing, battery sales, electronic special materials research and development, graphite and carbon product manufacturing, auto parts and accessories manufacturing, and new energy vehicle electrical accessories sales.

Recently, Byton Motors andFoxconn Technology Group, Nanjing Economic TechnologyDevelopment zoneOfficially signedstrategyThe cooperation framework agreement will work together to accelerate the mass production of Byton’s first model M-Bytejobs, And strive to achieve mass production of M-Byte before the first quarter of 2022.According to the agreement, Foxconn will provide manufacturing technology, operation management experience andindustryChain resources to fully support the mass production of Byton’s first model M-Byte. At present, the construction of the Byton Automobile Manufacturing Project base and equipment debugging in Nanjing Economic and Technological Development Zone is nearing completion, and it has obtained the qualification for complete vehicle production. The first batch of trial production vehicles have been rolled off the production line in the first half of 2020, and relevant safety regulations have been tested.

On January 6, AIWAYS announced that it has reached an in-depth cooperation with its Belgian partner Cardoen to further improve its business segment in the European market.Following the start of France, Germany, the Netherlands, and IsraelMovable pinAfter sale, the European version of Ai Chi U5 will also be officially launched in Belgium, priced from 39,950 euros.AIWAYS Executivevice presidentDr. Kelishi said: “Belgium has a growing demand for long-range electric vehicles.borrow The cruising range of over 400km under WLTP conditions will attract high attention in the Belgian market. “The country’s good recognition rate for new energy vehicles has laid a good foundation for the arrival of AIWAYS U5.

Can investment in new energy vehicles still be available?

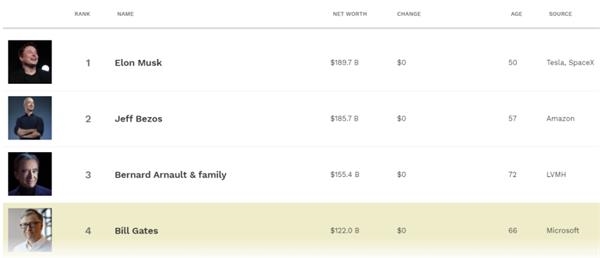

Since the beginning of 2021, new energy vehicles have become the hottest investment sector. Last Friday, Tesla’s stock price soared to $880.Market valueClimbed to 830 billion US dollars. In the first week of this year, Tesla’s stock price has risen by nearly 25%.Musk also officially surpassedAmazonFounder Bezos became the world’s richest man.

Weilai’s share price also stood at 58 yuan at the close on Friday, with a total market value exceeding US$92 billion, ranking second only to BYD in the market value of Chinese auto companies.

The prospects for the future development of the new energy industry are very bright and inspiring. It is precisely because of this that in the past six months, new energy sectors such as photovoltaics, lithium batteries, and electric vehicles have risen sharply, and individual stocks that have doubled are everywhere, greatly exceeding people’s expectations. But with the rise of the sector, can investment in new energy vehicles still be available?

A well-known investor said in an article published in his own media that Weilai and Tesla did not build cars for the sake of building cars. They have a strategic vision that other car companies do not currently have, and it is not too late to get on the car.

At the policy level, in November last year, the State Information Office officially released the “New Energy VehicleIndustrial DevelopmentThe Plan (2021-2035) proposes that by 2025 the sales of new energy vehicles and new vehicles will account for 20%, and the policy direction is set. Under the policy guidance, new energy vehicles will become the main tool for travel, whether it is public or private travel. , The industry’s alternative production of new energy vehicles will accelerate.

West China Securitiesresearch reportIt is pointed out that the sales of new energy vehicles are expected to reach 1.3 million in 2020.YoY+8%, sales of new energy vehicles are expected to exceed 2 million in 2021, +54% year-on-year. At the beginning of 2021, new benchmark models such as Tesla Model Y and Weilai ET7 will lead,supplyEnd-to-end qualitative changes continue to drive demand, analogy to the history of mobile phone development, and the emergence of explosive models will accelerate the increase in the penetration rate of new energy vehicles and promote the industry from the introduction period to the growth period.

Bohai Securities pointed out that Tesla’s domestic Model Y was officially listed. Its price has dropped sharply and its configuration has been improved. It is cost-effective and is expected to create explosive models. At the same time, Model 3 has also increased and reduced prices.Tesla’s series of products have cost-effective advantages and high-tech attributes. Its product sequence is gradually improved and the certainty is extremely strong. It is expected that China’s sales in 2021 are expected to exceed 400,000 vehicles; and the US President-elect Biden’s strong support for new energy vehicles is expected In 2021, global sales are expected to exceed 1 million vehicles, and subsequent production capacity will be released one after another. The future is full of spaceImagine. With policy support and vigorous development of auto companies, we continue to be optimistic about the growth prospects of domestic and global new energy vehicle sales.

althoughBrokerageHe is optimistic about the industry, but there are still different voices in the market.Yang Dong, the founder of the tens of billions of private equity Ningquan Assets, said recently that it is not investing in photovoltaic, lithium, and electric vehicle stocks.Hershey’sThe opportunity is over, they have gradually withdrawn from new energy-related stocks because the current price/performance ratio is already very unfriendly to investors.

In addition, he also emphasized that maybe some are strong and lucky to leadenterpriseTime can be used to resolve the valuation and become the ultimate true king, but most of the new energy stocks that have been slammed may only be able to digest the valuation in the future with a sharp drop in stock prices.

Industry insiders said that although the track is very good and promising, it is no longer cost-effective.Recently, Cao Dewang has also warned of risks. He said that the new energy vehicle sector has accumulated a certain bubble, and may end up wasting a lot of money.Overcapacity。

Cao Dewang believes that there are no particularly good investment opportunities now. Many people think of new energy vehicles as a good investment opportunity or outlet, so some companies are swarming to invest in new energy batteries and cars. But I think that new energy vehicles still use electricity, not water. The so-called new energy vehicles are essentially electric vehicles. Some companies call them new energy vehicles just because they want to get subsidies, but they won’t live long on subsidies.

(Source: e company official micro)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.