概要

[Burst4minesinarow!Thestockpricehashitarecordlowinthepast11yearsandtheveterancompanythathasbeenlistedfor27yearsisoutofplay?Sincetheinitiallossof572millionyuanininventoryGuangzhouLangqi’snegativesidehasneverbeenbrokenNowGuangzhouLangqihasbeeninvestigatedbytheSecuritiesRegulatoryCommissionforviolationsoftheletterandthecompany’ssecretaryoftheboardhassuddenlyresignedInadditionthecompanyhasthreebankaccountsfrozenandsomeofthesubsidiary’snewequityiswaitingtobefrozenNowondersomestockholderssaid“GuangzhouLangqieitherdoesnotmakeanannouncementandtheannouncementisthunder”WhatmakesinvestorsevenmorecoolisthatthestockpriceofGuangzhouLangqihasjusthitanewlowinnearly11yearsIts36700shareholdersareexperiencing”tensofthousandsoftempers”

572 million yuan since the beginningstockAfter the strange disappearance,Guangzhou LangqiThe negative side has never been broken. right now,Guangzhou LangqiHe was also investigated by the Securities Regulatory Commission for violations of the letter,the companyThe Secretary of the Board also resigned suddenly.In addition, the company has 3bankThe account was frozen, and the newly added equity of some subsidiaries was waiting to be frozen. No wonder some investors said, “Guangzhou LangqiOr notannouncement, Lei is the first announcement. “What makes investors even more cool is that Guangzhou Langqi’s share price has just hit a new low in nearly 11 years. Its 36,700shareholderIs experiencing “thousand tempers”…

Investigated by the Securities Regulatory Commission

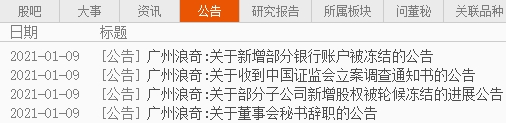

On the evening of January 8, Guangzhou Langqi issued four announcements in a row. Just looking at the headline, there was no good thing, and all of them were “thunder.”

That night, Guangzhou Langqi issued an announcement saying that the company receivedChina Securities Regulatory Commission“Investigation Notice”, due to the company’s suspected information disclosure violations, in accordance with the relevant provisions of the “Securities Law of the People’s Republic of China”, decided to file an investigation of the company.

According to a report from the Shanghai Securities News, it may be a matter of time before Guangzhou Langqi was filed for investigation. After all, since September 2020, since Guangzhou Langqi’s “exceptional disappearance of 572 million yuan in inventory”, the company’s information disclosure has exposed more and more problems. more.

As early as November 9, 2020, the Guangdong Securities Regulatory Bureau issued the “Decision on Measures to Issue Warning Letters to Guangzhou Langqi Industrial Co., Ltd., Zhao Biqiu, Zhong Lianjun, Tan Xiaopeng, and Li Yanmei” administrative supervision measures decision. In this decision, the Guangdong Securities Regulatory Bureau has determined that Guangzhou Langqi has a number of violations of information disclosure: first, it failed to disclose in a timely manner its failure to pay off major debts that were due, and second, it failed to fully disclose the relevant inventory risks in a timely manner .

After being supervised by the administrative authorities, Guangzhou Langqi continued its “sorry operation”. For example, after receiving more than 2 billionlandAfter the compensation, Guangzhou Langqi plans to carry outaccountingDeal with the changes, so as to the company’s current operationsPerformanceCaused a significant impact, leading to huge differences in information disclosure before and after. When the company received the land transfer confirmation, it did not disclose it in time.

Secretary of the Board of Directors suddenly resigned

In addition to being investigated by the Securities Regulatory Commission, Guangzhou Langqi’s secretary to the board of directors who took office less than half a year also suddenly resigned.

On the evening of January 8, Guangzhou Langqi issued an announcement stating that it had received a written resignation from the company’s board secretary, Mr. Tan Xiaopengreport. For personal reasons, Mr. Tan Xiaopeng applied to resign from the position of secretary of the company’s board of directors, and after resignation, he no longer holds any position in the company.

On July 31, 2020, Guangdong Langqi issued an announcement on the change of secretary of the board of directors. Wang Gang’s term of secretary of the board of directors expired and resigned, and the company appointed Tan Xiaopeng as the company’s secretary. In other words, Tan Xiaopeng has been in office for less than half a year. According to the original plan, Tan Xiaopeng will serve as Secretary of the Board of Guangzhou Langqi for up to three years, until July 2023.

Judging from the content of the announcement, Tan Xiaopeng’s resignation appeared sudden. Currently, Guangzhou Langqi has not yet found a new secretary of the board of directors. During the vacancy of the position of secretary of the board of directors, the company’s chairman Zhao Biqiu performed the duties of the secretary of the board.

There are 3 morebankAccount is frozen

Also on the evening of January 8, Guangzhou Langqi also announced that the company has 3 morebankAccount is frozen, totalFrozen funds3,967,200 yuan. As of January 7, the company has a total of 27 bank accounts that have been frozen, and the accumulated balance of funds frozen is 285 million yuan.

What is the concept of 285 million yuan?This is the company’s most recent periodauditNet assets14.94% of the third quarter report of 2020 is 39.27% of the unaudited net assets, which is the unaudited third quarter report of 2020currency38.25% of the fund balance.

In addition, Guangzhou Langqi and its subsidiary Guangdong Qihua have opened a total of 105 bank accounts that have not been cancelled, and the number of frozen bank accounts accounts for 25.71% of the total number of bank accounts opened.

Subsidiary equity is frozen

Guangzhou Langqi’s “bottomless black hole” is not just fermenting itself, its subsidiaries andSun CompanyThere are also troubles.

On the evening of January 8, Guangzhou Langqi also issued an announcement stating that as of the date of the disclosure of this announcement, some of the company’s subsidiaries and the company’s Sun Company had frozen equity registered capital totaling 599 million yuan.

As of the date of the disclosure of this announcement, Guangzhou Langqi’s frozen shares include Guangzhou Huatang Food Co., Ltd., Guangzhou Qihua Co., Ltd., Shanghai Qihua Industrial Co., Ltd. 100% equity and Guangzhou Langqi Daily Necessities Co., Ltd. 98.9% equity.

More and more missing inventory

It can be said that Guangzhou Langqi’s current predicament all began with a sudden inventory disappearance in September 2020. On September 27, 2020, Guangzhou Langqi issued an announcement stating that the company’s inventory in Ruili warehouse and Huifeng warehouse was missing, with a total book value of 572 million yuan.

The problem is that the follow-up investigation not only failed to find the inventory, but more and more lost inventory. On the evening of December 25, 2020, Guangzhou Langqi issued an announcement stating that it has evidence to show that there is a third party whose accounts are inconsistent in the trading business.warehouseInventory amount and other accounts are inconsistentrelease productsThe total amount has reached 898 million yuan.

More and more default debts

In addition to the increasing number of missing inventories, Guangzhou Langqi also has more and more default debts. Just a few days before Guangzhou Langqi broke out the bizarre disappearance of 572 million yuan in inventory (September 24, 2020), Guangzhou Langqi issued an announcement stating that some of the company’s debts were overdue due to tight capital conditions.throughCorporate FinanceDepartmental statistics verified that as of September 24, 2020, the company’s overdue debt totaled 395 million yuan, accounting for 20.74% of the company’s most recent audited net assets.

On January 4, 2021, Guangzhou Langqi issued an announcement stating that as of December 30, 2020, the company and its subsidiaries had overdue debts totaling 710 million yuan, accounting for 37.2% of the company’s most recent audited net assets. . In other words, in almost three months, the company has added 315 million yuan in default debt.

Stock price hit a record low in nearly 11 years

Recently, I just felt that Guangzhou Langqi was “increasing” everything, more and more bank accounts were frozen, more and more missing inventories, more and more default debts, and so on. But only Guangzhou Langqi’s stock price is getting lower and lower.

When Guangzhou Langqi broke out that 572 million inventory was missing, the company’s stock price fell by two straight down limits, and then the stock price has been sluggish. In the intraday trading on January 8, Guangzhou Langqi’s share price hit 3.2 yuan (previouslyRestoration, The same below). The last time Guangzhou Langqi’s stock price was lower than 3.2 yuan, it also dates back to nearly 11 years ago on May 18, 2010, when Guangzhou Langqi hit a minimum of 3.19 yuan.

During the 2015 bull market, the performance of Guangzhou Langqi was very impressive. From around 6 yuan in mid-2014, it soared to 21.39 yuan on June 15, 2015, an increase of about 2.6 times in about a year. Now, in about 5 and a half years, Guangzhou Langqi’s share price has fallen by 84%.

In the face of the “thunder rolling” Guangzhou Langqi, the company’s shares are full of complaints, either saying that Guangzhou Langqi has delisted, or reminding everyone to prepare for compensation. Some stockholders even said: “Either you don’t make an announcement, or the announcement is thunder.”

As an old stock that has been listed for 27 years, Guangzhou Langqi is not useless.Founded in 1959, it is the earliest detergent production in South Chinaenterprise.Its core is “Langqi”Brand, Also has brands such as Gaofuli, Tianli, Wanli, Jienengjing, etc. The main products are washing powder, liquid detergent, and daily chemical washing materials. In 1990, the company was named the 500 largest in ChinaindustryOne of the enterprises.

But now, Guangzhou Langqi is encountering the catching up from the rising stars such as Blue Moon and Liby, plusProcter & Gamble、UnileverWaiting for the encirclement and suppression of foreign capital, the trend of declining west is becoming more and more obvious. For the 36,700 shareholders of Guangzhou Langqi, the future may not be too good…

(Article Source:Oriental wealthResearch center)

(Editor in charge: DF075)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.