原标题:消费者基金经理为什么要购买技术成长股? -成长股票思维笔记(一)

概要

[Whydoconsumerfundmanagersbuytechnologygrowthstocks?】Whydoconsumerfundmanagersbuytechnologygrowthstocks?Someinvestors’impressionsofconsumer-stylestarfundmanagershaveboughthigh-qualitycompaniesunderthedefinitionoftraditionaltechnologygrowthamongthetoptenheavyweightstockssuchasHikvisionGlodonLongjiCATLAVICYiyiNetworkandsoon

Investment points

★ConsumptionfundWhy do managers buy technology growth stocks?The consumer-style star fund managers in the impression of some investors have bought high quality under the definition of traditional technology growth among the top ten heavyweight stocks.the company,E.gHikvision、Glodon、Longji shares、Ningde era、AVIC Optoelectronics、Yealink Networkand many more.

★We believe that behind this phenomenon is not “exceeding the circle of ability”, but “new and old” growing up and dividing. “Growth core assets” (new) gradually bid farewell to the attributes of “emotional cycle stocks” (old), starting from “Game“Based PEG valuation” has shifted to “holding DCF valuation”, which has been held by some investors for a long time. The industry structure is clear and increased.ChangheThe high and stable “new” growth of ROE is expected to be revalued by holding investors using DCF logic.

★Reviewing the investment in growth stocks in 2020: 1) The performance of traditional growth sectors (computers, media, communications) is bleak, and the emerging growth sectors (new energy vehicles, photovoltaics, military industry) are particularly eye-catching, almost completely aligned with the 2015 bull marketReverse. 2) The opposition is not traditional and emerging growth, but “new and old” growth. Tradition and emerging growth are internally differentiated greatly. In the past year, it is not only necessary to choose the right traditional and emerging growth, but more importantly, to choose the right “new and old” growth. 3) Say goodbye to “emotional cycle stocks” and welcome “growth core assets”.Select “speakPerformance“New” growth stocks with long performance is the best growth stock investment strategy in the past year. The traditional growth sector is not not rising, and good companies with stable growth can still get rid of the gravity of “emotional cycle stocks”; emerging growth The sector is not rising randomly, high-quality companies are still in the force field of “growth core assets”.

★ Behind the differentiation of “new and old” growth is the changing industry, investors, and valuation logic.

1) Industry: The fundamental change is that the fundamentals are “achieving performance and seeing long-term performance”.The ups and downs of growth stocks in the past were largely due to market sentiment followingindustryExpected to fluctuate sharply, it is difficult to see sustained performance growth landing, and the current “growth core assets” are gradually accumulating, out of the category of “emotional cycle stocks”.

2) Investors: Internationalization and institutionalization are accelerating, changing from a game-type to a holding-type. Fundamental changes in growth stocks have prompted changes in the investor structure. Internationalization and institutionalization have been the best stock selection indicators for growth stocks in recent years. “New” companies with good growth form a positive cycle of “good performance gets additional allocations and good performance with additional allocations”.

3) Valuation logic: The valuation logic of some growth stocks may be shifting from “gaming PEG valuation” to “holding DCF valuation”. The investment in “old” growth stocks is mainly based on PEG valuation, and the competition is the judgment of the inflection point of the prosperity, the marginal expected game and the speed of buying and selling. Investment in “new” growth stocks turned to DCF valuation, and the competition was to select a good track with “thick snow and a long slope” and a good company that “snowballed”.

★We summarize the growth stock investment strategy under the logic of “new and old” growth differentiation into four sentences:

1) “New” growth is better than “old” growth, bid farewell to “emotional cycle stocks” and welcome “growth core assets”.

2) Look for core growth assets in the segmented areas that “can produce performance and see long performance” and “success in a horse race”.

3) In “new” growth companies, explore investment opportunities in the accelerated phase of internationalization and institutionalization.

4) Grasp the valuation logic of individual stocks from PEG to DCF’s value revaluation gains.

After communicating with various growing industries, we selected six cases for display:Ningde era、Longji shares、Kingsoft Office、Guolian shares、Yealink Network、Hikvision.Recent departmentBranch officeSigns of logical change have appeared, among which the “new and old” military industries are splitting, and the industry restoration process that embraces the “new” military industry growth stocks is particularly intense.

Risk Warning: Escalation of Sino-U.S. Frictions, Second U.S. Epidemic Lockdown, Financial Supervision,AntitrustSupervision.

Report body

1. Why do consumer fund managers buy technology growth stocks? “New and old” are growing up in differentiation

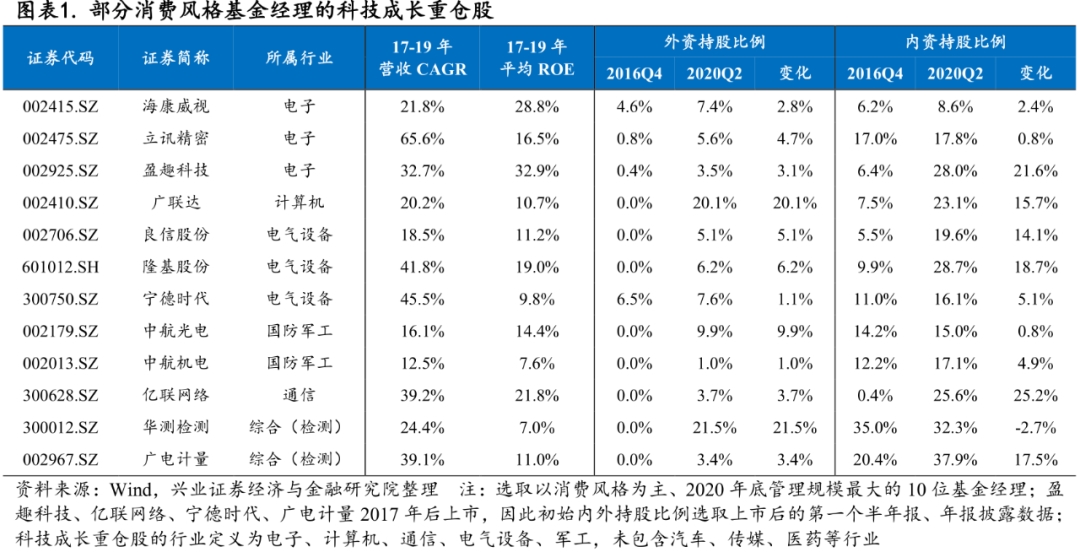

In the process of combing fund holdings in the third quarter of 2020, we found an interesting phenomenon: some investors’ impressions of consumer-style star fund managers have bought high-quality companies under the definition of traditional technology growth among the top ten heavyweight stocks (for the time being defined) For electronics, computers, communications, electrical equipment, military industry).

We believe that behind this phenomenon is not “exceeding the circle of ability”, but “new and old” growing up and dividing. “Growth core assets (new)” gradually bid farewell to the “emotional cycle stocks (old)” attribute, and shifted from “gaming-based PEG valuation” to “holding-based DCF valuation”, which has been held by some investors for a long time.The industry pattern is clear and increasingChangheThe high and stable “new” growth of ROE is expected to be re-evaluated by holding style investors using DCF logic.HikvisionAs an example, the current valuation is still smaller than the core consumer assets with similar financial texture, so they are constantly being repaired by investors’ new logic.

1.1 In 2020, traditional growth sectors are bleak, and emerging growth sectors are bright

The past 2020 is a big year for growth stock investment. The top 50 partial equity funds in the annual performance all achieved returns of more than 100%, and their investment styles are mainly distributed in growth (new energy vehicles, photovoltaics, military industry, electronics, etc.) and consumption (liquor, medicine, leisure services, etc.) Among them, growth style funds account for a higher proportion.

Traditional growth sectors (computers, media, and communications) performed bleak, while emerging growth sectors (new energy vehicles, photovoltaics, and military industries) were particularly eye-catching. The computer, media, and communications sectors, as the star sectors of growth stocks in the past, have lagged behind in this year’s growth stocks bull market. The annual growth rate is ranked 16, 17, 27 in all industries, and 26, 25, and 27 after July 14. . Electronics benefited from the performance of the semiconductor sector in the first half of the year. It ranked 7th and 15th around July 14. The industry performance is stable and there is a certain degree of differentiation in the sector. We will not discuss this in this article. In the 2015 bull market (January 1-June 12), computer (201%)>media (163%)>communication (144%)>electronics (137%)>photovoltaics (131%)>new energy Automobile (125%)>National Defense Industry (116%), while the growth industry ranking in 2020 will almost completely reverse.

1.2 The opposition is not traditional and emerging growth, but “new and old” growth

We divide the internal of new energy vehicles, photovoltaics, national defense and military industry, computers, media, and communications into companies with the top 20% of revenue performance in 2020 and companies with the bottom 80% of revenue performance. Compare the performance of the two combinations in 2020, and you can see Regardless of whether the traditional growth sector or the emerging growth sector, the internal differentiation is great. In the past 2020, investment in growth stocks has not only selected the right traditional and emerging growth sectors, but more importantly, the right “new and old” growth stocks.

1.3 Say goodbye to “emotional cycle stocks” and welcome “growth core assets”

The differentiation between the traditional and emerging growth sectors in 2020 is due to “speaking of performance and long-term performance.” Comparing the market performance of growth stocks in various industries in 2015 and 2020, the market performance is consistent with expectations. In 2015, the traditional growth boom will be dominant, and the emerging growth boom will be dominant in 2020. Currently: 1) New energy vehicles: dual-cycle resonance of policies and new models, at home and abroad The inflection point of demand has come. 2) Photovoltaic: Non-fossil energy sources increase the target + absolute cost advantage, and the installed capacity is expected to increase substantially. 3) Military industry: benefiting from the “14th Five-Year Plan”, downstreamclientNeed more certainty,Industry chainRelatively closed.Traditional growth stocks continue to be constrained by financial and epidemic issues, and no longer have the industry-wide resonance and extension of the 4G technology cycle in 2015M&AExpansion of the overall sector boom.

How to distinguish between “new and old” growth? It depends on whether it is “speaking of performance and long performance.” Sorting out the top 10 companies in the growth industry growth list in 2020, the biggest difference between this round of growth stocks and the past bull market is that the top growth companies are not all small votes, but a group of growth stocks with real performance.

The traditional growth sector is not about not rising, and good companies that grow steadily can still get rid of the gravity of “emotional cycle stocks”; the emerging growth sector is not rising randomly, and high-quality companies are still in the force field of “growth core assets”.

2. Behind the differentiation of “new and old” growth is the changing industry, investors, and valuation logic

2.1 Industry: The fundamental change is “achieving performance” and “growth core assets” precipitation

The fundamentals of many growth segments have been “achieving performance and seeing long-term performance”, and leading companies have gradually “successfully won.” Looking back at the leading companies in the growth sector from 2013 to the present, although new energy vehicles, photovoltaics, military industry, computers, communications, and media have been classified as growth sectors, the leading companies have been changing since 2013, and it is difficult for leading companies to experience steady and continuous expansion. Steady head position. The big ups and downs of growth stocks in the past were largely due to the large fluctuations in market sentiment following industry expectations, making it difficult to see sustained performance growth landing.However, in recent years, with the entry of high-quality companies on the capital market, the growth industry has become more mature and stable. A group of companies’ fundamentals have gradually moved out of the category of “emotional cycle stocks” and are expected to become true “growth core assets” in the market, such asNingde era、Longji shares、Middle public education、Kingsoft Officeand many more.

2.2 Investors: Accelerating internationalization and institutionalization, shifting from a gaming type to a holding type

As the fundamentals of growth stocks have undergone fundamental changes to “achieve performance and see long-term performance”, domestic and foreign institutional investors, as the strongest marginal funds in recent years, have begun to continuously allocate “new” growth and promote the growth of “new” growth stocks. Internationalization and institutionalization are accelerating. Such companiesPricingFrom the game type to the holding type.

Internationalization and institutionalization are the best stock selection indicators for growth stocks in recent years. The growth rate of “new and old” growth stocks in 2020 is highly correlated with the degree of institutionalization: “new” growing high-quality companies have been tapped by domestic and foreign institutions and continued to be allocated. The company performed well in the process of capital allocation and entered the vision of other institutional investors , And then attract incremental capital allocation again, and finally form a positive cycle of “good performance gets additional allocations, and good performance gets additional allocations.”

Looking back at 2017 to the present, the internationalization and institutionalization of “new” growth stocks has actually been on the way, and changes in the medium and short-term business climate only change the rhythm and not the trend. The internationalization and institutionalization of leading companies have continued to occur since 2017 and accelerated since 2019. The leading companies that have received continuous allocation of marginal funds continue to expand the growth differentiation of “new and old” in the market.We have observed that the degree of institutionalization of “new” growing top companies is generally below 40%. If “new” growing companies can enter the core asset stock pool that the market expects and is willing to hold for a long time, refer to overseasTSMC, The potential for future additions is huge. From the perspective of the holding characteristics of domestic and foreign institutional investors, market pricing has gradually shifted from a game-type to a holding-type. Some recognized “growth core assets” and “not for sale” attributes have gradually emerged, and some investors are more inclined to “value” >price“The logic.

2.3 Valuation logic: Changes in the industry and investors may shift PEG to DCF

The fundamentals of the growth sector have shifted from “market sentiment fluctuates substantially following industry expectations” to “achieving performance and seeing long-term performance”. The investor structure superimposed on “new” growth core assets has accelerated internationalization and institutionalization, and some growth stock valuation logic It may be shifting from “gaming PEG valuation” to “holding DCF valuation”:

1) The investment in “old” growth stocks is mainly based on PEG valuation. Investors’ Alpha comes from the judgment of the inflection point of the prosperity. The competition is the marginal expectation game and the speed of buying and selling.

2) Investment in “new” growth stocks is shifting to DCF valuation. Investors’ perceptions are poor in the industry track, competitive landscape, etc. The competition is to select a good track with “snow thick slopes” and a “snowball” Good company.

From the perspective of the DDM model, the driving force of “new” growth stocks is based on the risk appetite and risk-freeinterest rate, Turning more attention to long-term growth at the molecular end.

3 How to construct investment strategies under the trend of “new and old” growth differentiation?

We summarize the growth stock investment strategy under the logic of “new and old” growth differentiation into four sentences:

1) “New” growth is better than “old” growth, bid farewell to “emotional cycle stocks” and welcome “growth core assets”.

2) Look for core growth assets in the segmented areas that “can produce performance and see long performance” and “success in a horse race”.

3) In “new” growth companies, explore investment opportunities in the accelerated phase of internationalization and institutionalization.

4) Grasp the valuation logic of individual stocks from PEG to DCF’s value revaluation gains.

After communicating with various growth industries, we selected six cases for display: CATL, Longji,Kingsoft Office、Guolian shares、Yealink Network, Hikvision. Some companies have recently shown signs of logical change. Among them, the “new and old” military industries are split, and the industry restoration process that embraces “new” military growth stocks is particularly intense.

New energy vehicles: Policies and new models resonate in two cycles, and the inflection point of domestic and overseas demand has come. According to the calculation of the new energy group of power equipment, it is estimated that the CAGR of global new energy vehicles will reach 35% in the next 5 years, and the CAGR of power lithium battery demand will reach 40% in the next 5 years.New energy group recommendation for power equipment: Ningde era of the mid-upstream industrial chain, battery linkYiwei Lithium Energy; DiaphragmEnjie shares; ElectrolyteXinzhoubang、Godsend materials(Covered by chemical group); structural partsKodali;negative electrodePutailai;positive electrodeDangsheng Technology; RelayHongfa sharesWait.

Photovoltaic: Non-fossil energy sources increase the target + absolute cost advantage, and the installed capacity is expected to increase substantially. According to the calculation of the new energy group of power equipment, assuming that the proportion of non-fossil energy will reach 20% in 2025 and 30% in 2035, it is estimated that the installed capacity center will increase to 70-80GW in 2020-2025, and will further increase to 160GW in 2026-2035. It is expected that the industrial differentiation will continue, and the differentiation of bargaining power will gradually form in each link. Photovoltaics is optimistic about glass and silicon materials in the short term, and modules are optimistic about the long-term; the new energy group of power equipment recommends: Longji,JA Technology、Tongwei shares、Flat、Foster、Almaden、Sungrow、Goodway、Jinlang Technology、GoodwayWait.

Military industry: The new and old military industry is divided, and the new military industry “new” growth stocks under the “14th Five-Year Plan” are more likely to be seen.The military industry team predicts that in the next five years, in the context of building an army for actual combat, the military industry is expected to usher in structural acceleration: aerospace equipment is expected to usher in a systematic acceleration; aerospace equipment is expected to usher in a significant acceleration in new military aircraft; electronic equipment as a supporting equipmentproductThe demand growth rate is the weighted average of other fields, and is expected to continue to maintain rapid development under the background of continuous and vigorous advancement of informatization; ground equipment and ship equipment are expected to maintain steady growth. Military industry group recommendation: It is recommended that the direction of over-equipment of military electronic components in the next six months is recommended, and aerospace equipment and new aviation equipment industry chain high-growth high-quality targets are scarce bargaining chips. Focus:Philip、AVIC Optoelectronics、Hongyuan Electronics、Torch Electronics、Aerospace Electric、Hongda Electronics、Ziguang Guowei、AVIC Shen Fei、AVIC Hi-Tech、Aileda、China Jane Technology、Triangle defense、AVIC ElectromechanicalWait.

Computers: The strong scale-effect leader of domestic computers is expected to cross the bulls and bears. The leading computer with strong scale effect has the characteristics of increasing scarcity, higher growth ceiling, and strong performance realization ability. Based on the experience of the US market in the past ten years,Market valueTop ten technology categoryenterpriseThey are all product-based and platform-based companies with strong economies of scale, and their performance growth, profitability, and stock price performance have continued to outperform the overall market, showing strong anti-cyclical properties. Recommendation from the computer team: a leading company with a super-matched productization and platform-based core track with a strong scale effect. It is recommended to pay attention to Jinshan Office,Glodon、Yonyou Network、Guolian shares、Zhongfu Information、Anheng Information、Dingjie Software、Convinced、Hang Seng Electronics、Tai Chi shares、Weining Health。

Communications: The epidemic has accelerated the popularization of “new normal office”, and the future of unified communications can be expected.Now, deploy the videomeetingThe penetration rate of small meeting rooms for equipment is less than 3%, and it is expected to increase from 18% to 75% in the next 5 years; the domestic remote office penetration rate is about 0.6%, and the global penetration rate is also at a low level. The global epidemic has driven the outbreak of unified communications industries such as remote office and education, and the demand for “video first” continues to grow. The new 5G infrastructure will further promote the popularization of “new normal office” and accelerate the development of the unified communications industry. The global unified communications market is expected to grow to 48.3 billion U.S. dollars in 2023. Communication group recommendation: Yealink Network. 5G meets the network requirements of ultra-high-definition video communication, and the demand for remote meetings and network collaborative office is significantly increased, accelerating the popularization of cloud video conferencing.Unified Communications Leader/HD Video ConferencesupplierWith SIP as the anchor and VCS as the propeller, Yealink will fully share the dividends of the booming industry, and its performance is expected to continue to grow rapidly.

Electronics: 1) Hikvision. As a security leader, the company’s management has a forward-looking strategic vision, strong execution, strong algorithmic capabilities, and a deep understanding of technology, and successfully captures every industry change. After the adjustment of the organizational structure, the company’s efficiency is expected to be greatly improved, with more adequate preparations for this round of industry changes.The bidding data continues to improve. We are optimistic that Hikvision’s PBG business will resume growth. At the same time, the company’s unified software architecture has basically been built, and its response capabilities have been further improved.Big DataThe efficiency of the company’s transformation process is also expected to continue to improve. 2)Luxshare Precision。appleThe self-manufacturing rate of Lixun’s components in watches is much higher than that of AirPods, which enhances the company’s integration and coordination. Watches are expected to take over AirPods to help high growth.The company entered into mobile phone assembly through the acquisition of Wistron, and its development space continued to expand.Big customerWith a sales volume of nearly 200 million mobile phones each year, the mobile phone business will become a new growth point for the company.

(Article source: XYSTRATEGY)

(Editor in charge: DF358)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.