原标题:银行股票连续两天变红。 住房贷款的“紧缩诅咒”有多大影响? 房地产公司承受的压力更大,这种融资渠道是否应该“解雇”?

概要

[Bankstockshaveturnedredfortwoconsecutivedaysandwhatistheimpactofthe”tighteningcurse”ofhousingloans?Onthelastdayof2020theCentralBankandtheChinaBankingandInsuranceRegulatoryCommissionissuedthe”NoticeonEstablishingaCentralizationManagementSystemforRealEstateLoansinBankingFinancialInstitutions”whichsetsclearupperlimitsontheproportionofbankrealestateloansandpersonalhousingloans(BrokerChina)

a new Year,bankHow will we face the “tightening curse” of the New Mortgage Deal?

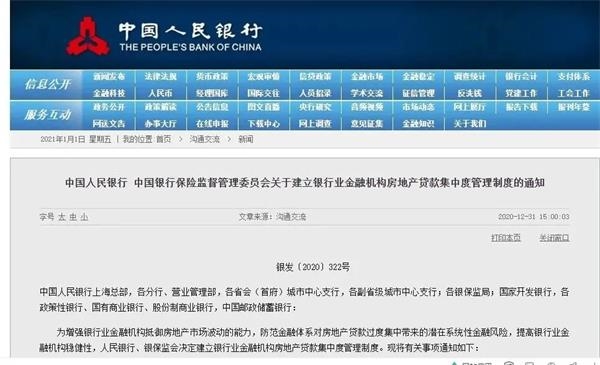

On the last day of 2020, the Central Bank and the China Banking and Insurance Regulatory Commission issued thebankIndustry financial institutionreal estate“Notice on the Loan Concentration Management System”,bankreal estateA clear upper limit is proposed for the proportion of loans and personal housing loans.

People in the industry generally said that the introduction of the New Deal is expected, and overall it has little impact on banks. As market sentiment gradually stabilized, unlike the “green” performance of bank stocks at the beginning of the year, from January 6th to 7th, the bank stock index went red for two consecutive days.

There are also real estate companiesBrokerageChinese reporters revealed that changes on the financing side will force real estate companies to invest more carefully and focus more on the core.futurereal estateThere may be differentiation within the industry, and the development of leading real estate companies has the upper hand. Small and medium-sized real estate companies do not rule out beingM&APossible.

What are the banks’ strategies for reducing the proportion?

In the case where the supervision clearly specifies two upper limits for the proportion of real estate loan balance and the proportion of personal housing loan balance, how will banks respond?

Some insiders in the banking industry have analyzed to a brokerage China reporter that from the perspective of the strategy of reducing the proportion, banks can choose other risk-adjusted yields close to housing loans.product, Asset securitization, overdue and bad collection pressure drop, etc., “Big the denominator is also a way, if the big part is to support the real economy, it is more in line with the orientation.”

In terms of the proportion of personal housing loans, frombusinessFrom a sexual perspective, it is high-quality due to its low risk and low capital consumptionCreditAssets, oftencommercial BankFavor. However, some people in the industry said that normal personal loans that are still in repayment will not be pressured down, and rigid demand is still encouraged.

“In fact, the bank’s adjustments will not be too great, because the relevant adjustments in the mortgage business have already started in the early stage.” A senior practitioner from a large state-owned bank told reporters.

In recent years, the government’s determination to regulate and control the real estate market has become increasingly prominent. Under the guidance of “no speculation in housing and housing”, the adjustment of real estate loans in the banking industry has continued for a period of time, and the New Deal only institutionalized the previous policies. The above-mentioned practitioners told reporters that banks have already begun to adjust the concentration of real estate loans.

On the one hand, strictly control the access of real estate developers, that is, conduct strict investigations on real estate development projects,enterprisecash flow,profitThe bank will conduct detailed understanding and due diligence on the situation and the status of the project in progress; on the other hand, from the demand side, that is, the households who purchase the real estate, the bank mainly focuses oninterest rateThe degree of rise is adjusted, and many restrictions have been added to the approval of personal mortgage loans.

“For banks that do not exceed the standard, it is also in accordance with the national policy guidelines and requirements to increase support for the real economy as much as possible. Of course, suitable real estate projects are still to be done, depending on the actual situation.”

Minsheng Securities Guo Qiwei also said that as the economy recovers,manufacturingWith rising demand for loans and consumption, the direction of loan investment is expected to be more diversified, and bank loans other than real estate are expected to accelerate, thereby reducing the proportion of housing-related loans and reducing policy pressure.

ABS wants to “fire”?Small real estate companies can’t hide their worries

Some financial industry analysts mentioned to reporters that as asset securitization (ABS) can circumvent the “three red lines” while achieving financing needs, the proportion of ABS issued by real estate companies in the total financing channels is likely to increase in the future.

“ABS is financing in a disguised form. It does not essentially change the asset-liability ratio of the company. It is only the leading companies that can issue ABS. Only the real estate company with very good qualifications can issue it. If the entire real estate industry is viewed as an industry, the development of ABS is beneficial Supply-side reform.” The above-mentioned analysts pointed out to reporters that from the perspective of various financing channels, the total amount of real estate financing will show a decline, but the proportion of ABS may increase.

However, some head real estate companies have expressed different opinions on this, “ABS can be issued, but bank development loans are the mainstream, because now speaking, bank development loan interest is the cheapest.” The reporter learned, In addition to higher qualification requirements for real estate companies, the issuance of ABS has higher interest rates and higher costs.

From the’three red lines’ to the current new housing loan policy, overall, it is gradually standardized.The real estate company also predicted to reporters that in the context of tight financing, there will be differentiation within the real estate industry in the future, and the development of leading real estate companies will have the upper hand. “Because the stall is bigger, there are more opportunities. Relatively speaking, Small real estate companies have little ability to resist risks, basicallyGo to meetingIt’s the state of the strong and the strong.

In addition, due to the lack of qualifications of small real estate enterprises, some banks are morecreditLow-priced real estate companies cannot obtain development funds from banks and can only use financial controlthe company、TrustWhen financing is done, the interest rate is higher and the cost is also very high.

Zhongtai SecuritiesDai Zhifeng also said that the new regulations will further promote the concentration of loans to leading real estate companies from the financing end.Out of the consideration of maintaining strategic customers, large banks will give priority to scarce quotasGuaranteeLeading real estate companies and small and medium-sized real estate companies have become more difficult to obtain bank loans, or they can only guarantee their own cash flow by speeding up the processing of inventory, and subsequent acquisitions are not ruled out.

The supply side implements real estate loan concentration management for banking financial institutions, and the demand side sets “three red lines” for real estate enterprises. At present, macro-prudential management measures have been gradually implemented, and deleveraging in the real estate industry is underway.

Forcing real estate companies to invest more cautiously

In line with the “three red lines”, the new housing loan policy further implements a comprehensive reduction in real estate from both supply and demand.CreditThe scale of the situation.

A big linePractitionersThe reporter told the reporter that the “eye-catching point” of real estate loans in the past is that real estate projects generally first have start-up funds, which will bring some enterprises to banks first.deposit, Increase the bank-enterprise linkage. If the project prospects are promising, such as the ability to resist risks and recover funds in a timely manner, the bank can also provide development loans for the development of corporate projects.Invest ingold.

When the real estate project enters the mature stage, it can attract customers to purchase the developed real estate, which in turn provides banks with high-quality customers who are able to purchase real estate by issuing personal mortgage loans. On the whole, banks are able to issue corporate loans and expand personal loans to benefit all parties.

On the other hand, the real estate industry cycle is relatively short. After the real estate is sold, the funds can be recovered and the project loan can expire. “Compared with loans in other industries, the real estate industry has a short cycle and quick results. It takes only a few years from the beginning of construction to completion.” The above-mentioned bank practitioners said that this is not like asset loans or large-scale projects in other industries. The loan will drag on for many years.

However, real estate projects also occupy relatively large amounts of funds, and are subject to many uncertain factors such as policies and markets. “So it can also be said that housing development projects have high risks and high returns.”

In recent years, real estate control policies have been continuously promulgated, along with the frequent “chicken ribs” in real estate projects. Good locations have basically been fully developed. For banks, housing development projects are becoming more and more prudent. “For example, when a major bank reviewed the development projects of a leading housing company in a third-tier city in East China a few years ago, it was originally The provincial bank passed, but the head office rejected it during the approval process, thinking that the funds are at risk.”

Faced with the tightening of financing, a person close to the investment department of a leading real estate company revealed to reporters that changes in the financing end will force real estate companies to invest more cautiously and focus more on the core. “If the loan is strict, the project review will also Correspondingly become stricter. From the perspective of our investment side alone, because if you invest in positions that are not particularly core,Pay backThe return is slow and the income effect is poor”.

Added “Tightening Curse” as expected

“Overall, it is a signal to guide banks to invest less in real estate and support the real economy more. This is consistent with the previous regulatory guidance.”Bank of CommunicationsXia Dan, research specialist of the Financial Research Center, told a reporter from China Securities.

In fact, the New Deal is nothing new in terms of content. Prior to this, housing loan concentration management was also mentioned as a means of macro-prudential supervision.

On October 21, 2020, Pan Gongsheng, Deputy Governor of the Central BankFinancial StreetAt the annual meeting of the forum, it was pointed out that the People’s Bank of China will promote the improvement of macro-prudential management of real estate finance, and gradually implement the concentration of real estate loans and residents.Debt incomeMacro-prudential policy tools such as ratio, real estate loan risk weight.

Many analysts told reporters that the impact of real estate loan concentration management on banks is not significant. At present, most banks basically meet the policy requirements, and the pressure on the stock of real estate loans is limited.

The new housing loan policy divides banks into five tiers, and sets requirements for the concentration of real estate loans in tiers, that is, sets upper limits on the proportion of real estate loans and personal housing loans, and allows local regulatory agencies to limit the third, fourth, and fifth tiers of banks Float 2.5 percentage points up and down.

At the same time, the New Deal stipulates rectification requirements for banks that exceed the upper limit, that is, those exceeding the limit within 2 percentage points have a transition period of 2 years, and those exceeding the limit by 2 percentage points or more have a transition period of 4 years.

Not long ago, the “three red lines” of the new regulations on real estate financing issued by the regulatory authorities have also attracted attention: first, the asset-liability ratio of the real estate company after excluding the advance payment shall not exceed 70%; second, the net debt ratio of the real estate company No more than 100%; third, the “short-term cash debt ratio” of real estate companies is less than 1. As long as “stepping on the line”, the scale of interest-bearing liabilities cannot be increased or must be strictly controlled.

“Because of the relatively flexible transition period, even if it is calculated in 2-4 years, the total annual pressure drop of banks that exceed the limit is about several hundred billion yuan. Banks that do not exceed the limit are not easy to increase according to the upper limit, because the mortgage management has always Relatively stricter.” Some analysts told reporters that development loans are subject to long-term strict control, and banks have a certain degree of flexibility in lending to personal mortgage loans. The fluctuations are relatively large. After the policy is introduced, banks that step on the line will also slow down. Loan impulse.

(Source: Brokerage China)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.