原标题:太热了! 在3天之内,向南方增加366亿元购买香港股票的情况很少! 今年最大的机会?

概要

[Toohot!In3daysitisraretoadd366billionyuantothesouthtobuyHongKongstocks!Thebiggestopportunitythisyear?InthepastmonthnorthboundfundshavefluctuatedgreatlywhilesouthboundfundshaveshownnetinflowsafterDecember21andtheamountoffundshasincreasedsignificantlyinrecentdaysAsofJanuary5southboundfundshaveaccumulatednearly666billionyuanininflowinthemostrecentmonth(ChinaFundNews)

On January 6, the Hang Seng Index turned from a fall to a rise in the afternoon, and showed a bottoming and rebounding trend throughout the day. As of the close, the Hang Seng Index closed again to a new high.

At the same time, southbound funds continued to be strong in the early afternoon and continued to flow in. The enthusiasm for southbound funds to participate in Hong Kong stock transactions continued to rise.As of the close, the total southbound funds on the dayNet inflow12.396 billion Hong Kong dollars. It is worth mentioning that this is already three consecutive trading days after the Southbound Fund has exceeded 10 billion yuan.

Hang Seng Index out of V-shaped market

Southbound net inflow of funds exceeded 10 billion for 3 consecutive days

On January 6, the Hong Kong stock market closed, and the Hang Seng Index closed up 0.15% in a shock wave, to 27692.3 points, achieving nine consecutive gains, with a full-day turnover of 218.122 billion. In addition, the state-owned enterprise index rose 1.17% to 10899.83 points, and the red chip index rose 1.5% to 3882.21 points. The Hang Seng Science Index closed at a new high, rising 1.73% today to 8609.6 points.

In terms of industry sectors, the retail industry ranked first, while semiconductors, energy,software serviceWait for the front.

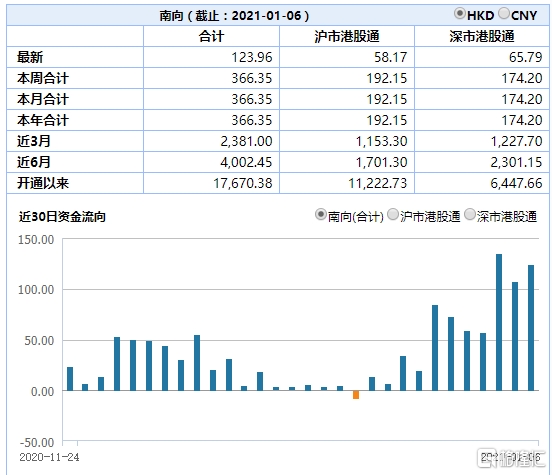

At the same time, the enthusiasm of southbound funds to participate in Hong Kong stock transactions continued to rise. As of the close of Hong Kong stocks on January 6, the total net inflow of southbound funds on that day was HK$12.396 billion, of which the Shanghai stock marketSouthbound tradingThe net inflow was HK$5.817 billion, and the Shenzhen-Hong Kong Stock Connect net inflow was HK$6.579 billion.

It’s worth noting that the southboundCash flowThe average income exceeds 10 billion, totaling HK$36.6 billion. According to data, the total net inflow of southbound funds on January 4 and January 5 was HK$13.495 billion and HK$10.743 billion respectively.

In the past month, northbound funds have fluctuated greatly, while southbound funds have shown a net inflow after December 21, and the amount of funds has increased significantly in recent days. As of January 5, southbound funds have accumulated nearly 66.6 billion yuan in inflow in the most recent month.

SMIC, Tencent, Meituan, etc. are popular

On January 6, the top ten trading stocks of Southbound Trading (Shanghai) wereSMIC, Xiaomi Group,Tencent Holdings, Meituan,China Mobile、Chinese Flying Crane、China National Offshore Oil Corporation、CRRC、Anta Sports、Sunny Optical Technology。

among them,SMIC(0981.HK) continued to strengthen today and pulled up in late trading. It rose 12.94% today, and rose more than 19% during the intraday session. As of closing at HK$22, the latest total market value is HK$267.7 billion, turnover is HK$10.6 billion, and the turnover rate 8.55%.

On the news, SMIC on the evening of January 5announcement,the companyWill disclose the company’s fourth quarter of 2020 after the trading hours on February 4, 2021Performance. In order to facilitate the majority of investors to have a more comprehensive and in-depth understanding of the company’s operating performance, the company plans to hold the “Presentation Meeting for the Fourth Quarter of 2020” on February 5, 2021.In addition, the semiconductorindustrySet off a wave of price increases, many listed companies sent letters to increase prices,Industry chainThe chain reaction intensified and chip stocks collectively rose.

Hong Kong stocks are currently the global valuation depression

Optimistic about investment opportunities in Hong Kong stocks in 2021

Looking back on 2020,Industrial SecuritiesIndicates that as of November 20, the total net inflow of southbound funds in 2020 is about 530 billionRMB, Setting the highest in history, structurally prefer finance,information Technology, Optional consumer industries.In terms of configuration preferences, grabTraditional financeShares and embrace the new economy.The 10 AH stocks with the most net inflows, dividend yieldMedianAlmost as high as 7%, and the valuation is relatively low and the AH premium is superimposed, giving Hong Kong stocks a unique advantage in the allocation of large-scale assets. on the other hand,Tencent HoldingsThey appear in the top ten actively traded stocks of Southbound Stock Connect every day. SMIC, Meituan, Xiaomi, Sunny, etc. also appear on the list more times, indicating that funds also favor the representatives of Hong Kong stocks in the new economy, especially Hong Kong stocks. Core assets that are scarce in China. In 2021, it is expected to attract 300 billion yuan of funds to the south to helpPublic offeringfundThicken α.The earnings of Hong Kong stock companies are closely related to the mainland. As my country’s economy takes the lead in the global recovery, Hong KongStock baseThe current economy is up.

Debon FundGuo Chengdong pointed out that the performance of Hong Kong stocks has been lagging behind the A-share market for more than two years, and the scissors gap of AH has been expanding, and it was even close to the peak level in mid-2015, reflecting the different focus of the two markets on risk premiums. Back to the market itself, in the past three years, the ecological changes in the Hong Kong stock market have quietly begun, and the market structure has undergone major changes and jumps. In view of the current situation where southbound funds are concentrated in the new economic sector, Guo Chengdong believes that this trend will change, and the allocation opportunities in the Hong Kong stock market will be multi-directional.

Lu Yang, founder of Botong Investment, pointed out that from the recent A-share market,CSI 300withGrowth Enterprise Market IndexUnder the leadership of leading companies in liquor, medicine, and new energy vehicles, there are signs of speeding up to catch up. As a result, it has further widened the valuation gap between individual stocks and each sector, that is, widened the arbitrage space. One of the arbitrage spaces is the paired arbitrage trading between A shares and H shares.He explained that the current heavyweights of H-shares are fully adjusted, and the price of AH is also at a historical high. Therefore, in the process of de-bubbling A-shares this year, short the CSI 300 and A-sharesStart a businessFor the board index, the Hang Seng Index with long H shares is also a good pairing transaction. Looking at the two trading days since the new year,Northward capitalAll are net outflows, and the southward capital flows into Hong Kong stocks more than 10 billion every day. Behind this phenomenon is that foreign investors are concerned about short-term bubbles under the current structure of A-shares. Domestic retail investors are buying large numbers of public offerings as receivers, and domestic institutional funds tend to be Hong Kong stocks.

Gray Assets stated that it is most optimistic about the investment opportunities of Hong Kong stocks in 2021, especially those of Hong Kong stocks.the InternetIndustry track. Zhang Kexing, general manager of Gray Assets, previously stated that the best investment era in China’s capital market has come, and the long-term high probability is the volatile and upward slow bull market. Both A shares and Hong Kong stocks will have good market performance next year, especially Hong Kong stocks have greater opportunities. The Hong Kong stock market is facing a qualitative change. Both the market structure and the major indexes are being reborn and conform to the new trend of China’s economic development. It is expected that the premium of AH shares will further converge in 2021. After July this year, it has severely underperformed A shares. It has also changed the contrarian trend that Hong Kong stocks have severely underperformed the global emerging market index since mid-2019. Turn, start to accelerate this convergence. There is no reason why Hong Kong stocks, as the value depression of the global capital market, should not rise.

(Source: China Fund News)

(Editor in charge: DF380)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.