原始标题:[Market Portrait]A股市的价值每年飙升20万亿! 北方的资本流动规模超过一万亿元,杠杆资金不断增加!百元股进入C位,新能源行业牛股大量涌现

概要

[Marketportrait:Astockmarketvaluesurged20trillionayear!Northboundfundsfloatinginexcessoftrillionsofleveragedfundsfrequentlyincreasepositions!】In2020undertheleadershipofcoreassetssuchastechnologyandconsumptionA-shareswillusherinasharpreboundTheShanghaiCompositeIndexhasrisen1387%forthewholeyearwhichissecondonlyto2019inthepastsixyearsInthecontextoftheaccelerationoftheScienceandTechnologyInnovationBoardandtheimplementationoftheGEMregistrationsystemhigh-qualityassetshavechosentolistonthedomesticcapitalmarketIn2020thenumberofA-shareswillexceed4000forthefirsttimereaching4140anincreaseof11%comparedtotheendof2019TheamountofA-shareIPOfinancinghita13-yearhightheamountof”science”includedcontinuedtoincreaseforeignandleveragedfundsenteredthemarketacceleratedandthemarketvalueofBeijingcapitalholdingsdoubled(Datatreasure)

In 2020, under the leadership of core assets such as technology and consumption, A shares will usher in a sharp rebound.The Shanghai Composite IndexThe cumulative increase for the whole year was 13.87%, and the increase in the past six years was second only to 2019.inScience and Technology Innovation Boardaccelerate,Start a businessUnder the background of the implementation of the board registration system, high-quality assets have chosen domestic capitalmarketWhen listed, the number of A-shares in 2020 will exceed 4000 for the first time, reaching 4140, an increase of 11% compared to the end of 2019. The amount of A-share IPO financing hit a 13-year high, the amount of “science” included continued to increase, and the entry of foreign and leveraged funds accelerated.Northward capitalPositionMarket valueDoubled.

1、Growth Enterprise Market IndexLeading the world, the highest annual closing point in history

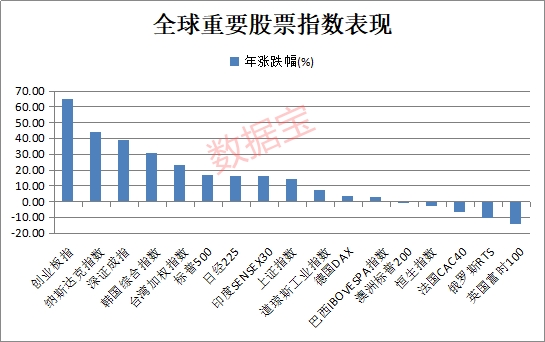

2020 A shares will close,themeThe hotspots are brilliant, and the market value of industry leaders frequently hit new highs. The Shanghai Composite Index closed at 3473.07 points, an increase of 13.87% throughout the year, and it has risen for two consecutive years.Growth Enterprise Market IndexThe annual increase was 64.96% to close at 2966.26, the highest annual closing point since the opening of the GEM.GloballyMajor market indexIn the ranking, the growth rate of the ChiNext Index is the first, Leading the second-ranked United StatesNasdaqThe index is 21.32 percentage points.

2. A-share growth is amazing, with a surge of 20 trillion a year

Data treasure statistics show that A shares are listedthe companyThe total market value is nearly 80 trillion, an increase of 20 trillion compared to the end of 2019, an increase of 34%, and an increase of more than 2.7 times compared with the end of 2011.Food, medicine, and technology have become the sectors with the highest market value growth. In 2020food and drinkThe added value of the total market value of industries such as medical and biological, electrical equipment, and electronics exceeded 2 trillion.

As China’s capital market matures, itsInfluenceMore and more extensive, financial assets represented by A sharesnational economyPlay the role of the mainstay. 2019 ChinaGDPNearly 99 trillion, The total market value of A-shares accounted for nearly 80% of GDP at the end of 2020, an increase of 20% from the end of 2019。

3. With the outbreak of new energy, the electrical equipment industry has become a concentration camp for bull stocks

Data treasure statistics show that in 2020, 28 Shenwan first-level industries,real estate, Communications, building decoration and other 7 industries fell,real estateThe biggest decline, down 10.85%, 14 industry indexes outperformed the Shanghai Composite Index over the same period.

Leisure services, electrical equipment andfood and drinkThe industry index steadily ranks among the top three industry gains by 99.38%, 94.71% and 84.97%.The leisure service industry index nearly doubled due to the largest heavy stockChina FreeThe strong performance of the stock price,China FreeThe market value reached 551.5 billion, accounting for 70% of the leisure service sector, with an annual increase of 218.74%, contributing most of the increase in the leisure service industry index.

2020 is the year of the outbreak of new energy,As many as 27 stocks in the electrical equipment industry doubled their gains during the year, With photovoltaic, lithium battery, and wind energy concept stocks in the majority. This sector is the undisputed bull stock concentration camp in 2020.

4. Matthew effect, nearly 150 stocks above 100 yuan

A-shares continue to rise, and the number of stocks above 100 yuan in 2020 will increase sharply. At the end of the year, it has risen to 149, which is three times the number at the end of 2019.Kweichow MoutaiThe stock price rose to 1998.98 yuan, close to 2,000 yuan, FollowingKweichow Moutaiafter that,Stone TechnologyThe stock price also stands at the thousand yuan mark.

There are 45 companies listed on the Sci-tech Innovation Board among stocks of more than 100 yuan. The surge in the number of high-priced stocks not only represents the rise of the Sci-tech Innovation Board, but also represents that high-quality companies are being sought after by more and more funds and are improving in the long term.The data shows that except for the 2020 listingNew crotchIn addition, only two of the stocks of more than 100 yuan showed a decline in the stock price, namelyGoodix TechnologywithEspressif Technology。

The A-share Matthew effect is obvious, and the trend of individual stocks is divided. While the number of high-priced stocks is rising,Low-priced stocksThe number is also increasing. At the end of 2019, there were only 54 low-priced stocks below 2 yuan.At the end of 2020, there are 89 companies, of which ST stocks account for the majority。

As more and more companies go public, A sharesMarket structureIn the process of reshaping, the strong will remain strong, and the industry leaders will continue to hit new highs; the weaker the weaker, the listed companies with poor fundamentals and poor governance will be abandoned by funds. In the future, the phenomenon of good money driving out bad money will become the norm.

5. Technology stocks have become a hot spot, and IPO financing hit a 13-year high

The amount of A-share direct financing has increased significantly, and the new stock camp will continue to expand in 2020. A total of 396 companies have successfully landed in the A-share market (Note:Dongbei GroupConverting B shares to A shares,ST Country Heavy EquipmentTo relist after delisting), the number ranked second in history, second only to 436 in 2017.Year-on-yearIn 2019, it increased by 95.52%.

In 2020, the total amount of A-share IPO funds raised by new shares hit a 13-year high, at 470 billion, An increase of more than 85.56% year-on-year in 2019, and the total IPO fundraising ranked second in history. Data treasure statistics show that in the past 30 years, the total annual IPO fundraising of A shares has exceeded 400 billion only 3 times. The previous two were in 2007 and 2010. The total IPO funds raised for new shares that year were 477.1 billion and 4643. Billion.

From the perspective of fundraising, compared with previous years, in 2020, emerging semiconductors, computers and medical biologyindustryBecome a “hot spot” for fundraising.

Nearly half of the total IPO funds raised are contributed by science and technology innovation board companies. Since the opening of the Sci-tech Innovation Board for more than a year, IPOs have grown rapidly.The 145 science and technology innovation board stocks to be issued and listed in 2020 have a total initial capital of 222.6 billion. As of the end of 2020, the number of new shares listed on the Science and Technology Innovation Board reached 215 companies.

Total A-share initial fundraising in recent years

6. The GEM registration system has been implemented, and the initial fundraising has increased by nearly 5 times

In 2020, China’s capital market has ushered in a profound institutional change-the establishment of the ChiNext registration system, an innovativeenterpriseThe convenience of financing has become another major change in the capital market after the establishment of the Science and Technology Innovation Board.

Data treasure statistics show that since the launch of the GEM registration system on August 24, 63 companies have successfully issued and listed on the GEM.The initial funds raised totaled 66 billion, a year-on-year increase of nearly 5 times.Among them, the largest fundraising isArowana, The amount of funds raised is 13.9 billion; the smallest fundraising scale isCarbide, The raised amount is less than 300 million.

Since the registration system has been implemented,The average daily turnover of GEM reached 234.2 billion, an increase of 125% over the same period last year, The stock activity increased substantially.

GEM registration system facilitates corporate fundraising

7. Leveraged funds continueAdd warehouse, The balance of the two financial institutions exceeded 1.6 trillion

At the end of 2020, the balance of the Shanghai and Shenzhen stock markets exceeded 1.6 trillion yuan, of which the financing balance exceeded 1.4 trillion.The balance of the two financial institutions set a new high in five years since July 7, 2015.

The two financing funds are also called leveraged funds, mainly financing funds, as incremental funds, representing investors’ confidence in the market. At the end of 2020, the balance of the two financings increased by nearly 600 billion from the 1,019285 billion at the end of 2019, and the annual increase was second only to the 679.1 billion in 2014.

From an industry perspective, since 2020, 28 Shenwan Tier 1 industries have been net purchases by financing customers. Among them, the net purchases of the two major industries of medical biology and electronics have exceeded 50 billion, followed by non-bank financials. , Electrical equipment and computer industries, the net purchases of financing all exceeded 20 billion. It can be seen from this that leveraged funds are highly favored by the growth sector. On the whole, the agriculture, forestry, animal husbandry, and fishery industries accounted for the highest proportion of the two financing balances in the circulating market value, accounting for 4.45%, followed by communications,Non-ferrous metalsAnd computers, and leisure services andfood and drinkIndustry, 0.49% and 0.93% respectively.

Changes in the balance of financing between the two cities in recent years

8. The right to speak of foreign capital has been enhanced, and the floating profit of Beijing capital holdings exceeds one trillion for the first time

With the inclusion of important international indexes such as MSCI and FTSE Russell with increasing weights, the process of A-share internationalization has further accelerated, and the voice of foreign capital in A-shares has increased significantly. At the end of 2020, the market value of foreign holdings of A shares increased by 60% from the end of 2019.

In 2020, Beijing Capital will sweep A-shares and become an important force in the stock market. Statistics show that the transaction volume of Beijing Capital in 2020 is 21 trillion, an increase of 116% year-on-year, and the growth rate has exceeded 100% for four consecutive years. Transaction activity has increased significantly. However, the speed of net purchases has slowed down, and the net purchases of funds from Beijing Capital have been 208.9 billion in the whole year, which is a year-on-year decrease.

While Beijing Capital is actively investing in A shares, it has also achieved a major breakthrough in earnings. Data treasure statistics show that since 2020,The floating profit of the capital holdings in Beijing has grown rapidly, and finally passed the 1 trillion mark in December. Compared with the end of 2019, the floating profit has more than doubled, setting a new record。

(Article source: data treasure)

(Editor in charge: DF506)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.