原标题:困惑! 格力房地产董事长被调查并参与内幕交易! 曾经因为“免税概念”的8联板,股价会再次动摇吗?

概要

[ThechairmanofGreeRealEstatewasinvestigatedforinsidertrading!Eversincethe”tax-freeconcept”8-linkedboardsharepricehastoshakeagain?InjusttendaysatleastthreecompanychairmenhavebeeninvestigatedbytheSecuritiesRegulatoryCommissionforsuspectedinsidertradingOntheeveningofDecember30GreeRealEstateissuedanannouncementstatingthatthecompany’schairmanLuJunsiwasinvestigatedbytheChinaSecuritiesRegulatoryCommissionforsuspectedillegalactsofinsidertradinginthesecuritiesmarket(BrokerChina)

In just ten days, there have been at least threethe companyThe chairman was investigated by the Securities Regulatory Commission for suspected insider trading.

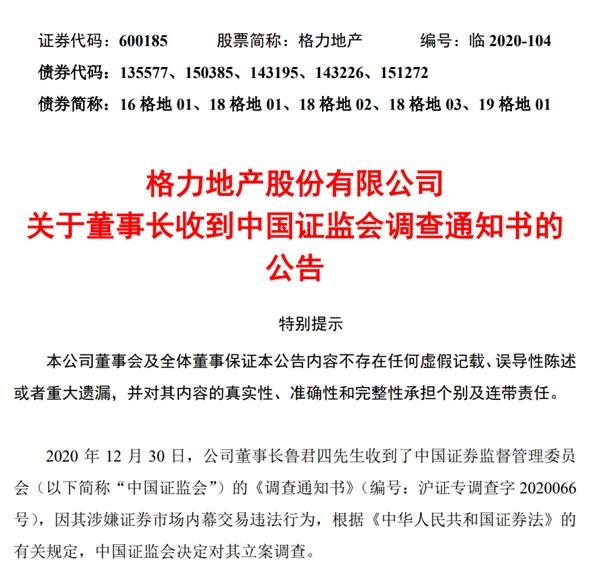

In the evening of December 30,Gree Real EstatereleaseannouncementSaid that the company’s chairman Lu Junsi was suspected of securitiesmarketThe illegal act of insider trading was investigated by the China Securities Regulatory Commission.

The company stated that during the investigation period, Lu Junsi can perform his duties normally and the company’s board of directors can also operate normally. This matter will not affect the company’s daily routine.Production and operationActivities, the company’s management, business and financial status are normal. However, the company’s follow-up announcement showed that because the chairman is being investigated by the Securities Regulatory Commission,Gree Real Estatebuyduty freeenterpriseThere is a risk of suspension or termination.

since this yearGree Real EstateThe share price rose by 48%. It is worth mentioning that under the support of the “tax-free concept”, GreeReal estate stocksThe price had a daily limit of 8 consecutive boards, and the stock price once reached a historical high of 18.1 yuan per share, and then the stock price fell all the way. The lowest stock price during the year was 3.74 yuan per share. Based on this calculation, Gree Real Estate’s stock price rose by 384% so far this year.According to Gree Real Estate Disclosure CompanyNumber of shareholdersThe latest situation, as of September 30, the companyshareholderThe number is 72,083.

In fact, listed companiesExecutivesWith a large amount of insider information, it has long been the focus of investigations by the Securities Regulatory Commission on insider trading. As soon as such announcements are made, listed companies are often “implicated” in their share prices “diving.”HavelawyerIt is said that before the results of the investigation, it is difficult to judge the impact of individual executives on listed companies, but at the same time there are suspected insider trading and listed company information disclosure violations by executives.CaseNot uncommon.

Regulators have repeatedly stressed that they will unremittingly crack down on illegal acts of insider trading and safeguard capitalMarket Order, Protect the small and mediuminvestmentInterests. Some lawyers also said that the new “Securities Law” has greatly increased the penalties for illegal acts of insider trading, and the “Criminal Law” is also undergoing supporting adjustments.

Executives are frequently investigated by insider trading

In the past ten days, at least four company executives have been investigated by the Securities Regulatory Commission for suspected insider trading, including three chairman.BrokerageChinese reporters smoothly sorted out the following according to the announcement time:

December 21,Jinke CultureMr. Wang Jian, the chairman of the board, was investigated by the China Securities Regulatory Commission for alleged insider trading when he reduced his holdings of the company’s shares from November 2019 to March 2020.

December 24,*ST BeixunversusGujiajiaAnnouncements successively stated that the company’s executives received the “Notice of Investigation” of Insider Trading from the Securities Regulatory Commission.

among them,GujiajiaChairman Gu Jiangsheng was involved in the company’s acquisitions from 2018 to 2019XilinmenFurniture sharesLimited company(Abbreviated as “Xilinmen”) through the secondary market transactionXilinmenThe stock matter was investigated by the Securities Regulatory Commission.

On December 30, Gree Real Estate issued an announcement stating that the company’s chairman Lu Junsi was filed for investigation due to insider trading.

The above-mentioned announcement generally stated that the CSRC’s investigation of the personal behavior of the incumbent executives will not affect the normal performance of the executive’s duties, nor will it affect the current company’s daily operation and management activities.movable propertyHealth adverse effects.

It is understood that insider trading behavior refers to the use of undisclosedpriceThe act of conducting securities trading activities with sensitive information in order to seek profits or reduce losses. It usually includes: insiders use inside information to buy and sell securities, disclose inside information to relevant investment traders or advise others to buy and sell securities based on inside information; non-insiders obtain inside information through improper means or other means, and buy or sell securities or make recommendations based on that information Others buy and sell securities, etc.

The impact on listed companies remains to be seen

As soon as the investigation announcement on the insider trading behavior of executives came out, listed companies were often “implicated” in their share prices “diving.” E.g,GujiajiaAfter the announcement was made on the evening of the 24th, the market fell 8.79% at the opening of the next day. It was close to the daily limit, and closed at 70.64 yuan per share on the day, a drop of 4.62%.

This time, Gree Real Estate also issued a follow-up announcement stating that the company is issuing shares and payingcashPurchase tax exemption in ZhuhaiEnterprise GroupSignificant assets of 100% equity of the limited company and raising supporting fundsReorganizationmatter. According to the “Administrative Measures for the Major Asset Restructuring of Listed Companies”, this restructuring may be suspended or terminated.

Li Jian, a lawyer at Zhejiang Yufeng Law Firm, said that it is difficult to judge the impact of individual executives on listed companies before the investigation results are issued. “But it is worth noting that it is not uncommon for the China Securities Regulatory Commission to impose administrative penalties on the chairman of listed companies for suspected insider trading and listed companies for suspected information disclosure violations.” He gave an example. Yang Huaijin, former chairman of Hareon Solar, was punished for suspected insider trading At the same time, Hareon Solar was also punished for allegedly illegal information disclosure.

According to the announcement, the Securities Regulatory Commission often conducts retrospective investigations on the past historical behavior of senior executives. Li Jian pointed out that if the insider trading behavior involved in the case occurred before the implementation of the new “Securities Law” on March 1, 2020, according to Article 202 of the old “Securities Law”, it may be ordered to deal with illegally held securities and confiscate illegal income. A fine of not less than one time but not more than five times the illegal income shall be imposed; if there is no illegal income or the illegal income is less than 30,000 yuan, a fine of 30,000 yuan up to 600,000 yuan shall be imposed. If according to the new “Securities Law”, the upper limit of penalties will be increased to ten times, and the amount of fines will be greatly increased, that is, if there is no illegal income or the illegal income is less than 500,000 yuan, the penalty will be more than 500,000 yuan and less than 5 million yuan. fine.

In addition, according to the relevant provisions of the Securities Law, if insider trading causes losses to investors, it shall be liable for compensation in accordance with the law. If insider trading constitutes a crime, according to Article 180 of the Criminal Law, if the circumstances are serious, they shall be sentenced to fixed-term imprisonment of not more than five years or criminal detention, and a fine of not less than one and not more than five times the illegal gains; Fixed-term imprisonment of not less than five years but not more than ten years, and a fine of one to five times the illegal gains.

“Stubborn diseases” need heavy medicine

Insider trading undermines the principle of fair trade in the market and infringes on the legitimate rights and interests of investors. It has always been a persistent “disease” in the capital market.

In this regard, the China Securities Regulatory Commission has repeatedly stated that it will focus on building a comprehensive and three-dimensional accountability system for administrative punishment, criminal accountability, and civil compensation. Order and protect the legitimate rights and interests of investors.

According to statistics, in 2019, the China Securities Regulatory Commission issued a total of 136 administrative penalties and 13 market banning decisions, and as many as 55 cases involving insider trading, accounting for more than 40%.

Currently, penalties for insider trading are still increasing. “Compared with the original Securities Law, the new “Securities Law” has greatly improved the penalties for insider trading, but the implementation of penalties still requires greater administrative enforcement, so that you will be caught if you reach out.” He Haifeng, director of the Securities Law Research Institute of the Chinese Law Society, pointed out that the criminal law is currently being revised in conjunction with the new “Securities Law.”

In addition, He Haifeng said that under China’s current legal system, insider trading is a very serious type of illegal or even criminal behavior, which is deterred by civil, administrative and criminal legal liabilities, but the current legal web is not very tightly woven. . With the improvement of civil liability rules, the strengthening of administrative enforcement and the improvement of the criminal law, it is believed that insider trading will be more severely sanctioned in the future.

(Source: Brokerage China)

(Editor in charge: DF512)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.