原标题:发疯! 盘中一度下跌13%,并在30天内蒸发了1.7万亿元。 特斯拉怎么了? “女性版的巴菲特”正在赌博,基金正在兑现,散户接管吗?

概括

[Intradayplunged13%whathappenedto17trillionTeslain30days?”FemaleversionofBuffett”Awkwardbetup!】ThelinkagebetweentheChineseandAmericanstockmarketsisgettingcloserHereA-sharesandHongKongstocksconsumertechnologystarshavesufferedatragiclossofWaterloowhileUSstockstechnologystarshavealsofallensharplyAmongthemTeslaisespeciallytheleaderinnewenergyvehiclesInlessthan30tradingdaysTesla’sstockpricefellfromabove$900tobelow$600adeclineofmorethan30%andithasfallenintoatechnicalbearmarketIntermsofmarketvalueTesla’slatestmarketvaluehasevaporatedmorethanonePingAnofChinafromtheJanuary25high(Datatreasure)

TeslaCan it strengthen again?

The linkage between the Chinese and American stock markets has become increasingly close. Here, A-shares and Hong Kong stocks consumer technology stars have been brutally defeated by Waterloo, while US stocks have also fallen sharply.Among them, new energy vehicles lead in particularTeslaWhy not. In less than 30 trading days,TeslaThe stock price fell from above US$900 to below US$600, a drop of more than 30%, and has fallen into a technical bear market.ToMarket valueLooking at it, Tesla’s latest market value has evaporated from its January 25 high.Ping An of ChinaMore.

It’s worth noting that according to previous reports, the world’s largest hedgefundIt has already cleared Tesla a few years ago.At the same time, the person saidWall StreetCathie Wood, the “female Buffett”, is still firmly optimistic about Tesla and Bitcoin.

Drop onePing An of China

Tesla enters a technical bear market

Looking at the world, the technology leader with the worst performance recently is Tesla. Following the sharp drop of nearly 5% in the previous trading day, the US stock market Tesla shares plunged again overnight, falling more than 13% intraday to below $540. As of the latest close, Tesla has fallen more than 3% to $597.95, and its market value has fallen below $580 billion.

Compared with the January high, Tesla’s stock price has fallen by more than 33%, and its market value has evaporated by more than US$270 billion (contractRenminbi1.75 trillion), which is equivalent to a dropPing An of ChinaMarket capitalization. According to the establishment of a technical bear market with a decline of more than 20% from the high point, Tesla stock has entered a technical bear market.

In the context of Tesla’s leading decline, the global new energy vehicle sector has undergone substantial adjustments.U.S. stocksmarketThe adjustments of the three new car-making forces have been even greater,Wei LaiFrom nearly 67 US dollars to the lowest 32 US dollars,Xiaopeng MotorswithIdeal carAll were also cut in half, Xiaopeng fell from above 74 US dollars to the lowest of 26 US dollars, ideally from above 47 US dollars to the lowest of 20 US dollars.

Related underlying A-share Hong Kong stock market also fell across the board,BYDA shares fell from above 270 yuan to less than 200 yuan,Great Wall MotorIt fell from above 51 yuan to below 32 yuan.

BMW kick hall

Are the European and American markets being eaten away?

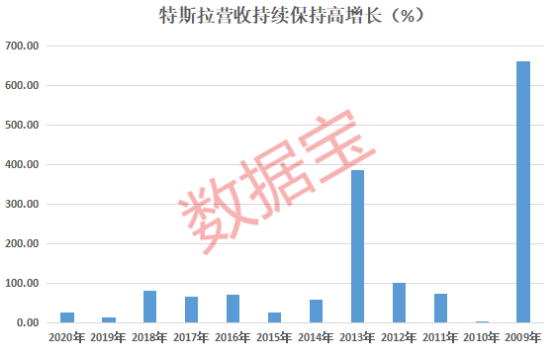

The decline in Tesla’s stock price is considered to be paying off debts that have skyrocketed over the past year. In addition, some analysts believe that Tesla is unlikely to continue to maintain its previous growth rate in the future. The data shows that Tesla’s revenue has maintained a positive growth for 13 years. In 2020, the revenue growth rate will exceed 28%, and the net profit growth rate will exceed 183%.

However, Tesla’s markets in Europe and the United States are currently being eaten away.

Recently,Morgan Stanley(Morgan stanley) released the latestreportSaid that in February of this year, TeslaGuoxin EnergyThe share of the automobile market has declined, and it is the Mustang Mach-E, a pure electric SUV under Ford that “stole” it.The report pointed out that in February, the United StatesGuoxin EnergyCar market salesYear-on-yearAn increase of 35%, of which the pure electric vehicle market sales increased by nearly 40% year-on-year, while the overall automotive market sales fell by 5% year-on-year.Although Tesla still occupies most of themarket share,But its market share has dropped significantly from 81% in the same period last year to 69%.

In addition to the US market, Tesla’s performance in Europe is even worse. According to reports, in January this year, Tesla registered 1,619 pure electric vehicles in 18 major European markets, accounting for only 3.5% of all registered pure electric vehicles that month. In 2019, Tesla easily reached the top of the European electric vehicle rankings, with annual car sales exceeding 109,000, accounting for 31% of the European pure electric vehicle market. In 2020, the situation has reversed, and Tesla’s share of the European market has dropped to 13%.

Tesla’s competitors in the European market can be described as strong.BMW ManagementCommitteeChairman Kiptzer kicked Tesla directly: We are also vigorously advancing, as other manufacturers launch electric vehicles, Tesla may not be able to maintain rapid growth.BMW was the first to vigorouslyinvestmentOne of the traditional car companies of electric vehicles, and currently has led the traditional car companies in the process of electric vehicles.BMW’s public data shows that for the whole year of 2020, including BMW, Mini andRolls RoyceAmong them, BMW sold a total of 2,324,800 vehicles, of which BMW’s electric vehicle sales increased by 31.8% year-on-year, and more than 135,000 electric vehicles were delivered in Europe alone.

Turnover rate is nearly 17 times a year

More than 96% A sharesthe company

Once upon a time, Tesla’s market value was the sum of the global market value of the second to ninth car companies, and today its market value still exceeds the sum of the second to sixth place. For this valuation, once there is a stir, the fluctuation of the stock price can be imagined. Spring River Plumbing Duck Prophet.As the world’s largestHedge FundBridgewater Fund has liquidated Tesla in the fourth quarter of 2020.It is worth mentioning that the younger brother of Tesla CEO Musk is also a member of Tesla’s board of directors.Kimbal-Musk cashed out and sold shares worth US$25.6 million (approximately RMB 165 million) in early February this year.

During the last round of stock price surges, Bridgewater Fund was not the only institution that ran away.Tesla long-termshareholderRon Baron said on Thursday that the company sold 1.8 million Tesla shares in the past six months. In addition, Hillhouse Capital liquidated Tesla in the third quarter of last year.And according toGoldman SachsIt is judged that in the fourth quarter of last year, hedge funds are reducing their holdings of Tesla.

Retail investors may become high-end investorsMain force. Tesla can be regarded as the largest stock with the highest turnover rate in US stocks, which means that there may be a lot of retail investors among them. According to data, Tesla’s turnover rate has been close to 17 times in the past year, ranking first in the turnover rate of US stocks with a listed value of 500 billion yuan. Tesla’s monthly average turnover rate also often dominates the list. The stock’s average daily turnover rate in September last year was close to 9%, and the average daily turnover rate in December last year was close to 6%.

Compared with the A-share market, there are only 154 A-share companies with a turnover rate exceeding Tesla in the past year (excluding the secondNew crotchAfter), accounting for only 4%. This data means that Tesla’s turnover rate in the past year has exceeded 96% of A-share companies.

Obviously, from the perspective of Tesla’s change of hands, it’s hard to say that the U.S. stock market is aMature market。

“Female version of Buffett” is still firmly optimistic

Cathie Wood, known as the “female version of Buffett,” has gained fame because of the surge in profits from investing in technology stocks such as Tesla. Wood said in a webinar a few days ago that although investors are worried about the high stock market valuation and rising inflation, the S&P 500 index has recently fallen, but her fund is still full of opportunities.

Wood said withartificial intelligencewithrobotThe pace of innovation in other fields is accelerating, “benchmarks are filling the value trap… We believe that the biggest risk lies in benchmarks, not what we are doing.”

She said,Tesla stock currently accounts for ARKKPositionAbout 10% of it.In view of Tesla’s leading position in the field of autonomous driving, she believes that the stock is still attractive. Although Tesla has risen by nearly 345% in the past 12 months, it has fallen by nearly 20% in the past four weeks.

In addition, Wood also expects Bitcoin’spriceWill continue to rise because there will be more U.S. companies and this encryptioncurrencyNaInvest inBalance sheet. For example, Tesla said on February 8 that it had purchased $1.5 billion worth of bitcoin, and Square said on February 23 that it added another $170 million in bitcoin positions in the fourth quarter. Wood believes that if other American companies follow suit, the price of Bitcoin may rise to $400,000.

Related reports:

Frightened all night! Tesla fell below $600 and Weilai plunged 18% during the intraday session. Is there still a scene for new energy vehicles?

(Article source: data treasure)

(Editor in charge: DF150)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.