原始标题:[Xingzheng Macro]大宗商品上涨了,通胀何时开始? -从历史经验看美国通货膨胀的传递

概括

[Whendoesinflationstartwhencommoditiesrise?】TherapidriseincommoditypricesandUSbondyieldssincetheSpringFestivalhastriggeredmarketconcernsaboutUSinflationandtheFed’stighteningofliquidity(WangHanonMacro)

Investment points

Bulk since Spring FestivalProductpriceAnd the rapid rise in U.S. bond yields, triggering market concerns about U.S. inflation andMidlandThe reserve tightens liquidity concerns. By reviewing the history of rising bulk prices and U.S. inflation from 2009 to 2011, we hope to have a deeper understanding of the current situation:

The chain of “bulk price hikes-rising inflation in the United States-the Fed to Eagle” has a time lag of about 8-11 months.Looking back at the history of the two rounds of major increases from 2009 to 2011,MidlandThe core of the reserve decision lies not in the rise in bulk prices, but in the rise in core inflation and economic recovery in the United States.It takes about 4-5 months from a rise in bulk prices to a rise in U.S. core inflation, and it takes about 4-5 months from the bottom of core inflation toMidlandThere is a time lag of about 4-6 months for the reserve’s attitude to the Hawks. This means that, based on historical experience, there will be a time lag of 8-11 months before the rise in bulk prices until the Fed is worried about inflation and its attitude turns to the Eagle.

There are 4 differences between this cycle and the bulk price rise cycle of 2009-2011:

The current round of loose policy is uninterrupted, and the fluctuation of asset prices comes more from the financial market itself.From 2009 to 2011, the disturbance of asset prices mainly came from the “intermittent” policy withdrawal, which caused the economy to “turn and turn.” However, in this round of easing cycle, the continuity and expected guidance of European and American easing are obviously stronger. Therefore, disturbances from the actual withdrawal of policies will decrease, while disturbances from financial market issues (such as valuation) will increase.

Residents’ balance sheets were not affected this round, and consumer demand recovered faster.The 2008 subprime mortgage crisis had a huge impact on the balance sheets of US residents, which did not fully recover until the end of 2012. This led to a major increase in 2010 but a decline in core inflation.But this round of the U.S. “distribution of money” by a large margin, residents of Q2 in 2020Net assetsIt has been fixed, and the recovery of consumer demand is faster.

The time lag from the rise in bulk prices to the rise in U.S. core inflation in this round is relatively short.Since the current round of residents’ balance sheets has not been damaged, once the epidemic eases, the release of demand may be faster (as evidenced by the rare increase in durable goods prices), the time lag between the bulk increase and the rise in core inflation in the United States may be shorter than 2009-2011 The inflation cycle. In addition, the impact of crude oil on core inflation may last longer than expected, according to the Fed’s research or 2-5 months.

However, the Fed is more tolerant of inflation this round.After the epidemic, the U.S. economy has become more closely tied to the market. At the same time, the U.S. government debt ratio has hit a record high, which means that the Fed is actually “easy to loosen but hard to tighten.”Under this circumstance, the time lag between the rise in U.S. core inflation and the change in the Fed’s attitude may be longer. Considering that the rise in U.S. inflation caused by the base in the second quarter is already within expectations, the third quarter may be due to the market and the Fed.GameTime window.

Risk warning: Federal ReservecurrencyPolicies exceed expectations, overseas epidemic situation, and vaccination progress exceed expectations

text

Biden deal continues, inflation concerns gradually rise

The global economy recovers, Biden transactions continue, and bulk prices continue to rise.With the advancement of vaccines and the recovery of the global economy, Biden’s 1.9 trillion yuan policy is expected to be launched in March, with bulk oil and copper as the representativeCommodity priceRise rapidly.We are in “20210121- this roundCommodityIs the rise over? “It was mentioned in the article that the current rise in bulk prices is mainly driven by the demand side. With the economic recovery not over yet and policy stimulus, bulk prices are expected to continue to rise.

The issue of inflation and whether it affects the Fed’s easing attitude has gradually caused market concerns.The rapid upward movement of bulk prices has prompted the market to rethink whether there will be a great inflation similar to that of 2009-2011, leading to an early tightening by the Federal Reserve. In “20200913-How to Understand the Current Stage of Recovery-Taking 2009 as a Lesson”, we pointed out that the current economic recovery is similar to 2009-2010. And in the “20210128-previous economic recovery, when did the Fed turn to”, it was mentioned that after the epidemic, the U.S. government debt ratio hit a record high. Cooperating with fiscal expansion and maintaining the sustainability of the stock debt, it means that the Fed is actually “easy to relax and difficult to tighten.” . From Powell’s speech on February 23, 2021, it can also be seen that the Fed still maintains a dovish attitude, believing that current inflation is still relatively moderate, and maximizing employment is the main goal of the Fed’s policy.

2009-2011:

How to interpret the transition from bulk rise to US inflation?

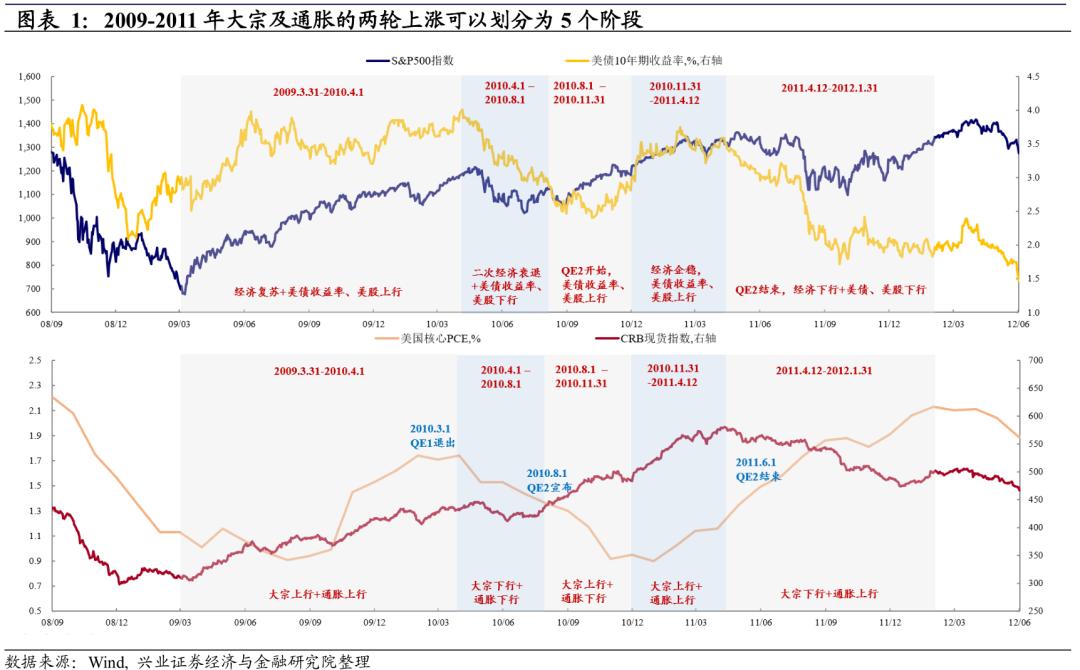

From 2009 to 2011, the U.S. market experienced two major waves of upswing and inflation, which can be roughly divided into five stages, which are closely related to the economic situation and monetary policy at that time. Bulk rises—U.S. inflation goes up—each link in the transmission chain of the Fed tightening actually has a certain time lag. By analyzing the history from 2009 to 2011, we can have a clearer understanding of where we are currently.

March 2009-April 2010: Economic recovery, asset prices generally rose, and inflation rose.In response to the subprime mortgage crisis, the Fed opened the first round of quantitative easing (QE1). Stimulated by QE1, the recovery of US real estate has driven the US economy to recover from the bottom up. In the context of economic recovery, U.S. stocks, U.S. Treasury yields, commodity prices, and inflation all show upward trends.

In this round of economic upward rebound from bottom to bottom, the focus of the market and the Fed is on the economy andlaborThe extent to which the market is repaired, not the upward trend of inflation. There is a time lag of about 4 months from when the bulk prices rebounded from bottoming to when the core PCE started to rise. It wasn’t until the core PCE reached a high of 1.74% in January 2010 that the Fed began to mention “a slight increase in long-term inflation”, which is about a 6-month lag between the core PCE’s rebound from the bottom to the top. In this round of the bulk rise cycle, the transmission time of the chain of “bulk rise-core PCE rise-Fed worried about inflation” is about 10 months.

April 2010-August 2010: The second economic recession, asset prices generally fell, and inflation fell.As we stated in “20200913 How to Understand the Current Stage of Recovery-Taking 2009 as a Lesson”, after the subprime mortgage crisis, the recovery of the US economy is not smooth sailing, but similar to a “roller coaster.” With the expiration of the first round of QE in March 2010, US real estate sales, which had improved significantly in the previous period, fell again. At the same time, because the balance sheets of US residents have not been repaired, consumption growth has also declined after lack of policy support.Superimposed on the escalation of the European debt crisis in 2010, the US economy fell into recession again, and the USNational debtThe term spread continued to decline during this period, reflecting the expected reversal of economic recovery.Affected by the economy, asset prices have generally fallen, and inflation has also fallen. The Fed’s focus has returned from inflation to economic growth.ChangheEmployment.

August 2010-November 2010: QE2 started, inflation and bulk trends diverged, and assets generally rose.In loose liquidity,supplyUnder the triple effects of shocks and economic slowdown, there was a deviation in this stage where prices rose and inflation fell.In terms of liquidity, in August 2010, the economicSecond dipUnder the expectations of the US Federal Reserve, the Fed launched the second round of quantitative easing, pushing bulk prices and the stock market back to the upward trend. In terms of supply, affected by the global drought in August 2010, the food crisis broke out. Many countries announced food embargoes, and the prices of barley, corn and other grains rose rapidly. Economically, as mentioned earlier, after QE1 expired in April 2010, the US economy experienced a second recession. Although the Fed launched the second round of quantitative easing in August 2010, the economy has stabilized to a certain extent, but consumption is still weak. This is mainly because the 2008 subprime mortgage crisis caused serious damage to the balance sheets of US residents. It was not until 2012 that US residents’ assets returned to their normal levels before the crisis. The fragile household balance sheet has caused the recovery of consumption to lag behind the recovery of the economy, and the weakening of consumption of housing and durable goods has dragged down the core PCE price.

During this period, although bulk prices continued to rise, because the core PCE was still weak, the focus of the market and the Fed was on economic recovery and employment, and there was no obvious concern about inflation. The Federal Reserve’s FOMC in September 2010meetingThe above emphasized that current inflation is lower than the ideal level (2%), and inflation may continue to be suppressed.

November 2010-April 2011: The economy is stable, and the rise in core inflation resonates with the bulk rise.Supported by the stimulus of QE2, the economy has gradually emerged from the second recession. The core PCE price of leasing, durable goods, and service consumption have all been repaired to promote the core PCE upward.At the same time, the originalOil priceAffected by the political turmoil in Libya in February 2011, Georgia was affected by supply shocks, which led to a rapid upward movement, driving the core PCE higher. However, before March 2011, the market generally believed that although the core PCE had upward momentum, it was difficult to cause inflation due to insufficient economic recovery. In March 2011, the Fed’s attitude towards inflation changed from “inflation levels still low” to “inflation expectations increased in the previous period”, which was about a four-month lag when compared to the core PCE bottoming out and rebounding.

April 2011-January 2012: The economy is down, asset prices generally fall, and inflation continues to rise.In April 2011, the U.S. economy fell again,SMEsThere was a significant decline.Affected by the European debt crisis, the United StatescreditThe bond rating was downgraded by Standard & Poor’s for the first time, dampening market confidence. In terms of monetary policy, the core PCE rose to 1.35% in April 2011, and many officials of the Federal Reserve became hawkish, and QE2 withdrew in June 2011.We mentioned in “20110519-Fed’s exit path becomes clear-a quick review of the minutes of the Federal Reserve’s April meeting” that the Fed discussed the easing policy exit path at the April 2011 FOMC meeting, that is, “stop rolling purchases expireBond—Rising interest rates —Selling non-treasury debt assets.” In the context of economic weakness and the Fed’s concerns about inflation, commodity prices peaked and fell in April 2011. However, due to the lagging nature of inflation, inflation did not follow The economy and bulk prices went down, but continued to go up, and the economy entered a period of “like stagflation”.

From the historical experience from 2009 to 2011, there is a significant time lag between the bulk rise—inflation rise—the Fed’s response to each link. This is because the Fed’s focus is on core PCE rather than commodity prices. There is a lag of about 4-5 months from the rise of bulk prices to the rise of core PCE, and there is about 4-6 months from the rise of core PCE to the Fed’s concern about inflation. Therefore, it will take about 8-11 months from the beginning of the bulk increase to the Fed’s expression of concern.

The difference between the current recovery cycle and 2009-2011

Difference 1: The current round of US stimulus policies continue, and asset price fluctuations come more from the financial market itself

From 2009 to 2011, why did asset prices “go and stop”? ——The market worries about policy withdrawal and the outbreak of secondary crisis from time to time.From the review of the US economic recovery in 2009-2011 above, it can be seen that the constant policy withdrawal concerns and the outbreak of secondary crises such as European debt made the US economic recovery in 2009-2011 “tumbles”, which also led to stocks and large stocks. The rise in commodity prices has experienced “one twists and turns”.

In this round of loose stimulus policies in the United States, the fluctuations in asset prices are more from the financial market itself.Unlike the previous cycle, the policy of “Release-Release-Release-Release-Release-Receive” is that there is almost no “window period” between the period from CARES to US$900 billion to US$1.9 trillion in fiscal stimulus. . The expectations given to the market at the policy level are also “unstoppable.” Therefore, disturbances from the actual withdrawal of policies will decrease, while disturbances from financial market issues (such as valuation) will increase.

Difference 2: Residents’ balance sheets have not been affected in this cycle, and consumer demand has recovered rapidly

Compared with the subprime mortgage crisis, the biggest difference in this cycle is that US residents have not experienced a balance sheet decline.In the previous review, we saw that although liquidity easing promoted the rise of commodity prices, core inflation in 2009-2010 was a downward trend, and even in 2010 it caused the market and the Federal Reserve to worry about long-term deflation (Disinflation) . The very important reason behind this is that the collapse of the US real estate market in the last cycle has caused the balance sheets of US residents to suffer a rare shock in history. The net assets of US residents did not return to their pre-crisis levels until the end of 2012. The balance sheet recession has slowed the recovery of demand from American residents, and the situation of “bulk prices rose but core inflation fell” in 2010 occurred.

However, the current balance sheet restoration of US residents has exceeded the level before the epidemic.As mentioned above, the residents’ balance sheets have not been damaged in this cycle. In the short term, the net assets of US residents have exceeded the level before the epidemic in the second quarter of 2020. The actual USGDPThe speed of gap repair is also significantly faster than the previous cycle, which means that the rapid recovery of consumption in this round will not become a drag on core inflation.

Difference 3: The time lag from the current round of bulk rise to the resonance of bulk and core inflation is relatively short

In the context of the rapid recovery of consumption, the time lag between this round of bulk rise and the rise of core inflation is relatively short.Since the current round of residents’ balance sheets have not been damaged, once the epidemic eases, their consumer demand will be released quickly, and will not be restricted by residents’ balance sheets like in 2010. Therefore, unlike the cycle of 2010-2011, the time lag from “bulk price rise” to “bulk and core inflation resonance upward” may be shorter. Specifically:

-

“Sending money” will continue to stimulate the price increase of consumer durables.Under the large fiscal stimulus, the price of durable goods in the United States has risen for the first time since the 1990s. The fastest month-on-month rise in durable goods prices in 2020 corresponds to two rounds of fiscal stimulus. In the future, Biden’s 1.9 trillion stimulus plan will continue to stimulate the price of durable consumer goods in 2021.

-

The delayed recovery of the service industry will push up the price of housing and other services in the later stage.The service industry accounts for approximately 70% of the core PCE in the United States.The current service consumption is limited by the epidemic, and there is still a large gap compared to before the epidemic, such as the price drop significantlytrafficRecreation or catering tourism that has not yet risen by item. From the current point of view, at the end of the second quarter of 2021, there is a high probability that after the vaccine coverage increases, the economy will gradually open up, and this part of the recovered consumption will be further released.

-

The impact of the low base of crude oil on core inflation may be longer than expected.Although the core PCE price index excludes the impact of food and energy prices, crude oil prices can still be correlatedproductAnd services have an indirect impact on the core PCE. From the historical perspective, the fluctuation of WTI crude oil price and the core PCE of the United StatesYoYThere is a high correlation, especially since 2014. According to the research results of the Federal Reserve paper (Conflitti & Luciani (2017)), the shock of crude oil prices has a lagging effect on the core PCE of the United States and will last for a long time (about 2-5 months). In 2021, crude oil prices will rise sharply or drive the rise of core PCE in the United States, and its impact may be more lagging and sustained than expected.

Difference 4: The Fed is more tolerant of inflation this round

Although core inflation has started, the Fed has a higher tolerance for this round of inflation.Due to the particularity of the economic impact of the new crown epidemic, the Fed’s tolerance for inflation is higher than that of 2010-2011.At the Fed’s FOMC meeting in September 2020, it was emphasized thatGuaranteeWith the goal of maximizing employment, the Fed will allow inflation to exceed 2% for a period of time. And Powell’s speech on February 23, 2021 also reiterated that the current inflation is still soft (Soft), and will continue to loosen to support the dovish stance of the job market. In “20210128-Economic Recovery, When will the Fed Turn?” we mentioned that after the new crown epidemic, the economy and the market are more closely bound. Even if the Fed turns to the Eagle, it will fully anticipate and guide it in advance. In the long run, the US government debt ratio has hit a record high after the epidemic, and coordinating fiscal expansion and maintaining the sustainability of the stock debt means that the Fed is actually “easy to loosen but hard to tighten.”

The time lag from the rise in bulk prices to the rise in U.S. core inflation in this round may have narrowed compared to 2009-2011, but the Fed’s tolerance for inflation in this round of This may take longer to express concerns. Considering that the rise in U.S. inflation caused by the base figure in the second quarter is already within expectations, the third quarter may be a time window for the market to compete with the Fed.

Risk warning: the Fed’s monetary policy exceeds expectations, overseas epidemic situation and vaccination schedule exceed expectations

(Source: Wang Han on Macro)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.