原标题:外国投资者激烈调整仓位并购买招商银行! 中金公司:将增长56%! “茅屋”被卖掉近五十亿白酒真的结束了吗?

概要

[ForeigninvestorsviolentlyadjusttheirpositionsandbuyChinaMerchantsBank!CICC:Itwillincreaseby56%!】ThisweektheA-sharesfluctuatedbuttheenthusiasmofthenorthwardfundstobuytheA-shareswasnotdiminishedandtheA-shareswereincreasedeverydayThetotalnetpurchasesfortheweekwerenearly18billionyuanandthenetpurchasesweremaintainedfor11consecutiveweeksAmongthemShanghaiStockConnecthasanetpurchaseof45billionyuanandShenzhenStockConnecthasanetpurchaseof135yuanCapitaltradinginBeijingalsocontinuedtoremainhighlyactivewithaturnoverof7319billionyuaninthewholeweekaslightincreasefromthepreviousmonthandthelargesttransactioninthepastsixmonths(Ecompany)

This week, the A-shares fluctuated, butNorthward capitalUnabated buying enthusiasm, every dayAdd warehouseA-shares had a total net purchase of nearly 18 billion yuan throughout the week, maintaining net purchases for 11 consecutive weeks. among them,Shanghai Stock ConnectNet purchase of 4.5 billion yuan,Shenzhen Stock ConnectNet purchase of 135 yuan. Beijing Capital Trading also continued to remain highly active, with a turnover of 731.9 billion yuan in the whole week, a slight increase from the previous month and the largest transaction in the past six months.

bankShares favored

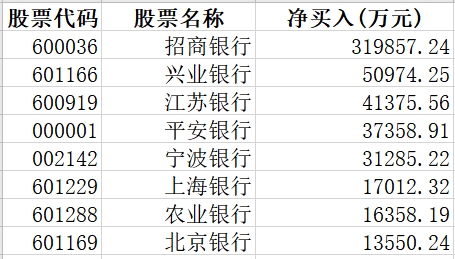

bankShares received a net purchase of more than 5.612 billion yuan from Beijing Capital this week, which is one of the industries with the most net purchases.Of which net purchasesChina Merchants Bank3.199 billion yuan, the stock with the most net purchases this week, and the only stock with a net purchase of more than 3 billion yuan.Beijing Capital HoldingsChina Merchants BankPositionIt broke 1.1 billion shares for the first time in history, and the market value of its holdings exceeded 50 billion yuan for the first time in history.China Merchants BankReleased this FridayPerformanceNewsletter, realized in 2020Operating income290.508 billion yuan,Year-on-yearAn increase of 7.71%,Net profit97.342 billion yuan, a year-on-year increase of 4.82%, basic earnings per share of 3.79 yuan, and a non-performing loan ratio of 1.07%, a decrease of 0.09 percentage points from the end of the previous year.

Net foreign purchases this week exceeded 100 million yuanbankshare

After the announcement of the results,China Merchants BankThe stock price rose nearly 10% on Friday, hitting a record high. Ping An Securities said,China Merchants BankUnder the influence of the 2020 epidemic, revenue andprofitThe stable growth of the company, the profit turning point has been established, the performance report is better than previous expectations, and the excellent profitability and asset qualityGuaranteeNext, optimisticChina Merchants BankThe long-term investment value maintains a “strongly recommended” rating.CICCA target price of 79.85 yuan was also given to China Merchants Bank, which still has a potential of over 56% compared with Friday’s closing price of 51.14 yuan.

Same day,Industrial BankIt also released a performance bulletin. In 2020, it achieved operating income of 203.137 billion yuan, an increase of 12.04 year-on-year, and it exceeded 200 billion yuan for the first time in history.Net profit66.626 billion yuan, a year-on-year increase of 1.15%, of which single-quarter net profit in the fourth quarter increased by 34.61% year-on-year.Industrial BankOn Friday, it also opened sharply higher, rising by more than 9% at one time, setting a record high (recovery).Northbound funds net buy this weekIndustrial Bank510 million yuan, a record high in more than half a year. Due to the sharp rise in stock prices, the market value of the positions exceeded 13 billion yuan for the first time in history.

Minsheng Securities believes that social finance peakscreditTightening, increased bargaining power on the asset side of banks, and the lifting of policy restrictions on profit release have all promoted accelerated improvement of bank fundamentals. It is recommended to actively grasp the bank Express market quotations from January to February, as the quotations are just beginning.From January to February last yearShare23 listed banks released performance bulletins, of which only 3 have been released so far this year. The valuation of bank stocks still has room to rise. Recommend Industrial Bank, China Merchants Bank,Ping An Bank、Changshu Bank。

Bank of Jiangsu、Bank of Ningbo、Ping An Bank、Shanghai BankWaiting for this week to get a net purchase of more than 100 million yuan in funds from Beijing,ICBC、Minsheng Bank、Construction BankWaiting to be slightly net sold.

Liquor stocks are now divided

Liquor stocks fluctuated violently this week, with the sector index plummeting 10.47%, the biggest weekly decline in more than two years.Beishang Capital sold a net 2.258 billion yuan in liquor stocks this week. However, from the perspective of individual stocks, Beishang Capital’s attitude towards liquor stocks has a huge divergence, leading stocksWuliangye、Kweichow MoutaiIt was sold substantially net, while other second-tier liquors were bargain-hunting.

Foreign buying and selling of liquor stocks this week

WuliangyeIt was net sold 2.849 billion yuan this week, which was the most net sold stock. Beijing Capital Capital’s shareholding hit a new low in more than 2.5 years.Kweichow MoutaiIt was also net sold 2.096 billion yuan, the second-most net sold this week. The two major liquor faucets were sold for nearly 5 billion yuan in total.Alcoholic liquor、ShuijingfangIt was also net sold over 100 million yuan. But other than that, most of the other liquor stocks have been increased by Beijing Capital.Yanghe shares、Shanxi Fenjiu、Shunxin Agriculture、This worldThe net purchases were over 100 million yuan.

Tianfeng SecuritiesSaid that as the peak season for liquor sales during the Spring Festival is approaching, the Spring Festival will enterStock upStatus, the market has strong expectations for price increases, and wine companies have a low price in the first quarter of 2020Base effectPerformance flexibility is about to be released, superimposedcurrencyThe liquidity is abundant, and the structural prosperity of liquor is unabated. In 2020, wine companies control the price increase is the key word, 2021productStructure upwards to open up profit growth is still white wineenterpriseMain melody. The Spring Festival sales are about to continue after price increases,priceA critical period for maintaining stability and achieving performance.

Military stocks this week received a large proportion of Northbound funds Masukura.China Ship DefenseThe business covers four major sectors: defense equipment, ship repair and building, marine engineering, and non-ship business. The main products include military ships, special auxiliary ships, and official ships.Although this weekChina Ship DefenseContinuous adjustments, but the Beijing capital bucked the market and cost 148 million yuan, a substantial increase in holdings of more than 4.93 million shares, holdings increased from 2.85 million shares last weekend to 7.78 million shares, Masukura rate as high as 173%.

Sky Arrow Technology、Beimo High-tech、Steel Research Gona、Aerospace developmentSuch as military industry stocks this week also received more than 50% of the northward capital Masukura,AVIC Shen Fei、AVIC OptoelectronicsAnd so on, received a net purchase of more than 100 million yuan in funds from the north.

(Article source: ethe company)

(Editor in charge: DF075)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.