原始标题:涉及900万人,独立个人保险代理的新规则就在这里! “单飞,成为自己的老板”越来越热吗?

概要

[Newregulationsconcerning9millionindependentpersonalinsuranceagentsarehere!”Flyingsolobeingyourownboss”isgettinghot?】OnDecember29theofficialwebsiteoftheChinaBankingRegulatoryCommissionannouncedthattheChinaBankingRegulatoryCommissionrecentlyissuedthe”NoticeontheDevelopmentofIndependentIndividualInsuranceAgents”(hereinafterreferredtoasthe”Notice”)whichformedaregulatorydocumentwhichisthe”RegulationsontheSupervisionofInsuranceAgents””Thesupportingdocuments(ChinaSecuritiesJournal)

Independent individualInsuranceproxyThe human system has been gradual and deepened in the exploration.

On December 29, the official website of the China Banking Regulatory Commission announced that the China Banking Regulatory Commission recently issued the “Regarding the Development of Independent IndividualsInsurance“Notice on matters related to agents” (hereinafter referred to as “Notice”), which forms a regulatory document, isInsuranceThe supporting documents of the Regulations on Supervision of Agents.

“Notice” specifies independent individualsInsuranceThe agent is not affiliated with the team, and develops independentlyInsurance salesEssential characteristics, strictly stipulate the basic conditions and selection mechanism of personnel, focus on standardizing personnel’s professional behavior, and emphasizeInsurance companyResponsibilities for management and control and supervision of supervisory authorities.

Analysts pointed out that the traditional “pyramid” sales structure of the insurance industry will face restructuring, and the phenomenon of “single and self-employed” will increase.

Regulatory documents released

Independent individualInsurance agentThe human system has been brewing for several years, and now it has finally lifted the veil in the form of a formal regulatory document.

personalInsurance agentIntroduced to my country in 1992Insurance market, And the personnel team developed rapidly and gradually becameInsurance marketingThe most important channel.Currently, National Insurancethe companyShareThere are about 9 million individual insurance agents.

According to the “Notice”, an independent personal insurance agent refers to a contract with an insurance company directlycontract, Carry out insurance sales independentlyPractitioners。

What are the qualifications and threshold requirements for becoming an independent personal insurance agent?

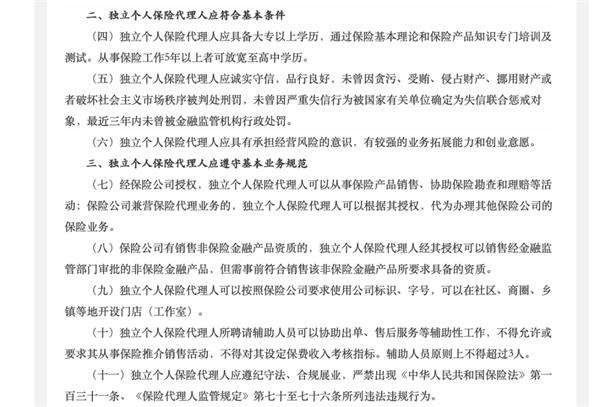

The “Notice” stipulates the basic conditions, business specifications and selection mechanism that an independent individual insurance agent should have.

Source: China Banking Regulatory Commission

Taken together, it can be summarized as the following key points:

In terms of market positioning, on the one hand, independent personal insurance agents belong to the category of personal insurance agents; on the other hand, they emphasize and highlight their independent business development and directly follow the agency salesinsuranceAccrualcommission, In order to be different from traditional team-type personal insurance agents.

Encourage independent individualsInsurance agent businessThere are various forms, which can be traditional “business” forms, or use company logos and trade names according to company requirements, and have fixed business locations in communities, business circles, townships and other places.

In terms of management mechanism, requirements are made from the perspectives of independent personal insurance agents and insurance companies. On the one hand, it strengthens insurance companies’ management and control responsibilities, requires strengthening of personnel behavior management, and establishes a commission fee system based on business quality and service quality. Assessment system; on the other hand, it also emphasizes the regulation of independent individual insurance agents’ business behaviors, and requires strict compliance with insurance sales,productSeries requirements for sales.

The previous “pyramid” structure is about to fall

Analysts believe that my country’s insurance market has traditionally expanded through “direct sales”, and the “pyramid” organizational structure and team development model dominate the mainstream.

“Insurance agent A can develop subordinate agent B and extract a certain management commission. At the same time, A will also train and coach B. Although this model can quickly expand the team, it will also cause some problems.”InsuranceInsiders said that if the upper level draws a certain percentage of profit from the next level of commission income, the stacking of layers will result in high sales liquidity and low retention rate at the bottom; some teams “pull heads” to expand their business, blindly pursuing numbers without paying attention to the team Quality and training allow false propaganda and misleading sales chaos to breed.

The above-mentioned people said that under the new regulations, the “pyramid” structure of the traditional insurance agent team is expected to be broken, which will help to effectively increase the income of front-line agents.

According to Chen Wenzhi, the founder of Most Benefits, under the traditional pyramid model, “when you reach the top of the tower, you can make a lot of money while lying down; you can only make money while staying at the bottom of the tower. All dedication can be set aside. This is the status quo of traditional insurance salespersons. Finally, the tower is about to fall.”

“Independent personal insurance agents are like self-employedInsurance agencyThe agents are all different, which is equivalent to starting your own business, operating independently, and taking responsibility for your own profits and losses. “certaininsurance brokerRelevant persons in the organization said that in this case, the customer resources no longer belong to the insurance company, but their own “wealth”, which can even be passed on.

In addition, because independent personal insurance agents are not limited to selling products of a single insurance company, they are more flexible in choosing products, can be more close to customer needs, and recommend more suitable products to customersInsurance Products。

Pave the way for the healthy development of the industry

“Independent personal insurance agents can’t rely on offline consumption of their own social circle and life circle to make profits from transactions. They can only improve their professional insurance knowledge andInsurance serviceThis is conducive to the healthy development of the industry. “An insurance industry insider pointed out.

According to the analysis of the above-mentioned individuals, for insurance companies, independent personal insurance agents may induce some middle-level insurance agent sales personnel to “fly solo”, which will have a certain impact on the original agent sales system of insurance companies. “It may have an impact on the direct agent market of insurance companies. It is not excluded that some direct agents or part-time agents of insurance companies will transform into independent individual agents.”

“Independent personal insurance agents can act for products of multiple insurance companies, and are no longer limited to the products of one insurance company. This will further pull insurance sales into a fair and objective competition track. Traditional sales such as crowded tactics and scale is king. The influence of the model is weakening a little bit.” The person said.

Many insurance institutions have taken adaptive measures in advance. For example, Huatai Property & Casualty Insurance and Sunshine Property & Casualty Insurance have been approved by the China Banking and Insurance Regulatory Commission to pilot the exclusive independent insurance agent model, and Dajia Life has also begun the deployment of independent personal insurance agents.

Yu Hua, deputy general manager of Dajia Life, said earlier that Dajia Life has begun to explore the establishment of an independent personal insurance agent team, focusing on the independent personal insurance agent model through recruitment and assessment, and adopting a more proactive attitude to meet industry changes and seek a high-quality Road to development.

Analysts also said that the independent personal insurance agent system has limited impact on intermediary agents and personal brokers on the market. On the one hand, the above entities can represent the products of multiple insurance companies; on the other hand, the intermediary agencies in the market generally have mature training systems and high-end office space. For some newcomers who have just entered the insurance industry, An intermediary agency or brokerage company may be a better choice.

(Source: China Securities Journal)

(Editor in charge: DF064)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.